Employees’ Provident Fund, popularly known as PF, is a mandatory savings scheme and retirement tool for many employees. According to the PF Withdrawal rules, the employee contributes 12% of the basic pay every month to create the PF fund. The employer adds a matching contribution to PF accounts. You can withdraw the PF amount either at the time of retirement or earlier. But how can you make a PF withdrawal online?

UPDATES:

- For the fiscal year 2023-24, the government has raised the EPF interest rate to 8.15%.

- Beginning from the financial year 2021-22, any interest earned on an employee’s contribution to an EPF account exceeding Rs 2.5 lakh is taxable for the employee. This interest is also subject to TDS under section 194A.

Let’s discuss the detailed process in this blog. This process applies to all PF withdrawals.

When Can You Make an EPF Withdrawal?

Complete PF Withdrawal

You can completely withdraw your EPF funds only in two instances:

- During retirement (the PF amount will be added to your retirement benefits by the employer)

- If you have been unemployed for two months (you can withdraw 75% of the total PF fund after being unemployed for more than a month. If this period extends to over two months, you can withdraw the remaining 25%)

What if you are changing jobs?

There is no need to withdraw money from your PF account when switching jobs. Full withdrawals are allowed only if you are unemployed for more than two months.

EPFO allocates UAN (Universal Account Number) to every employee eligible for PF. This UAN is linked to your EPF account and is portable throughout your lifetime. When you change jobs, the UAN will be automatically transferred to the new EPF account created by your new employer.

Partial Withdrawal

| PF Partial Withdrawal Reasons | Withdrawal Limit | Eligibility Criteria |

|---|---|---|

| Home loan repayment | Up to 90% of the accumulated PF amount | Minimum 10 years of service |

| Purchase of house/ land and construction of a house | Up to 24 times (for land) and up to 36 times (for house) of the monthly basic +DA | Minimum 5 years of service |

| Medical (self, spouse, children, &/ or parents) | Up to 6 times monthly basic salary

(Or) Total of employee’s share and interest |

No criteria (applicable to everyone) |

| Higher education (self, children) | Up to 50% of employee’s share | Minimum 7 years of service |

| Marriage (self, children, siblings) | Up to 50% of employee’s share | Minimum 7 years of service |

| Home renovation | Up to 12 times the monthly wages | Minimum 5 years of service |

| Partial withdrawal before retirement | Up to 90% of the total PF amount (if the employee is over 54 years) | One year before retirement |

Process to Enter Exit Date for PF Withdrawal

You need to mention the exit date clearly for the EPF withdrawal. A new facility has been introduced by the Employees’ Provident Fund Organisation (EPFO) that lets the employees enter the date of exit from their last employer or the Unified Member Portal. This is a welcome change as earlier only the employer could do so.

Here’s how you can enter the exit date on the portal.

- Use your UAN and password to log on to the UAN portal.

- Go to the ‘Manage’ tab and further click on the ‘Mark Exit’ option.

- Use the drop-down option to select the employer.

- Put in your DOB, date of joining and exit on the new page. Make sure that your exit date matches the date on your resignation or relieving letter.

- You can double-check the exit date under the ‘Service History’ section in the ‘View’ tab on the UAN portal.

How to Make a PF Withdrawal?

Let’s look at how to do a PF Withdrawal:

Physical Application

Download the Composite Claim Form (Aadhaar)/ Composite Claim Form (non-Aadhaar). Fill out and submit the form to initiate the withdrawal process.

Composite Claim Form (Aadhaar)

Use this form if your UAN is activated (your Aadhaar and bank details will be linked to your UAN on the official UAN website). Then submit the form at the EPFO office in your jurisdiction. There’s no need to get the attestation from your employer.

Composite Claim Form (Non-Aadhaar)

Use this form if your UAN is not activated (if your Aadhaar and bank details are not yet linked with your UAN). Then submit the form at the EPFO office in your jurisdiction after attestation by your employer.

Online Application

Here’s how to do a PF withdrawal online:

- Your UAN should be activated

- Your mobile number registered with UAN is active (and working)

- Your UAN is linked with your KYC (Aadhaar/ PAN/ bank details/ IFSC)

If the above criteria are met, you can straight away apply online to withdraw the PF funds. Otherwise, you will need an attestation from the employer.

Steps to Apply For EPF Withdrawal Online on UAN Portal

- Visit the UAN portal

- Login into your account using the UAN and password. Complete the Captcha verification and click on the sign-in button.

