The Payroll process is just as it sounds. It is the process of giving employees their wages for the work they’ve done in a specific time period. Unarguably, it’s a really important part of a business and involves different departments like finance and HR.

Initially, businesses relied on manual work and used spreadsheets to calculate and give out salaries. However, now, the process has become much more streamlined with the automation of this process. The market is rife with options for automated payroll software that makes this job much easier.

A payroll cycle is the time between two salary payments. Companies can choose to pay their employees every week, every two weeks, or every month. In India, it’s usually done monthly.

Functions of Payroll

Payroll is an essential function in any organisation, responsible for managing employees’ salaries and ensuring compliance with legal requirements. Here’s an overview of what the payroll process involves:

Payroll Policies and Procedures

The first step in payroll management is defining the organisation’s payroll policy. This policy outlines how employee pay is structured, including components like basic pay, variable pay, House Rent Allowance (HRA), Leave Travel Allowance (LTA), and other benefits. Clear policies ensure that everyone understands how their salary is calculated and what they can expect in their payslip.

Salary Calculation

Calculating salaries involves determining the gross salary, which is the total earnings before deductions. From this, various deductions are made, both statutory (required by law) and non-statutory. Statutory deductions might include Provident Fund (PF) contributions and taxes, while non-statutory deductions could be for health insurance or retirement savings plans. Accurate salary calculation is crucial to ensure employees receive the correct amount.

Record Keeping

The payroll department is responsible for creating and maintaining comprehensive records. These records include payslips, time and attendance logs, earnings details, and deductions. Proper record-keeping ensures transparency and provides a clear history of each employee’s payroll information, which is vital for audits and future reference.

Tax and Compliance

A significant part of the payroll function is ensuring compliance with tax laws and regulations. This involves depositing due amounts such as Tax Deducted at Source (TDS) and PF with the appropriate authorities. Staying compliant with legal requirements helps avoid penalties and ensures the business operates within the law.

Salary Disbursement

The primary role of the payroll department is to ensure that employees are paid accurately and on time. Salaries are typically disbursed either weekly, bi-weekly, or monthly, depending on the organisation’s payroll cycle. In India, monthly salary disbursements are common. Adhering to the established payroll cycle is crucial for maintaining employee satisfaction and trust.

Audits and Reporting

To ensure transparency and accountability, the payroll function must maintain proper documentation and reporting systems. These records are essential for audits and checks, allowing auditors to verify that all payroll processes are conducted correctly and that all financial records are accurate.

Addressing Queries

Employees and management often have questions related to payroll and payslips. The payroll department is responsible for answering these queries promptly and providing necessary information to all stakeholders. Effective communication helps resolve concerns and ensures everyone is informed about their payroll details.

In the past, businesses managed payroll using spreadsheets or manual methods, which could be time-consuming and prone to errors. Today, automated payroll software solutions have simplified these tasks, allowing businesses to handle complex payroll functions more efficiently and with fewer mistakes. This automation ensures that calculations are accurate and that all aspects of payroll management are streamlined.

