Being considered solvent means having the financial capacity to meet long-term expenses or debts. It’s about ensuring that your assets outweigh your liabilities. A solvency certificate serves as a declaration of an individual’s or company’s financial standing, often required for purposes such as standing as a surety, securing loans, or entering business contracts.

Typically, a solvency certificate is issued by either a government body or a bank. In this article, we’ll explore the detailed procedure for obtaining a solvency certificate from the government.

What is a Solvency Certificate?

When you possess a solvency certificate, it indicates to others that you have the financial stability to take on certain commitments. This document holds significance in various scenarios, and understanding the process of obtaining it can be beneficial for individuals and businesses alike.

To acquire a government-issued solvency certificate, you’ll need to follow a specific procedure. This involves providing relevant financial information and documents to the concerned government body. The aim is to demonstrate that your assets surpass your liabilities, showcasing your ability to handle long-term financial responsibilities.

This certificate can be instrumental in situations where financial reliability is crucial, such as when vouching for someone, seeking loans, or securing business contracts. As government bodies are often involved in issuing these certificates, the process is typically formal and requires attention to detail.

Solvency Certificates play a crucial role in verifying the financial standing of individuals or businesses, and both government and commercial offices commonly require them for a variety of purposes. Here are some instances where Solvency Certificates are essential:

- Tender Applications: When applying for tenders, having a Solvency Certificate is necessary. It assures the evaluating authorities of your financial capability to undertake the project.

- Contract Acquisition: Before entering into contracts, businesses often need to provide Solvency Certificates. This ensures that they have the financial capacity to fulfill the terms of the agreement.

- Visa Interviews: Individuals seeking visas may be required to present a Solvency Certificate. It demonstrates their financial stability and ability to support themselves during their stay in the foreign country.

- Legal and Court Proceedings: In legal matters, Solvency Certificates can be used as evidence of financial standing. This information may be relevant to court proceedings, settlements, or other legal requirements.