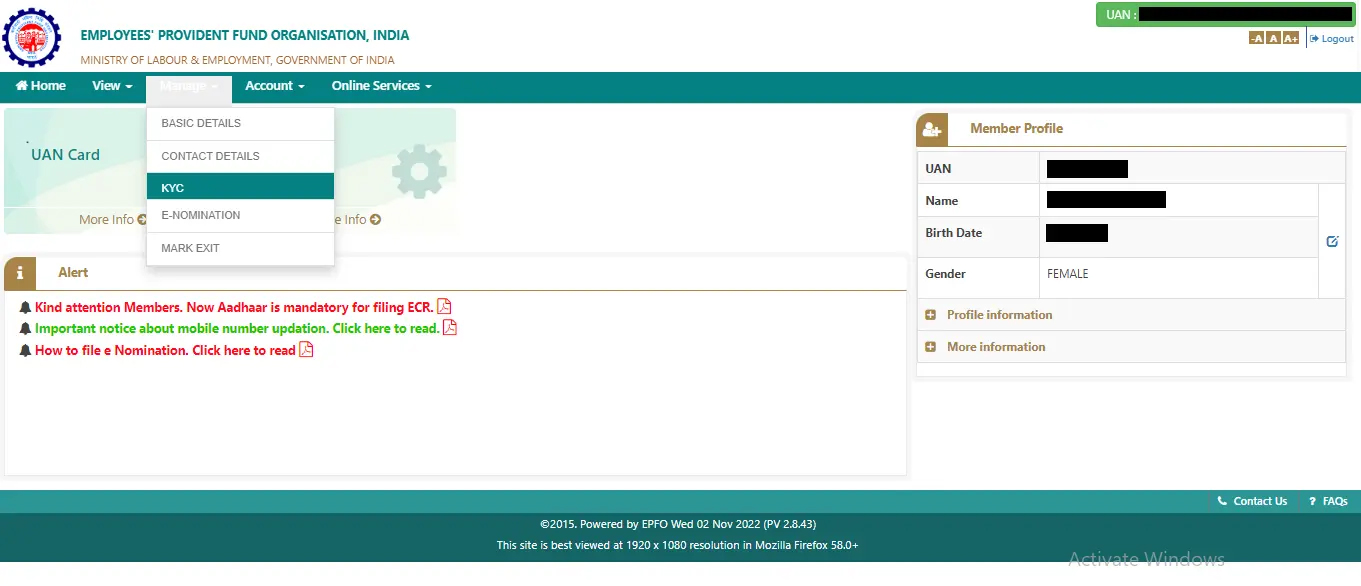

- Click on the Manage tab and select KYC (check to ensure your KYC details are verified. If not done, complete the verification).