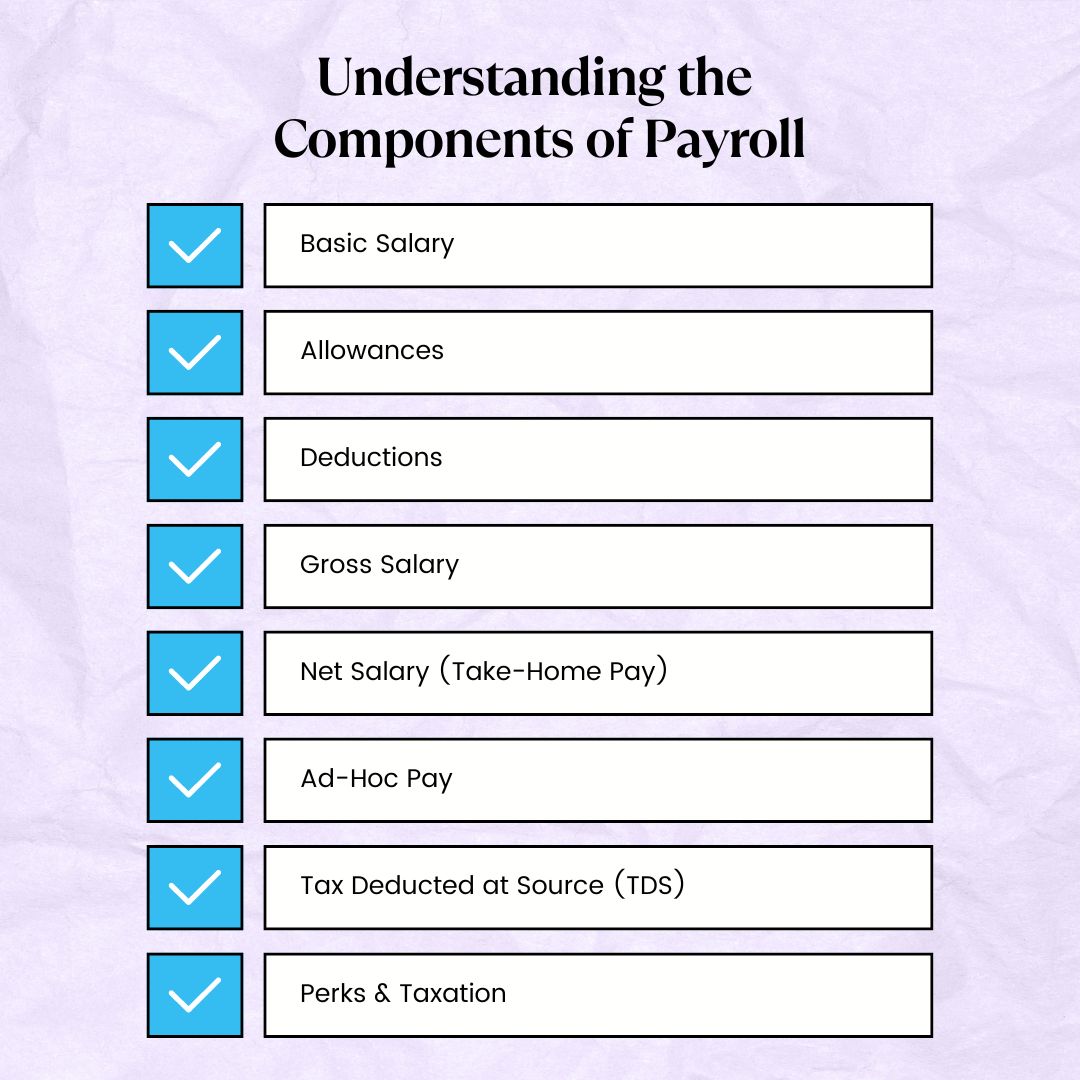

Understanding the Components of Payroll

Payroll is the process of compensating employees for their work, and it involves several key components that are important for accurate and efficient payment. Let’s break down these essential parts:

Basic Salary

The basic salary is the foundational part of an employee’s earnings. It is a fixed amount paid to employees before any additional bonuses or deductions. Typically determined by factors such as experience, job role, and industry norms, the basic salary serves as the benchmark for other elements of an employee’s pay. It is often used to calculate other parts of the compensation package, including various allowances and performance-based bonuses.

Allowances

Allowances are extra payments provided to employees on top of their basic salary to cover specific job-related expenses. These allowances help employees manage costs associated with their work, such as housing, transportation, and meals. For instance, a housing allowance may be provided to cover accommodation costs, while a transport allowance can help with commuting expenses. The tax implications of allowances can vary depending on local regulations and the type of allowance offered.

Deductions

Deductions are amounts subtracted from an employee’s paycheck before the final payment is made. They can be mandatory, such as income taxes and social security contributions, or voluntary, such as contributions to a retirement fund or health insurance premiums. Understanding these deductions is important because they affect the net salary employees receive. Properly managing deductions ensures compliance with legal requirements and helps employees understand how their pay is calculated.

Gross Salary

Gross salary represents the total amount an employee earns before any deductions are made. It includes the basic salary plus any additional allowances and bonuses. Gross salary is a key figure used for calculating taxes and other statutory contributions. It’s important to note that the gross salary does not reflect the actual take-home pay, as it does not account for any deductions.

Net Salary (Take-Home Pay)

Net salary, also known as take-home pay, is the actual amount of money an employee receives after all deductions have been made from the gross salary. This is the sum deposited into the employee’s bank account and is what employees have available for personal expenses. Calculating net salary accurately is crucial for ensuring employees are paid correctly and understand their compensation.

Ad-Hoc Pay

Ad-hoc pay refers to non-regular, one-time payments given to employees outside of their standard salary. These payments are often provided for specific reasons, such as rewarding outstanding performance on a project or covering unexpected work-related expenses. Unlike regular salary payments, ad-hoc pay is processed quickly to address immediate needs. Whether these payments are taxable can vary depending on the situation and local tax laws.

Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is a system used to collect income tax from employees by deducting it directly from their salary. This process serves as an advance payment towards the employee’s annual tax liability. Employers calculate the TDS amount based on factors like the employee’s income, tax bracket, and declared investments. The deducted amount is then paid to the government on behalf of the employee, which helps reduce the tax burden at the end of the financial year.

Perks

Perks are additional benefits provided by employers to enhance the overall compensation package. These benefits may include gym memberships, company cars, accommodation, or other incentives that add value to the employee’s compensation. Perks play a vital role in attracting and retaining top talent, offering employees added incentives to remain with the company. They can make a significant difference in employee satisfaction and motivation.

Taxation

Taxation is a crucial aspect of payroll management that involves calculating and withholding taxes from employee wages. This includes various taxes, such as income tax and, in some cases, unemployment tax. The specific tax rates and deductions depend on multiple factors, including the employee’s location, income level, and filing status. Ensuring accurate tax calculations is essential for compliance with tax laws, as it helps prevent legal issues and ensures employees are taxed correctly.

Payroll Processing in India

Preparing for payroll involves many steps that help ensure accurate and timely salary disbursements while adhering to legal and company policies. Here’s how to start:

Pre-Payroll

- Employee Information: Start by onboarding new employees and compile a comprehensive list of all staff members to be paid. Collect essential details like PAN numbers, bank account information, addresses, and other relevant data. This step is vital as it forms the foundation of accurate payroll processing.

- Understanding Payroll Regulations: Define clear payroll policies, including pay structures, leave and attendance regulations, and employee benefits. It’s imperative to align these policies with Indian labour laws and get management approval. This ensures that your payroll system complies with the legal framework and keeps both the company and its employees protected.

- Validate Employee Information: Before processing payroll, validate the gathered employee information. Cross-check it with company policies and approval models. Ensure that all active employees are accounted for while excluding any former employees from salary and compliance payments. This meticulous validation prevents errors and guarantees that payments are allocated to the right individuals.

Payroll

- Calculate Payroll: Once all inputs and information are validated, they are entered into the system. This data includes employee details, attendance records, and other relevant information. The payroll system calculates the final salaries, deducting taxes and other necessary compliances. This step ensures that employees are paid accurately in line with the company’s policies and legal requirements.

Post-Payroll

- Disbursement of Salaries: After confirming the availability of sufficient funds, the company initiates the salary payouts. Timely disbursement is crucial to employee satisfaction and maintaining the company’s reputation. It demonstrates reliability and professionalism, fostering trust among employees.

- Payment of Statutory Dues: The company must make statutory payouts to the relevant government bodies. These include contributions such as provident fund, professional tax, and employee state insurance. Fulfilling these obligations on time ensures compliance with Indian labour laws, avoiding penalties and legal complications.

- Distribution of Payslips and Tax Computation Sheets: Transparency is key in payroll management. Providing employees with detailed payslips and tax computation sheets enhances trust and clarity. Employees can review their earnings, deductions, and tax calculations. Distributing these documents promptly after payroll processing ensures that employees understand their finances and can address any concerns promptly.

- Payroll Reporting: Payroll reporting is the vital process of generating reports using payroll data to ensure compliance with statutory regulations. Employers must file monthly and annual returns to meet legal requirements, ensuring accurate records for taxation and audit purposes.

- Payroll Accounting: Salaries and wages constitute significant expenses for employers, underscoring the need for meticulous record-keeping. Properly recorded payroll data facilitates accurate financial reporting, aids in forecasting, and supports effective budgeting, enabling businesses to manage their finances efficiently.

How to Manually Calculate Payroll Taxes in India

Calculating payroll taxes in India involves several steps to ensure that employees are taxed correctly and in compliance with the current tax regulations. Here’s a step-by-step guide to understanding and manually calculating payroll taxes:

What’s Your Gross Salary

The gross salary is the total earnings an employee receives before any deductions are made. It includes:

- Basic Salary: The fixed amount paid regularly to the employee.

- Allowances: Additional payments like House Rent Allowance (HRA), Travel Allowance, and other taxable benefits.

- Bonuses: Any extra earnings added to the salary package.

Take Away the Exempt Components

Once you have the gross salary, the next step is to deduct any exempt components that are not subject to taxation. These typically include:

- House Rent Allowance (HRA): This can be partially or fully exempt based on specific conditions such as the city of residence and the rent paid.