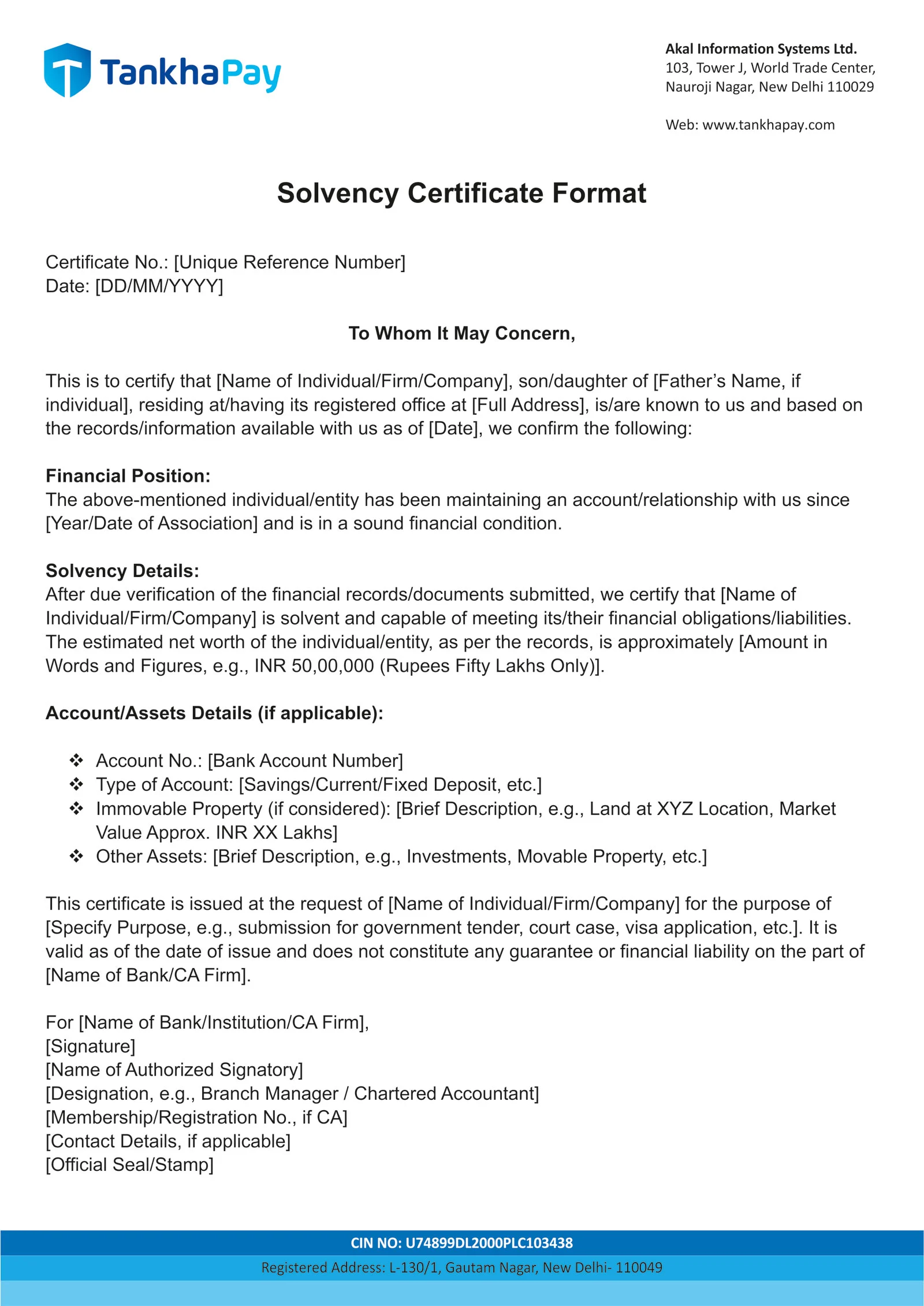

Solvency Certificate Format

While the format of a Solvency Certificate remains generally consistent across most banks and issuing authorities, it’s essential to note that slight variations may exist. These differences could stem from the specific entity for which the certificate is issued. It is advisable to obtain the exact Solvency Certificate format from the issuing authority. Below is a generic outline that captures the common elements:

Date: [Date of Issuance]

Certificate Number: [Certificate No.]

TO WHOMSOEVER IT MAY CONCERN

Subject: Solvency Certificate for [Applicant’s Name]

This is to certify that [Full Name of Individual/Entity], [Address], [City, State, Pin Code], is a valued customer of [Bank Name], holding account number [Account Number] with our branch.

This certificate is issued in response to [his/her/its] request and attests that, based on our assessment of financial records and documents provided, [Full Name] is financially solvent to the extent of [Amount in Words and Figures] as of [Date].

Signature of Authorized Signatory

[Name of the Signatory]

[Designation]

[Bank/ Institution/ CA Firm’s Name]

[Seal/ Stamp]

Note: This is a generic template, and specific details may vary. Always refer to the issuing authority for the accurate and official format.

Download Solvency Certificate in Different Formats

| Formats | Files |

|---|---|

Solvency Certificate Format in Word |

Download |

Solvency Certificate Format in PDF |

Download |

Issuance of a Solvency Certificate

The issuance of a Solvency Certificate is typically facilitated by the revenue department and banks, making it a relatively accessible process. Here’s how it generally works:

- Revenue Department and Banks: Individuals or entities can request a Solvency Certificate from the revenue department or their respective banks.

- Bank Issuance: Banks commonly issue Solvency Certificates to their customers. This involves a review of the customer’s account transactions and examination of available property documents.

- Chartered Accountant Report: To enhance the credibility of the Solvency Certificate, individuals or entities may obtain a financial status report from a chartered accountant. This additional verification aids in the issuance process, especially when requested from banks.

- Use in Tender Applications or Contracts: The Solvency Certificate obtained from banks is often utilised by customers for various purposes. This includes submitting tender applications or contracts to government offices, where the financial strength demonstrated in the certificate becomes crucial.

Documents Required for Obtaining a Solvency Certificate

To evaluate the financial standing of individuals or entities, public sector banks typically require a set of documents when customers request a Solvency Certificate. Here’s an overview of the necessary documents:

- Application Form: The bank provides specific application forms designed for customers seeking a Solvency Certificate.

- Identity or Address Proof: Current address proof for individuals or registered address proof for entities is essential.

- Bank Statement (Savings or Current): Banks issue Solvency Certificates to customers who have maintained accounts for a specified period. Bank officials assess financial history through current or savings account statements, including other accounts like loans or fixed deposits.

- Income Tax Returns: Banks may request income tax returns for a certain number of years to gauge the overall financial status of the customer.