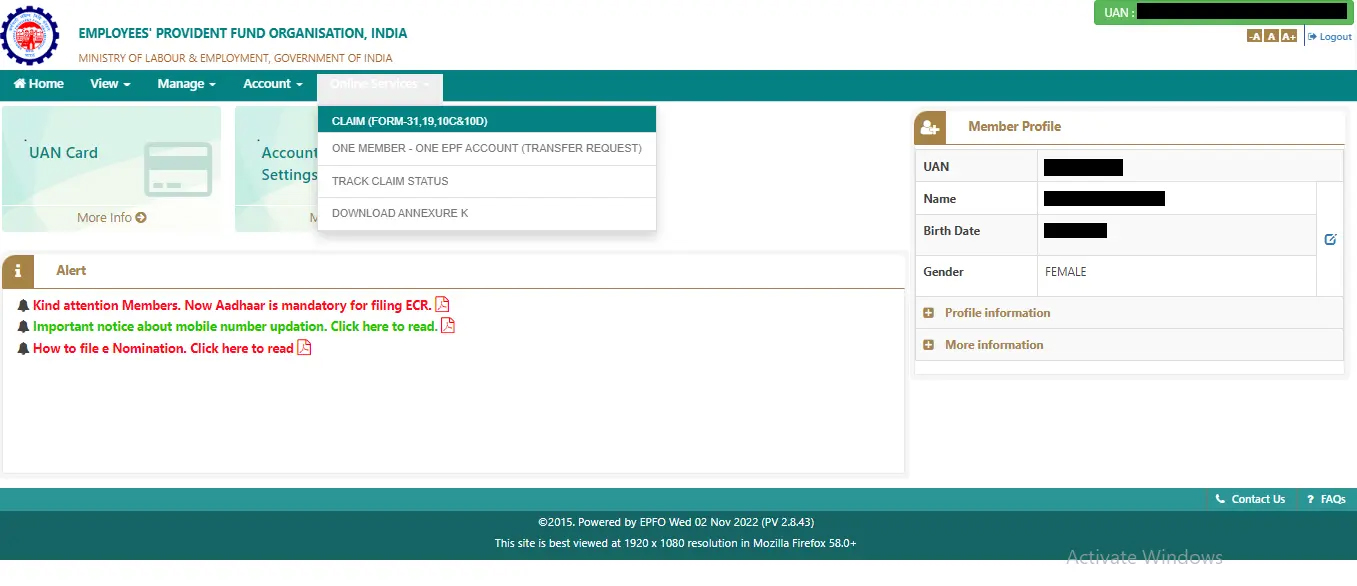

- Then, go to the Online Services tab and select Claim (Form-31, 19, 10C & 10D) from the drop-down menu.

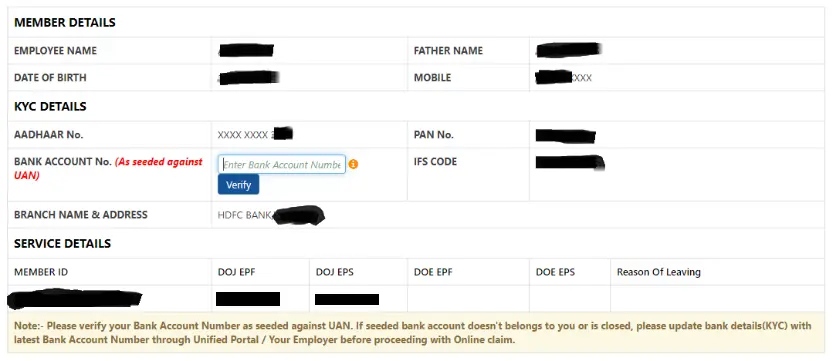

- Enter your bank account number and click on Verify.

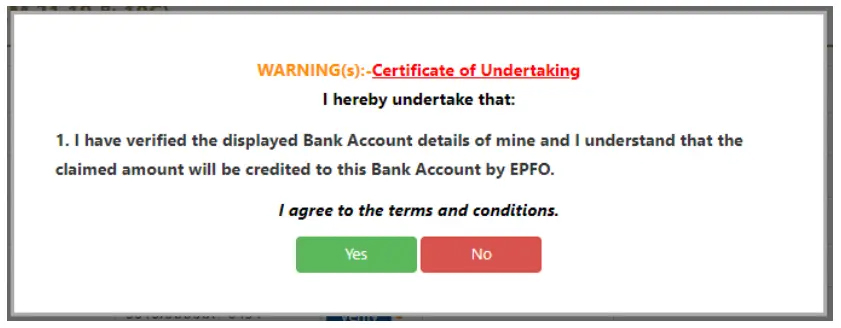

- Click on Yes to sign the undertaking certificate (T&C) and proceed to the next step.

- Click on Proceed for Online Claim and select the type of claim (full settlement, EPF part withdrawal, pension withdrawal). The options are available under the I Want To Apply For tab.

Note: This option will not be visible if you are not eligible to withdraw the PF funds.

- Now, select PF Advance (Form 31) and provide details for the purpose of withdrawal, the amount you want to withdraw, and your address.

- Submit the application and wait. Your employer has to approve the application.

Note: You may be asked to upload a scanned copy of the relevant documents. Keep them handy before you start filling out the claim form.

- Once done, the amount will be credited to your bank account. This can take around 15 to 20 business days.

PF Customer Care: How to Reach Them?

- Toll-free number: 14470

- Give a missed call to know your EPF details: 9966044425

- Enquiry for EPF balance: SMS “EPFOHO UAN” to 7738299899

- Email support: employeefeedback@epfindia.gov.in

Which are the Forms Used for PF Withdrawal?