- Leave Travel Allowance (LTA): This is exempt if claimed according to the rules set by the Income Tax Department.

- Standard Deduction: A fixed amount that is automatically deducted from your salary, currently set at ₹50,000 for the financial year 2023-24.

These exemptions reduce the taxable portion of your salary, known as Taxable Income.

What’s Your Taxable Income

Taxable Income is the portion of your salary that remains after subtracting the exempt components from your gross salary. This amount is what your income tax is based on.

Check the Income Tax Slabs

To calculate your income tax, apply the income tax slabs to your taxable income. The proposed income tax slabs for the financial year 2024-25 are as follows:

| Income tax slabs (In Rs) | Income tax rate (%) |

|---|---|

| 0-3,00,000 | 0% |

| 3,00,001-7,00,000 | 5% |

| 7,00,001-10,00,000 | 10% |

| 10,00,001-12,00,000 | 15% |

| 12,00,001-15,00,000 | 20% |

| 15,00,001 and above | 30% |

Consider Other Payroll Taxes

In addition to income tax, you may also need to account for other payroll taxes, such as:

- Professional Tax: A small tax levied by some states, typically ranging from ₹200 to ₹2,500 annually, depending on the state and income bracket.

- Provident Fund (PF) Contribution: A mandatory contribution to the employee’s retirement fund, usually around 12% of the basic salary from both the employer and employee.

Calculate Total Payroll Taxes

The total payroll taxes payable are the sum of your income tax and any other payroll taxes, such as professional tax and provident fund contributions.

Requirements for Processing Payroll

The payroll process relies heavily on precise data. Here are the key data requirements essential for seamless transactions:

Leave and Attendance Data

One of the fundamental aspects of payroll processing is accurate leave and attendance data. This data determines how much time an employee has worked during a specific pay period. Errors in this data can lead to incorrect compensation calculations, which in turn can cause dissatisfaction among employees. It’s not just crucial for payroll but also for HR departments to track employees’ work hours and adherence to stipulated work timings.

Payments and Deductions Information

Precise details about payments made to employees and deductions, such as taxes and other obligations, need to be recorded meticulously. This data is necessary to determine the net salary that an employee is eligible to receive for a specific period. Any errors here can lead to financial discrepancies and dissatisfaction among employees.

Income Tax Information

As per the Income Tax Act, employers are responsible for deducting income tax at source while paying salaries. This deduction is based on the estimated annual income and applicable tax rates. To ensure accurate tax deductions, organisations often collect declarations of tax-saving investments made by employees at the beginning of the financial year. Based on these declarations, the organisation calculates the taxable income and projected tax liability. Monthly deductions, known as Tax Deducted at Source (TDS), are then made from employees’ salaries.

Accurate collection and management of these data sets are vital. Errors can not only impact employee satisfaction but can also lead to legal and financial complications for the organisation. Therefore, organisations need to invest in efficient systems and processes to handle this data accurately, ensuring payroll processes are smooth, compliant, and employee-friendly.

Required Forms for Payroll Process

There is a diverse array of payroll forms that are required in the country. These are indubitably crucial for effective tax compliance. We have provided a list of the key forms and their purposes:

| Forms | Download |

|---|---|

| Form 24Q This form is essential for filing returns on tax deducted at source from salary payments. Employers must submit it quarterly, detailing the salary payments and corresponding TDS deductions. |

Download |

| Form 12B Employers use Form 12B to inform employees about their income details when they join mid-year, ensuring clarity in tax calculations. |

Download |

| Form 12BB Employees declare their tax-saving investments for a financial year in Form 12BB, aiding accurate tax deductions. |

Download |

| Form 15H and Form 15G These forms are for senior citizens and others to file Income Tax Returns for one financial year. |

Download |

| Form 16 and Form 16A Form 16 signifies TDS deductions from salary, while Form 16A provides details of TDS/TCS for various transactions between the deductor and the deducted. |

Download |

| Form 16B Employed in property transactions, this certifies TDS on income earned from the sale of immovable property. |

Download |

| Form 10C Claiming benefits under the Employee Pension Scheme (EPS) involves filling and submitting Form 10C. |

Download |

| Form 26QB and Form 26AS Form 26QB is for TDS payment, while Form 26AS (Tax Credit Statement) maintains tax credit details for each taxpayer. |

Download |

| Form 27C This document aids in obtaining tax exemption from TDS, applicable to specified goods as per the Income Tax Act. |

