The Voluntary Provident Fund (VPF) is an excellent option for employees wishing to save for retirement. It offers higher returns, tax benefits, and the flexibility to contribute according to one’s financial situation, making it a reliable way to accumulate a substantial corpus for post-employment years.

This blog will explore voluntary provident funds, benefits, tax exemption, interest rates, and withdrawal rules.

What is a Voluntary Provident Fund?

The Voluntary Provident Fund (VPF) is a savings scheme that allows employees to deposit more than the maximum permissible contribution to the Employee Provident fund (EPF). The interest earned on the additional amount is the same as the EPF contribution.

Employees can choose how much to contribute, but they are recommended to contribute more than the 12% PF limit. They can deposit their basic salary and dearness allowance into the VPF account.

The VPF account is linked to the employee’s EPF account, and the interest earned on VPF is credited to the EPF account. It is mandatory to have an EPF account to invest in VPF. The same interest is offered on VPF as on EPF.

Features of Voluntary Provident Fund

VPF has the following features:

- Employees can contribute 100% of their basic salary, including dearness allowance, towards their VPF Account.

- VPF is a subset of the EPF account, differing only in the proportion of salary contribution, which is 12% for EPF.

- Unlike EPF, there’s no separate account explicitly designated for VPF.

- Eligibility for this scheme is restricted to salaried employees employed in organisations recognised by the Employees’ Provident Fund Organisation of India (EPFO).

- Self-employed individuals or those working in unorganised sectors are ineligible to opt for VPF.

- Enrollment in the VPF scheme is entirely voluntary, with no obligation for employees to contribute.

- The maturity term or lock-in period for VPF investments is five years, during which withdrawals are restricted.

- Initiating a VPF scheme at the beginning of the financial year is advisable for effective tax planning and financial forecasting for employees and employers.

- The interest rates on VPF are identical to those on EPF, with the current rate at 8.15% for FY 2022-23.

- Partial withdrawals, including loans, are permissible from VPF accounts, although complete withdrawals are subject to tax implications.

- Upon resignation or retirement from employment, the employee is entitled to the final maturity amount from the VPF account, which can be transferred to a new employer, similar to EPF schemes.

- Loans or partial withdrawals from VPF accounts are contingent upon the regulatory body’s purpose and discretion, and premature withdrawals are subject to tax deductions.

Eligibility Criteria for Voluntary Provident Fund

Individuals must satisfy the following conditions to qualify for VPF:

- The individual must be an active employee of an organisation that falls within the jurisdiction of the EPF scheme. This typically includes organisations with 20 or more employees.

- The individual must already be a member of the EPF scheme and possess an active EPF account, which serves as the foundation for participation in the VPF.

- The employer should extend the VPF option to its employees. Not all employers offer VPF as a savings option alongside EPF contributions. Therefore, the employer must provide this facility for employees to enrol in the VPF scheme.