When learning about PF withdrawal, you also need to have an idea about the various forms used for the process.

| Forms Required | Purpose |

|---|---|

| Form 10C | Withdrawal of pension or to claim scheme certificate |

| Form 10D | Pension claim after retirement |

| Form 11 | Automatic EPF funds transfer |

| Form 14 | To pay for the LIC policy from the EPF account |

| Form 15G | To Save TDS on the interest provided on the PF amount |

| Form 19 | EPF settlement |

| Form 20 | Claim PF by the nominee (applicable in case of employee’s death) |

| Form 31 | EPF withdrawal |

| Form 2 | EPF and EPS (employee pension scheme) nomination |

| Form 5 | New employee registration for EPF and EPS |

| Form 5(IF) | Claim assured benefits from deposit-linked insurance |

Taxability of EPF Withdrawal

Form 15G for PF Withdrawal without TDS

The EPF corpus amount is tax-free when specific criteria are met. To qualify for a tax exemption, you should have an EPF account (active) for a minimum of 5 consecutive years.

For premature withdrawals, the tax is deducted at the source, but only for amounts more than Rs. 50,000/-. You also need to submit your PAN card details in such instances.

However, you can submit Form 15G with your PAN details to avoid tax deductions if you are not liable to pay taxes even after an additional withdrawal amount. Download the form from the EPFO portal (website) or from the official website of all major banks in India.

Note: If you don’t provide your PAN at the EPFO and withdraw more than Rs. 50,000/-, a 35% of the amount is deducted as TDS.

Three Most Important Forms Used for PF Withdrawal

Form 19 for Final PF Withdrawal Funds Settlement

Form 19 is used when you want to withdraw the accumulated PF funds for the final settlement. This two-page form can be downloaded from the EPFO portal or filled and submitted online from the same website.

You should provide the necessary details such as your name, father/ spouse’s name, date of birth, name and address of the company you work for, joining and leaving (last working day) dates, PF account number, PAN, UAN, postal address, the reason for exiting the company, payment mode, and signatures (employee and employer).

You can use Form 19 to withdraw or transfer your EPF corpus fund when you quit your job or switch from one employer (organisation) to another.

To submit Form 19 online, you should follow the same steps as provided in the previous section. You will get an OTP (one-time password) to verify your Aadhaar. Keep the registered mobile with you.

Make note of the reference number on the screen after submitting the form. Use this number to track your application.

Form 31 for Partial PF Withdrawal

Use Form 31 to withdraw funds partially or to get an advance from your EPF account. You can get an advance only if your bank account details, PAN, and Aadhaar are updated on the EPF portal.

The form can be submitted online and offline. Download the form or submit it through the EPF portal. The process is the same as given above and will include an Aadhaar-linked OPT verification.

Form 10C for Withdrawal or Transfer from EPS

EPS is Employee Pension Scheme, which is different from EPF (Employees’ Provident Fund). You can submit the form online through the EPF portal or download it and submit it offline.

The online submission process is similar to the steps mentioned above. However, you should select the claim type as Withdraw PF Only or Withdraw PS Only. Then go to ‘I want to apply for’ and select Only Pension Withdrawal (Form 10C).

You should complete the Aadhaar-linked OTP verification to submit the form. A reference number will be sent to your registered mobile number. The claim amount will be credited to your bank account.

Documents Required for PF Withdrawal

When you need to make a withdrawal from your PF account, there is some documentation that you need to keep handy:

- Your UAN (Universal Account Number)

- Your Bank Account Information

- Address Proof

- Identity Proof

- Cancelled Cheque (with account number and IFSC code)

How to Apply for Home Loan Based on EPF Accumulation?

Now that you know the process of PF withdrawal of your funds, let’s check out the procedure to get a loan with the PF funds as collateral.

According to the EPFO rules, you can borrow up to 36 times your last month’s EPF contribution to purchase a home. This amount is limited to 24 times to purchase land. You have to be in service for 5 consecutive years to be eligible.

Offline/ Physical Application

Apply for a loan through the housing society. Follow the format detailed in Annexure 1 and submit the application to the EPF Commissioner. The Commissioner will issue a certificate with information about your EPF contribution for the last 3 months.

Alternatively, you can take a photocopy of the EPF bank account’s passbook with the last 3 months’ contribution and submit the copy to the housing society to get an estimate.

Online Application via UAN Portal

- Login into your account using the UAN and password on the UAN Member e-Sewa portal.

- Click on the Online Services tab and select Claim (Form-31, 19 & 10C).

- Check your details presented on the screen and enter your bank account number (the one registered with UAN). Click on Verify and select Yes to sign the certificate.

- Then select ‘Proceed to Claim’ and provide the reason for requesting an advance in your EPF funds. This option will be next to I Want to Apply For. (The option will be visible only to employees who are eligible for it.)