Download |

| Form 24G Employers use Form 24G to submit information regarding TDS for various individuals, including non-residents, for processing. |

Download |

| Form 64A It contains the statement of income paid or credited by Venture Capital Companies and Funds, as per the Income Tax Act. |

Download |

| Form 12BA This detailed statement showcases perquisites, fringe benefits, and profits in lieu of salary. |

Download |

| Form 27EQ This quarterly certificate outlines Tax Collected at Source (TCS) under Section 206C of the Income Tax Act. |

Download |

| Form 49B Employers apply for a TAN (Tax Deduction and Collection Account Number) using Form 49B, which is necessary for tax deductions and payments. |

Download |

Methods of Payroll Processing

In the early stages of operation, many companies opt for spreadsheet-based payroll management due to its convenience, especially when dealing with a small number of employees. Spreadsheets utilise standard templates with preset mathematical formulas for salary and compliance payment calculations. While this method is cost-effective and straightforward for small-scale operations, it becomes impractical as businesses expand and hire more employees. The opportunity cost of sticking to traditional systems over automated methods becomes considerably high. Additionally, reconciling and verifying values in spreadsheets can be challenging, leading to potential errors.

Outsourcing

For companies lacking dedicated personnel for payroll management, outsourcing becomes a viable solution. Outsourcing involves delegating the company’s payroll execution to an external agency. Companies provide the outsourced agency with salary details, leaves, attendance, and reimbursement data every month, based on the payroll cycle. The agency then calculates dues and ensures compliance with statutory regulations. This option is particularly useful for businesses seeking specialised expertise in payroll management.

Automation

The advancement of technology has introduced various payroll automation software and tools. These solutions streamline payroll computations, reducing manual efforts and enhancing efficiency. Automated payroll software addresses the challenges faced with spreadsheets and outsourcing. It eliminates the risk of mathematical or clerical errors and significantly improves accuracy. However, it is essential to keep the software updated with the latest compliance laws to ensure its effectiveness and reliability.

Implementing these methods judiciously based on the company’s size and requirements can lead to a more efficient and error-free payroll processing system.

Statutory Compliance in Payroll Processing

Statutory compliance is the guiding framework that organisations must adhere to when dealing with their employees. It’s not just a set of rules; it’s the legal backbone ensuring fairness and legality in the employer-employee relationship.

Understanding these compliance regulations is not just essential – it’s critical as it would find you in the hot waters of legal penalty if not carefully abided by. An in-depth knowledge of the legal landscape is needed to minimise the risks associated with non-compliance. Every nation has its unique set of compliance requirements, and India is no different. So, let’s go through the statutory compliances here:

ESI and PF (Provident Fund)

Employers in India are mandated to contribute to Employee State Insurance (ESI) and Provident Fund (PF). These funds are crucial for the financial well-being of employees, providing them with social security and a safety net for the future.

Professional Tax

Professional tax is a state-imposed tax levied on income earned by employees. Companies need to deduct and submit this tax to the respective state governments. It’s a vital compliance, ensuring state revenues and employee contributions to the state’s development.

TDS (Tax Deduction at Source)

TDS is a system through which income tax is deducted at the time of payment itself. Employers are responsible for deducting TDS from employees’ salaries and depositing it with the government. It ensures a regular inflow of revenue for the government and simplifies the taxation process for employees.

Gratuity

Gratuity is a form of retirement benefit and is mandatory for companies in India. It is paid by employers to employees who have completed five years of continuous service. This compliance ensures that employees are financially secure after their active working years.

When processing payroll in India, specific elements are crucial:

- Salary Components and Structures Configuration: Ensuring accurate configuration of salary components and structures is foundational. It directly impacts employees’ take-home pay and tax liabilities.

- Finance Settings: Proper configuration of elements like House Rent Allowance (HRA) and tax considerations for bonuses is essential. Employers must navigate the complexities of both old and new tax regimes to comply effectively.

- Income Tax Declarations: Managing Income Tax declarations is a global requirement. It’s important for employers to handle these declarations efficiently to meet legal obligations while ensuring employees’ financial well-being.

- Loans Facility: If an organisation provides loan facilities to employees, this needs careful management. It involves balancing financial aid to employees with the legal intricacies surrounding loans.

These aspects of payroll management aren’t simply administrative tasks but legal imperatives that safeguard the rights of employees and protect the interests of businesses. Adhering to these regulations aids companies in contributing to a fair and just work environment while avoiding the heavy penalties associated with non-compliance.