- Audited Financial Statements (for Companies or Partnership Firms): For companies or partnership firms, banks evaluate net worth by scrutinising audited balance sheets, profit/loss accounts, and cash flow statements over a specific period.

- Property Documents: Properties like land and buildings, considered valuable collateral, can demonstrate the financial status of individuals or entities that own them.

- Gold Valuation Certificate: Customers with gold as valuable security may have it appraised by the bank’s in-house appraiser.

- Certificate of Net Worth by a Chartered Accountant: Banks often require a net worth statement from a Chartered Accountant, detailing all assets and liabilities to date.

- Other Investment Certificates: Investment statements, such as mutual funds, shares, or provident fund statements, can support the bank’s analysis of solvency concerning current and future liabilities.

Once the bank reviews these documents and is satisfied with the financial standing of the individual or entity, it issues the Solvency Certificate to the customer. This comprehensive set of documents ensures a thorough assessment of the financial health of the applicant.

How Much Time Does it Take?

The processing time for a Solvency Certificate is typically swift and efficient. Once the application, along with the necessary documents, is submitted to the bank, the processing is usually completed within a week. Here’s a breakdown of the key points to keep in mind during the application process:

- After completing the Solvency Certificate request form, submit it along with photocopies of all the specified documents to the bank.

- Ensure that you attach clear photocopies of all the required documents, as specified by the bank official, to support your application.

- It is crucial to bring the original documents when submitting the application for verification purposes conducted by the bank. This helps validate the authenticity of the provided information.

- The bank will conduct a verification process to ensure the accuracy and legitimacy of the information provided in the application and attached documents.

- The bank typically processes the application within a week, after which the Solvency Certificate will be issued.

Fee for Solvency Certificate

The fee for obtaining a Solvency Certificate may vary among different banks. However, as a general guideline, most banks typically charge around Rs. 2000 for issuing the Solvency Certificate.

Note: The bank does not bear any liability for future consequences arising from the Solvency Certificate. Typically, the Bank Manager has limited authority to issue a specific number or value of Solvency Certificates. If the certificate issuance exceeds the Bank Manager’s discretionary powers, the request will be escalated to higher-ranking officials for approval. Solvency Certificates are granted exclusively to trusted and reputable customers, and the bank may impose a fee for issuing such certificates.

FAQs about Solvency Certificate

What happens if my Solvency Certificate is not initially granted?

If your Solvency Certificate is not initially granted, the Revenue Officer will review the application, provide feedback or reasons for denial, and may require additional verification or modifications. After necessary adjustments and completion of the verification process, the Solvency Certificate will be issued accordingly.

Where can I apply for a Solvency Certificate?

To obtain a Solvency Certificate, you can submit an application to your bank, the regional Revenue Officer, or the Chief Officer in Charge of Revenue Administration in the relevant district, sub-division, or tehsil. Alternatively, you may approach the Assistant Tehsildar or Assistant District Magistrate.

What are the fees for a Solvency Certificate?

The fees for a Solvency Certificate can vary, typically around Rs. 2000. However, it's important to note that the fee may differ among banks and financial institutions and could also vary across different states.

What is the validity period of Solvency Certificates?

Solvency Certificates issued by banks and financial institutions are generally valid for one year. After this period, they need to be renewed. It's crucial to note that the acceptance and validity of Solvency Certificates may vary based on the specific requirements of different authorities or organisations.

How can I obtain a Bank Solvency?

You can get a Bank Solvency by applying to your bank. They usually issue it to their customers after reviewing transaction details, account information, and relevant property documents.

Can a Chartered Accountant issue a Solvency Certificate?

No, a Chartered Accountant typically doesn't issue a Solvency Certificate. This certificate is usually provided by banks, financial institutions, or the revenue department of states.

What do Solvency Details entail?

Solvency Details refer to information about an individual's or entity's financial strength. It is often assessed through factors such as bank transactions, account details, and property-related documents.

Who will issue the solvency certificate?

Banks, financial institutions, and the revenue department of states have the authority to issue a Solvency Certificate. Banks typically issue this certificate to their customers based on transaction details, account information, and available property documents.

How is a Solvency Certificate made?

A Solvency Certificate is usually issued by the revenue department and banks upon request. Banks, in particular, issue it to their customers after reviewing account transactions and relevant property documents.