- Select PF Advance (Form 31) to withdraw EPF funds as an advance/ loan. Enter the required amount and your address.

- Upload the relevant documents if prompted. Click on the certificate to apply and complete the process.

- Your application has to be assessed by EPFO. Once approved, the payment will be directly sent to the housing society. This can take around two to three weeks.

How to Withdraw your EPF Without UAN?

You should follow the older process (physical filing and submission) and get an attestation from the bank manager/ gazetted officer/ magistrate in your jurisdiction. Submit the form at the Regional Provident Fund office. Check the alphanumeric code (Provident Fund Account Number) to identify the state and location. This detail will be available on your salary slip.

It is recommended to get the compulsory UAN and link it to your Aadhaar and bank details on the UAN website. It saves time and simplifies the entire process. Employers who hire informal workers (in organized and unorganized sectors) can use the TankhaPay app to provide EPF and other social security benefits. Credit the workers’ salary, EPF contribution, ESI contribution, etc., through the app.

All you need to do is provide the KYC of your informal workers and verify their details on the app. Then, set up automated payments every month so that the amounts will be credited to their respective bank accounts on the scheduled date. You can also provide a detailed salary slip and help your workers have a solid EPF and retirement plan to secure their future.

Any informal employee (from cooks to delivery persons, caregivers, construction workers, etc.), be it full-time or part-time, and even temporary workers can be added to the app. As a responsible employer, you can ensure that your workers are financially protected and covered under government schemes through the TankhaPay app.

Conclusion

Every employee or worker should know how PF withdrawal works and how to transfer the funds to their account. The easiest method is to use the UAN and EPF portals. Make it a point to get the compulsory UAN and link it with your Aadhaar, EPF bank account, and mobile number.

Frequently Asked Questions

Who is eligible for PF registration?

PF registration is compulsory for specific groups of employers and employees. Any factory or manufacturing plant with twenty or more workers, along with establishments employing at least 20 professionals during the previous year, are mandated to register for PF. Additionally, every employee earning a monthly salary below ₹15,000 is eligible for PF registration, regardless of the organisation's size.

Are EPF contributions eligible for tax deductions?

Absolutely, EPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act 1961. It's a great way to save on your taxes while securing your future.

Can I increase my EPF contributions?

Certainly, you can increase your EPF contributions and contribute up to 100% of your basic pay. This additional contribution goes into your Voluntary Provident Fund (VPF) account, offering you more financial security.

Can I withdraw my 100% PF amount?

You can access your entire PF savings once you reach the retirement age of 55. If you choose to retire before this age, you won't be able to withdraw the entire amount. However, a year before your retirement, you're eligible to receive 90% of your EPF savings.

Do I need the employer’s permission to withdraw funds from EPF?

Thanks to recent amendments, you can now withdraw funds from your EPF account without needing your employer’s permission, making the process more streamlined and efficient.

Can I make premature withdrawals?

Yes, you can make premature withdrawals under certain conditions, provided you provide the necessary documentary evidence, ensuring flexibility based on your specific needs.

Is PF withdrawal taxable?

Withdrawals from EPF are tax-free if made after five years of continuous service. However, if you withdraw your EPF balance before completing five years of continuous service, the withdrawn amount becomes taxable.

How can I withdraw the maximum possible amount if I have multiple EPF accounts?

You can consolidate multiple EPF accounts using your UAN. Submit an application to the EPF Office to merge your accounts. After consolidation, you can follow the standard EPF withdrawal process, either online or offline, for seamless transactions.

How long does it take for the EPF claim to be settled?

Typically, your EPF claim is processed and settled within 20 days, ensuring a relatively quick and efficient process.

I have completed five months in my current organisation. Can I withdraw my EPF money?

No, EPF withdrawals are permissible only when you are unemployed. According to current rules, if you're unemployed for one month, you can withdraw 75% of your EPF corpus. The remaining 25% can be withdrawn if you remain unemployed for more than two months.

How can I withdraw the EPF Amount if my claim is rejected due to no recent contributions?

To avoid claim rejection, ensure your employer consistently contributes to your EPF. Regular contributions are crucial. If faced with issues, consult your HR department to address the problem and maintain the active status of your EPF account.

Disclaimer: All information regarding the EPF is subject to change as per government policy. Kindly refer to the official website for accurate facts and figures.