Factors that Affect Employee Compensation

There are multiple factors that affect the final compensation that the employee takes home. Below, we have discussed some of them in needed detail.

- Income Tax: all working professionals in the country are subjected to pay Income tax, which varies from person to person as per their compensation. Tax-at-source (TDS) must be deducted by employers from the monthly salaries of the employees for the government.

- Provident Fund: This is the contribution that employers must put forward as a part of the retirement benefits scheme run by the government. This amount is set to be 12% of the employee’s basic pay, and the employer is required to match this contribution.

- Employee State Insurance (ESI): This is a scheme that comes under the provision of social security, which is responsible for providing cash and medical benefits to the employees. Any business that employs more than 10 people is required to register under the ESI Act. Under this act, the employer has to put 3.25% of the employee’s salary towards the fund, while the employee contributes 0.75%.

- Professional Tax: This taxation varies from state to state in India. This is levied on the working professionals of the country.

- Leave Encashment: All employees have annual leaves, and if they are not used, they can be encashed towards the end of the year. This encashment is dependent on the number of leaves remaining and the salary of the employee.

There are also other important elements of an employee’s salary structure in India. We have listed them below.

- CTC

- Gross Salary

- Net Salary

- Allowances

- Deductions

- Payslip

- Form-16

- Reimbursements

- Bonus/Incentives/Expenses/One-time payments

- Ad hoc Components

- Company PAN, PF, ESI, PT, LWF (if applicable) details etc.

- Signatory Details

- Company Bank Details

- Employee Financial Details

- Employee Investment Declarations

- Previous Salary Details

- Annual CTC / Gross of all the employees

Challenges of Handling Payroll Processing

As we have already stated multiple times, payroll processing is challenging. It is complex and layered. It also requires you to jump through multiple bureaucratic and legal requirements. It is also done every month. This is why a lot of businesses opt for outsourcing or rely on software to do the work for them. Before you consider either of the options (or simply decide to do it yourself), let’s go through the common challenges that one can expect while handling payroll.

Compliances

There is a legal framework that needs to be followed by all businesses operating in the country. This framework consists of 4 main components: Tax Deducted at Source (TDS), Provident Fund (PF), Employees’ State Insurance (ESI) and Professional Tax (PT). Each of these is computed separately. Businesses also needed to file returns periodically on four separate portals. Otherwise, they would be risking heavy penalties.

The challenges aren’t just at the separate filing systems; the employee laws change frequently, which makes it difficult to stay on top of them.

Complications with Spreadsheets

Recent surveys highlight a concerning statistic: a significant 57% of Indian businesses still rely on traditional paper documents or spreadsheet-based methods for payroll management. While manual systems are cost-effective, they come with notable drawbacks. Manual payroll processes, although simple and inexpensive, are time-consuming and prone to errors. Furthermore, they pose a risk of mishandling and tampering with crucial information.

Additionally, spreadsheets, a common tool for manual payroll, fall short when it comes to tax compliance. Tax laws change frequently, making it challenging for spreadsheet systems to keep up with the evolving regulations.

Data Security Concerns

Processing payroll demands employees to share sensitive information such as bank details, rental agreements, PAN, and Aadhaar documents. Protecting this data is paramount. Failure to do so not only jeopardises a company’s reputation but also the personal security of its employees.

Traditional paper documents are particularly vulnerable; they are easily misplaced, risking data integrity. Even when stored electronically on spreadsheets, this data is merely a password away from misuse, highlighting the urgency for more secure and reliable methods of payroll management.

Benefits of Automated Payroll Processing

While manual payroll processing has its benefits, automation is increasingly becoming the preferred choice for businesses today. Here are several reasons why automated payroll systems are superior:

Cost Saving

Automated payroll systems significantly reduce the chances of payroll errors, which means fewer penalties and fines for mistakes. These systems also save time and resources by handling repetitive tasks efficiently, ultimately leading to lower labour costs for your business.

Better Compliance

Keeping up with ever-changing tax laws and regulations can be challenging. Automated payroll systems automatically calculate and withhold taxes, ensuring that your business stays compliant with legal requirements. They also generate detailed reports that can be used to verify compliance during audits.

Increased Employee Satisfaction

One of the primary expectations employees have is to be paid correctly and on time. Automated payroll systems ensure accuracy and timeliness, which leads to happier employees. When employees know they can count on receiving their paychecks without errors, it boosts their morale and satisfaction.

Accurate Calculations

Errors in payroll calculations can lead to discrepancies in employee paychecks, causing confusion and dissatisfaction. Automated systems minimise these errors, ensuring that all calculations are accurate and reliable.