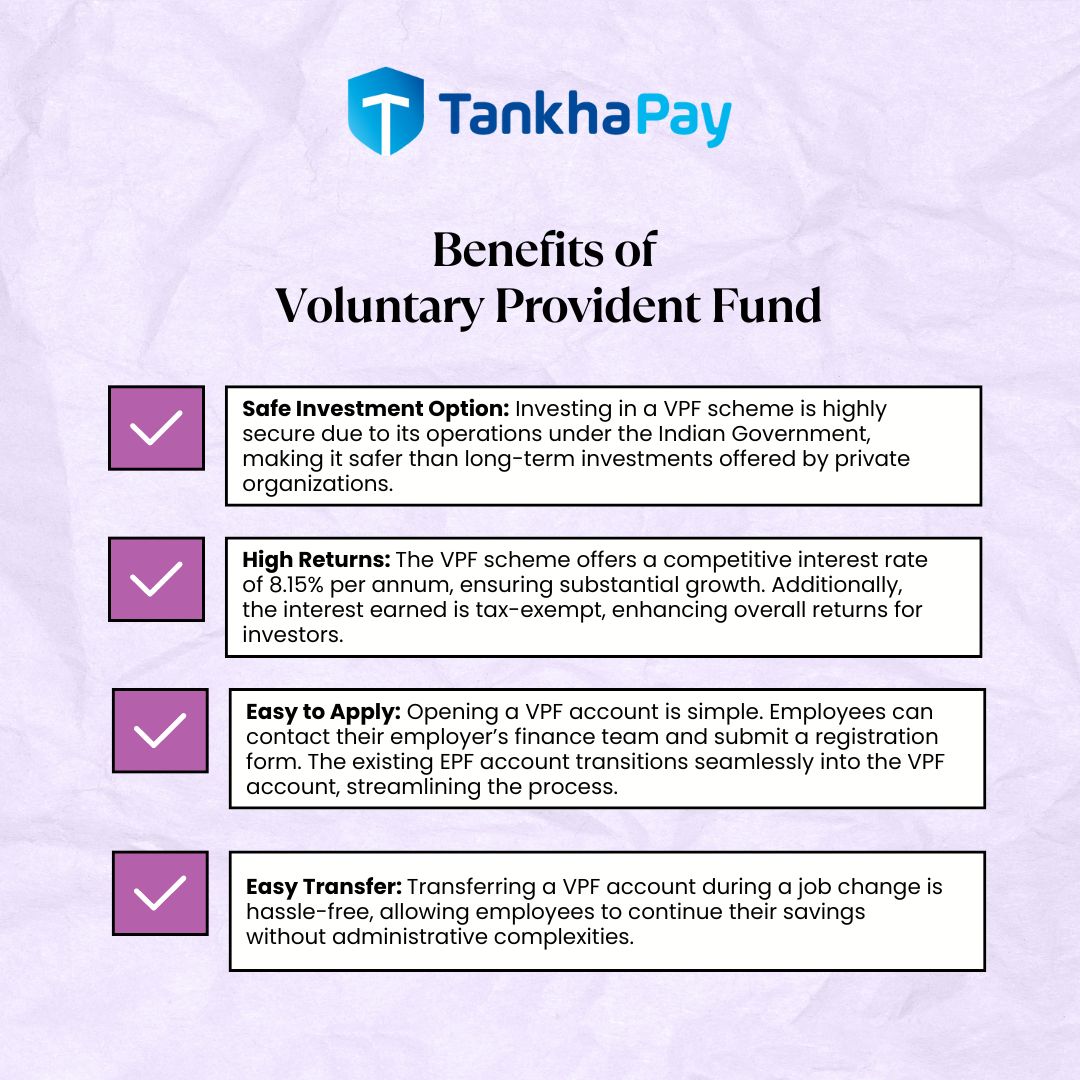

Benefits of Voluntary Provident Fund

The benefits of a PF is as follows:

- Safe Investment Option: Investing in a VPF scheme provides a high level of security due to its operations under the Indian Government. Compared to long-term investment options private organisations offer, VPF stands out as a particularly safe investment avenue devoid of inherent risks.

- High returns: The VPF scheme offers an attractive interest rate, currently 8.15% per annum. This competitive interest rate ensures substantial growth of contributions over time. Furthermore, the interest earned from these contributions remains tax-exempt, enhancing the overall returns for investors.

- Easy to Apply: Initiating a VPF account involves a straightforward application process. Employees can easily navigate this procedure by contacting their employer’s finance team and submitting a registration form. Notably, the existing EPF account seamlessly transitions into the VPF account, streamlining the entire process for participants.

- Easy Transfer: If an employee undergoes a job transition, transferring their VPF account from their previous employer to the new one is hassle-free. This simple account transfer process ensures that employees can continue their savings without any administrative complexities, making the scheme even more appealing.

Documents Needed to Open a VPF Account

The documents required to open a VPF account are as follows:

- Business Registration Certificate

- Company Registration Certificate with the Ministry of Finance (MoF)

- Form 24

- Form 49

- Memorandum and Articles of Association in case the organisation is an ‘Sdn Bhd’

- Company Profile

How to Open a VPF Account

An individual must submit a written request to their employer or the HR department to open a VPF account and start contributing towards it from their salary. This request should include personal details and the specified monthly amount intended to be contributed from the basic salary towards the VPF account.

The VPF account can be opened at any time during the financial year. Still, once an individual starts investing, they cannot discontinue it during the same year. The amount will be taxed if they withdraw the VPF amount within five years of opening the account.

Voluntary Provident Fund Interest Rate

The Indian government sets and revises the interest rate annually. The current interest rate for the Voluntary Provident Fund (VPF) for 2023-24 is 8.15 p.a., the same as the Employee Provident Fund (EPF) interest rate for the same period. The comparison of the PPF and VPF rates is as follows:

| Financial Year | PPF Interest (%) | VPF Interest (%) |

|---|---|---|

| 2023-2024 | 7.10 | 8.15 |

| 2021-2022 | 7.10 | 8.10 |

| 2019-2020 | 7.10 | 8.5 |

| 2018-2019 | 7.6 to 8 | 8.65 |

| 2017-2018 | 7.6 to 8 | 8.55 |

| 2016-2017 | 8 to 8.1 | 8.8 |

| 2015-2016 | 8.7 | 8.8 |

| 2014-2015 | 8.7 | 8.75 |

| 2013-2014 | 8.7 | 8.75 |

Voluntary Provident Fund Tax Benefits

VPF is considered one of the best tax-saving options in India. Employees can claim tax benefits of up to Rs.1.5 lakh on VPF contributions under Section 80C of the Income Tax Act, 1961. Moreover, the interest earned on VPF is also exempt from tax. Additionally, the maturity proceeds of VPF are tax-exempt when withdrawn five years after opening the VPF account.

Voluntary Provident Fund Tax Exemption

VPF is considered one of the best tax-saving options in India. Employees can claim up to Rs.1.5 lakh benefits on VPF contributions under Section 80C of the Income Tax Act, 1961. Moreover, the interest earned on VPF is also exempt from tax. Additionally, the maturity proceeds of VPF are tax-exempt when withdrawn five years after opening the VPF account.

