Universal Account Number (UAN) is a distinctive identification number assigned to every member of the Employees’ Provident Fund Organization (EPFO), issued by the Ministry of Labour and Employment. Each member is entitled to possess only one UAN throughout their service tenure, consolidating all EPF accounts under this unique identifier. To access various EPFO services, UAN activation and registration are imperative.

This article discusses the significance of UAN activation and provides insights into how one can generate and activate UAN online through the dedicated UAN Member Portal.

What is UAN?

The Universal Account Number (UAN) serves as a unique identifier for members of the Employees’ Provident Fund Organization (EPFO). Issued by the Ministry of Labour and Employment, each member is allocated a single UAN that links to all their EPF accounts throughout their service period.

UAN registration and activation are crucial steps in leveraging the benefits of this system. The UAN Member Portal facilitates the registration process, offering an online avenue for members to manage their EPF-related activities efficiently.

Upon successful UAN activation, which can be completed in just a few minutes, members gain access to a plethora of features. These include viewing account balances, initiating Provident Fund (PF) withdrawals, and handling various other transactions – all accomplished seamlessly through the official EPFO website.

The online activation ensures swift and convenient management of EPFO accounts and enables users to access their information from any location with an internet-enabled device. This user-friendly approach enhances the overall efficiency, making the process of overseeing EPF accounts more accessible and convenient.

Importance of Universal Account Number (UAN)

UAN serves as an umbrella, consolidating all PF accounts of a member. Previously, tracking multiple EPF accounts was challenging, but with UAN, it has become more straightforward. The introduction of UAN has streamlined the process of transferring PF funds. Members can easily transfer their PF from old accounts to new ones online, promoting convenience and efficiency.

Activating UAN provides members with access to various online services offered by EPFO. This includes checking account balances, withdrawing PF amounts, and managing PF-related transactions through a user-friendly online portal.

Key Features of UAN

UAN is unique. Here are a few of the key features that set it apart:

- UAN facilitates seamless tracking of multiple job switches by an employee, streamlining employment history for both the individual and employers.

- UAN contributes to the centralisation of employee data across the country, providing a unified platform for easy access and management.

- Companies benefit from reduced burdens in employee verification processes, as UAN centralises and authenticates essential employee details.

- The introduction of UAN has led to a reduction in EPF withdrawals, emphasising the stability and continuity it brings to employee provident fund accounts.

How to Generate UAN Online for EPF?

When an employee begins their journey in the service sector, it is the responsibility of the employer to initiate the generation of the Universal Account Number (UAN), especially if the company has a workforce of 20 or more employees. In situations where the employee already possesses a UAN from a previous organisation, it becomes essential to provide these details to the new employer.

To facilitate the creation of a new UAN for the employee, employers can follow these user-friendly steps:

- Access the EPF Employer Portal using the designated username and password.

- In the “Member” section, locate and click on the “Register Individual” tab.

- Input the necessary details of the employee, including PAN, Aadhaar, bank information, etc.

- Ensure all entered details are accurate and proceed to the “Approval” section for confirmation.

- The EPFO system generates a new UAN for the employee.

- The employer can now seamlessly link the PF account with the newly generated UAN of the employee.

The process to Know Your UAN

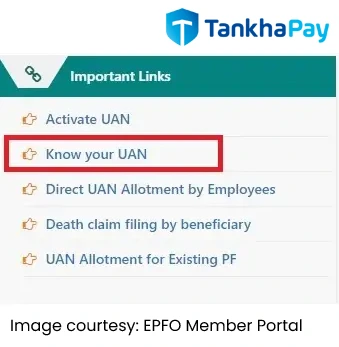

Once your UAN is generated and linked to your EPF account, employers usually provide the UAN and PF details. However, if you need to find out your UAN independently, here are the steps:

- Go to the EPFO Member Portal to discover your UAN.

- Click on the “Know your UAN” section.

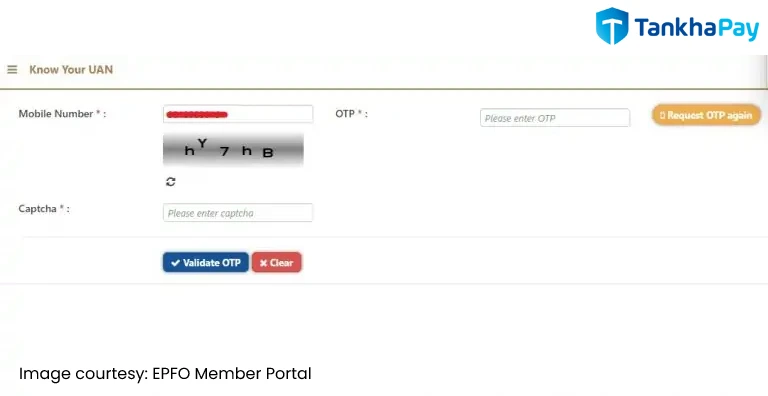

- Enter your registered mobile number and captcha code, and click “Request OTP”.

- Enter the OTP received and a captcha for verification.