Timely Payouts

With automated payroll, payments are processed quickly and efficiently. This ensures that employees receive their salaries on time, every time, which contributes to smooth business operations and employee trust.

Time Efficient

Manual payroll processing can be incredibly time-consuming, requiring significant effort and attention to detail. Automated payroll systems handle most of these tasks automatically, completing them in a fraction of the time it would take to do them manually. This frees up valuable time for your HR team to focus on more strategic activities.

Secure Data Handling

Automated payroll systems are designed with robust security measures to protect employee data. They drastically reduce the risk of data leaks and privacy breaches, which are more common in paper-based systems where records can be mishandled, lost, or stolen.

Easy Access to Data Insights

With all employee data stored digitally, businesses can leverage analytics tools to gain insights into workforce trends and employee behaviour. This information can be invaluable for making informed decisions and improving overall business strategy.

Simplifying Payroll Calculations with TankhaPay

Manually calculating payroll taxes can be complex and time-consuming, especially for businesses with numerous employees. Calculation errors can lead to compliance issues and financial penalties. TankhaPay is a reliable solution for effortlessly managing payroll.

Why Choose TankhaPay?

- Automated Calculations: TankhaPay automates the calculation of gross salaries, exemptions, and deductions, ensuring accuracy and compliance with the latest tax laws.

- Real-Time Tax Updates: Stay up-to-date with the latest tax regulations and income tax slabs, as TankhaPay automatically updates to reflect any changes in tax laws.

- Comprehensive Reporting: Generate detailed payroll reports that help you track salaries, deductions, and tax liabilities, making it easier to manage financial planning and audits.

- Employee Self-Service Portal: Employees can access their payslips, tax details, and other payroll information through a user-friendly portal, reducing administrative burden and improving transparency.

- Secure Data Handling: TankhaPay ensures that all employee data is handled with the utmost security, safeguarding sensitive information against unauthorised access.

How TankhaPay Transforms Payroll Management

The integration of TankhaPay into your payroll process can help you streamline operations, reduce manual errors, and focus on strategic business activities. Our advanced features ensure that all payroll components are calculated accurately, from basic salary to allowances, deductions, and final tax liabilities. Schedule a call with us today!

Payroll Glossary – Important Payroll Terms

The first step to understanding payroll is to familiarise yourself with key terms. Here is a list of a few important ones:

- Payroll Cycle: The gap between salary/wage disbursements, varying from monthly to weekly or contractual in India.

- Gross Pay: Total salary components, including bonuses, commissions, and allowances, before deductions like TDS, provident fund, and health insurance.

- Net Pay: Take-home salary after deductions like TDS, EPF, and ESI, and voluntary deductions such as health insurance and loan repayments.

- Overtime Pay: Extra hours worked beyond the normal working hours, compensated as per legal provisions or company policies.

- Pay Period: Frequency of employee payments, whether bi-weekly, weekly, fortnightly, or monthly.

- Compensation: Sum total of financial and non-financial rewards, including wages, benefits, bonuses, and incentives, provided by employers for work performed.

- Contractual Employees: Temporarily hired individuals, not permanently on the company’s payroll, with specified durations in their contracts.

- Salary Slip: Document detailing an employee’s gross salary, deductions, and net salary for a specific pay period.

- Tax Deducted at Source (TDS): Mandatory income tax deduction made by employers from employee salaries, remitted to the government on their behalf.

In Conclusion

Payroll processing is a tedious job, and if one pays heed to the challenges and technical difficulties involved, the need for outsourcing arises. Modern payroll solutions not only streamline the process but also ensure security and compliance with ever-changing tax laws.

FAQs on Payroll Process

What Are Different Payroll Methods?

There are three primary payroll methods:

- Excel-Based: Affordable but complex, mainly used by startups and small businesses.

- Outsourced: Involves hiring third-party payroll services if a business has the necessary resources.

- Payroll Management Software: Offers a straightforward solution with various trustworthy options available.

- Other Methods: Include commission pay, hourly wages, and base salaries.

Is Payroll Part of HR?

Yes, payroll is managed primarily by the HR department in businesses. It is one of several tasks HR oversees, ensuring timely and accurate payments, addressing discrepancies, and handling payroll-related issues.

What Are the Four Types of Payrolls?

The four types of payrolls are:

- In-House Payroll: Suited for small businesses with regular work hours.