Voluntary Provident Fund Contribution Limit

There are no set limits on the amount of VPF contributions an individual can make in a year. Individuals can contribute up to 100% of their monthly income (salary + dearness allowance) towards VPF. The employer doesn’t need to make contributions to the VPF account. Once the VPF account is opened, it cannot be closed for five years. Contributions cannot be stopped before five years have passed since the account opening.

Voluntary Provident Fund Withdrawal Rules

The VPF allows for partial and complete withdrawals as loans. Tax will apply to the accumulated maturity amount if the withdrawal occurs before the 5-year minimum tenure. The final maturity amount is paid out once an employee resigns or retires. In the event of the account holder’s untimely death, the nominee can take possession of the accumulated funds in the VPF account.

The VPF is popular because the accumulated money can be withdrawn anytime. In an unforeseen financial emergency, one can always rely on their VPF account. The account can be broken for the following reasons:

- Medical Emergencies of the employee or their family

- Marriage or Higher Education of the employee

- Buying a new Land/House or Construction of a House

- Education Expenses of children

Documents Needed for VPF Withdrawal

The documents required for VPF withdrawal are as follows:

- Personal details of the employee

- Employee’s EPF account number

- Form 31

- Employee’s postal address

- A cancelled cheque

- Bank details where the advance/maturity proceeds shall be credited

Difference between PPF, EPF and VPF

The difference between PPF, EPF and VPF is as follows:

| Features | PPF | EPF | VPF |

|---|---|---|---|

| Eligibility | Any Indian Resident, except NRIs | Any Employed Indian Resident | Any Employed Indian Resident |

| Period of Investment | 15 years | Up to retirement or resignation, whichever is earlier | Up to retirement or resignation, whichever is earlier |

| Employee Contribution (Basic + DA) | – | 12% of Basic salary | Voluntary (up to 100%) |

| Employer Contribution | – | 12% of Basic salary | – |

| Taxation | None | Tax-Free | None |

| Tax Rebate | Per section 80C | Per section 80C | Per section 80C |

| Maximum Loan | 50% after six years | Partial withdrawals are allowed | Partial withdrawals are allowed |

Difference between EPF, VPF and NPS

The difference between EPF, VPF and NPS is as follows:

| Particulars | EPF | VPF | NPS |

|---|---|---|---|

| Eligibility | Any salaried individual | Any salaried individual having EPF account | All citizens of India, whether resident or non-resident, between 18-60 years |

| Interest | 8.15% | 8.15% | 9% to 12% |

| Employer Contribution | 12% of Basic + D.A. | No contribution | Optional for private companies |

| Employee Contribution | 12% of Basic + D.A. | Up to 100% of Basic + D.A. | 10% of Basic + D.A. |

| Investment Period | Till retirement or unemployment | Five years or till unemployment | Till retirement |

| Tax Benefits | Up to Rs.1.5 lakh under Section 80C | Up to Rs.1.5 lakh under Section 80C | Up to Rs.1.5 lakh under Section 80CCE and 80CCD(2) |

| Partial Withdrawal | Allowed for specified purposes | Allowed for specified purposes | Allowed for specified purposes after three years of investment |

How to Check VPF Balance

Employees can check their VPF balance online by following the steps given below:

- Visit the official EPFO website.

- Select the ‘Our Services’ tab, and click the ‘For Employees’ option.

- Select the ‘Member Passbook’ option under the ‘Services’ heading.

- Enter the UAN and password to log in.

- Select the Member ID and select the ‘View Passbook’.

- The EPF passbook will show the details of the employee’s VPF account.

FAQs on Voluntary Provident Fund

Which is better, PF or VPF?

The EPF and VPF offer an interest rate of 8.15% on contributions. However, VPF allows for higher contributions, potentially resulting in better returns.

Is VPF tax-free?

EPF and VPF contributions are tax-deductible under Section 80C. PPF contributions are fully tax-deductible. Interest on EPF and PPF is tax-free, but VPF interest is taxable.

Can I withdraw from VPF?

You cannot opt out of the VPF scheme mid-year. You can invest 100% of your basic salary + DA in VPF. Withdrawing VPF money within five years incurs tax on interest earned from your contribution.

Does VPF come under Section 80C?

VPF contributions up to Rs.1.5 lakh/year are tax deductible under Section 80C.

What is the maximum VPF contribution?

There is no maximum contribution limit for VPF. Employees can contribute 100% of their basic salary + dearness allowance.

What is the current interest rate on VPF?

The interest rate of VPF for FY 2023-24 is 8.15%.

Is VPF better than PPF?

VPF offers better interest rates than PPF. The VPF amount can be withdrawn after five years, while the PPF has a lock-in period of 15 years. PPF is more suitable for long-term goals like child education, marriage, or down payment of a loan.

Is VPF eligible for tax benefits?

VPF falls under the EEE tax category, which exempts VPF contributions, interest, and maturity proceeds from tax. However, any VPF amount withdrawn within five years of investment is liable for tax.