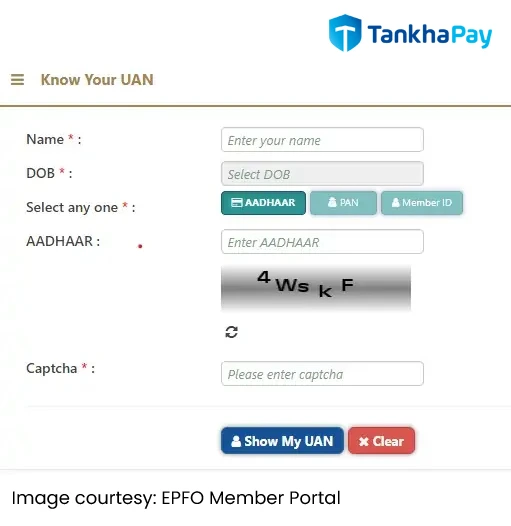

- Provide your Name, Date of Birth (DOB), Aadhaar/PAN/Member ID, and captcha. Click “Show my UAN” to reveal your UAN.

UAN Activation Online through the Portal

Before accessing any online EPFO service, UAN activation is essential. Follow these steps for activation:

- Go to the EPFO Member Portal and click on “Activate UAN”.

- Input your UAN/Member ID, Aadhaar number, Name, DOB, mobile number, and captcha, and click “Get Authorization PIN”.

- Receive an authorisation PIN on your registered mobile number.

- Enter the PIN, click “Validate OTP and Activate UAN”.

- Your UAN is now activated, and the password is sent to your mobile number.

Now, you can log in to your EPF account using the UAN and password provided during activation.

Linking Aadhaar with UAN

To link your Aadhaar with UAN for your EPF account, follow these straightforward steps:

- Visit the EPFO member home page and log in to your EPF account using your UAN credentials.

- Within the “Manage” section, click on “KYC.”

- Tick the square corresponding to Aadhaar and input your 12-digit Aadhaar number along with your name.

- Click on the “Save” option to submit your Aadhaar details.

- Your request will appear as “KYC Pending for Approval.”

- Once UIDAI (Unique Identification Authority of India) confirms your details, your current employer’s name will be displayed in “Approved by Establishment,” and “Verified by UIDAI” will be mentioned against your Aadhaar.

Necessary Documents for UAN Activation

To facilitate UAN activation, you need to provide the following documents, typically collected by your employer during your onboarding:

- A copy of your Aadhaar card is required for identity verification.

- Submit a copy of your PAN card for identification purposes.

- Furnish your bank account details along with the IFSC code to link your UAN with your financial information.

- Provide any other documents requested by the employer or EPFO for proof of identity or address.

Enhanced Employee Benefits through UAN

There are many benefits of UAN, they are as follows:

- UAN allows employees to monitor all their EPF accounts in one central location conveniently. This streamlines the process of keeping track of contributions and balances.

- Employees can easily access and view their EPF passbook online through the UAN portal. This provides a comprehensive overview of contributions, withdrawals, and other relevant details.

- UAN facilitates the online claiming of partial PF withdrawals. Employees can conveniently initiate and track partial withdrawal requests through the user-friendly online platform.

- Transferring EPF accounts from one employer to another is simplified with UAN. Employees can initiate the transfer process online, eliminating the need for cumbersome paperwork.

- The UAN portal enables employees to check the status of their EPFO claims online. This feature provides transparency and allows employees to stay informed about the progress of their claims.

FAQs about UAN Activation

Can I activate my UAN again if I change jobs?

No, UAN activation is a one-time process; it doesn't need to be repeated with job changes.

Can UAN activation be done offline?

No, UAN registration is specifically for availing of online services.

Is there any fee for UAN registration?

No, UAN registration is free of cost.

How to correct personal details in UAN?

Submit correct details to the employer, who verifies and forwards them for updating in the UAN portal.

Can my employer see all UANs allotted to its employees?

Yes, employers can view and download the list of UANs allotted to employees through the UAN member portal.

Why does UAN list all previous member IDs?

Initially configured for consolidation, UAN eliminates the need to list previous Member IDs in the future.

Can I upload KYC documents through the UAN portal?

Yes, KYC documents can be uploaded via the 'Profile' > 'Update KYC Information' option.

Can I change my mobile number or email ID in the UAN Member Portal?

Yes, you can update them in the 'Profile' section.

Procedure to Allocate UAN to New Employees?

Employers collect previous PF account details, verify, and forward them to EPFO for UAN generation.

What is the procedure for uploading KYC documents?

Documents can be uploaded using the 'Bulk KYC Text File Upload' option.

How to know your UAN?

Visit the EPFO Member Portal, click on "Know your UAN," and follow the steps for verification.

What is the Importance of UAN in PF Management?

UAN acts as an umbrella for PF accounts, easing tracking, transfer, and access to online PF services.

Are there any Employee-Specific Benefits of UAN?

Yes, there are many Employee benefits like easy EPF tracking, online passbook viewing, and simplified PF processes.

WHat are the Features of UAN?

UAN efficiently tracks job switches, centralises employee data, simplifies verification, and reduces EPF withdrawals.

How to link Aadhaar with UAN?

Log in to your EPF account, go to 'KYC,' select Aadhaar, and enter details for verification.

What are the Documents Required for UAN Activation?

Aadhaar card, PAN card, bank details, and any other required proof of identity or address.

What is the Procedure to Allocate UAN to New Employees?

Employers generate new employees' UANs after collecting and verifying previous PF details.

Can UAN be activated through SMS or a mobile app?

No, UAN activation is currently possible only through the UMANG app, EPF member portal, or UAN activation portal.