- Bookkeepers/CPA Managed Payroll: Involves hiring external experts when in-house expertise is insufficient.

- Agency Managed Payroll: Outsourcing to specialised agencies focused on payroll management.

- Software Managed Payroll: Utilises cloud-based software for automated, 24/7 accessible payroll processing.

Additionally, businesses can explore cutting-edge applications that automate payroll services, providing seamless and efficient solutions for managing employee compensation while reducing manual workload and ensuring accuracy.

What is the payroll process cycle?

The payroll cycle, or the pay cycle, refers to the duration between two consecutive payroll runs. It is the period between two paydays. For instance, if a company pays its staff weekly, every 7-day period represents a new payroll cycle.

What is full payroll process?

To complete payroll, one must calculate the total wages earned by employees, deduct any necessary withholdings, file payroll taxes, and make payments accordingly.

What is payroll vs salary?

Employees earn a contracted salary, while payroll tracks their earnings and taxes paid.

How long does payroll take to process?

The time taken to process payroll depends on the method you choose. Manual calculations can be time-consuming, taking hours to days, especially if you have many employees to process or must comply with several laws. Manual payroll processing may not be feasible if you are a large corporation operating across state lines. In such cases, using payroll software is a more efficient approach. Automation in payroll software can run payroll in minutes, saving valuable time.

What is end-to-end payroll processing?

End-to-end payroll processing connects payroll with other workforce management aspects, like performance measurement, training, scheduling, benefits, and compensation. This connection improves communication, record-keeping, analytics, and efficiency throughout the employee life cycle.

Why is the payroll process necessary?

Processing payroll is of utmost importance, as any delay in paying employees or incorrect filing of taxes might lead to penalties and interest on back taxes. Moreover, an unreliable payroll system could severely impact employee morale and damage the reputation of your business. Considering these severe consequences, allocating the necessary resources, be it time or money, is always advisable to ensure payroll is handled accurately and efficiently.

What is a payroll processing checklist?

A payroll processing checklist ensures accurate and compliant payroll by classifying workers correctly, verifying payment information, collecting and tallying hours, processing payroll on time, and accurately depositing and reporting employment taxes.

What are the three stages of payroll process?

The three stages of processing payroll are data collection, calculation, and disbursement. The first stage involves collecting essential details such as employee information, hours worked, deductions, and withholdings. This information is then used in the calculation stage. The net payment amount is determined by considering tax withholdings and overtime wages. Lastly, in the disbursement stage, payments are made to employees through various methods, such as direct deposit or paper checks.

Can you process payroll manually?

Yes, you can process payroll manually. First, you need to determine the gross pay for each employee, then calculate and subtract various deductions. Then, you must determine the net income, pay your employees, and make tax deposits to the relevant agencies.

What is payroll formula?

The payroll formula is used to determine an employee's net pay. The basic payroll formula is Net Income = Gross Pay - Deductions.

Gross pay is the total amount an employee earns before making any deductions. This includes their base salary, bonuses, overtime pay, and commissions.

What are the basics of payroll?

The payroll process tracks employee hours, calculates pay, and distributes payments via direct deposit or check.

What is payroll in Excel?

Companies perform calculations like in-hand salary, deductions, and taxes for their employees using Microsoft Excel.

What is bank payroll?

It is an electronic payment option. Electronic payments are a convenient way to transfer funds directly from one bank account to another.

What is a journal entry for payroll?

Payroll journal entries help record employee compensation in small or mid-sized businesses.

What is payroll function?

The payroll function is a fundamental component of any organisation. Its primary purpose is to ensure that all employees receive their wages.

Who prepares the payroll?

Generally, payroll is managed by external accountants or consultants.

What is a payroll statement?

A payroll statement is a document that provides a detailed list of wages and salaries paid to an organisation's employees during a specific period.

What is a payroll service?

A payroll service is a third-party company that helps with payroll processing, simplifying timely and accurate payment.

What is the meaning of payroll?

Payroll is the total amount a business owes its employees as compensation on a specific date or period. It's typically handled by an organisation's accounting or human resources department. However, in small businesses, the owner or a colleague usually manages payroll directly.

What is payroll?

Payroll is the amount of money a business pays its employees. It includes wages, salaries, bonuses, and other benefits. It is paid for a specific period or on a particular date. Payroll is an integral part of managing a business's finances.

What is a payroll agency?

A payroll service provider is a company that helps or takes care of payroll for another business. This is useful for employers who want to save time and ensure that their employees and taxes are paid correctly and on time.

What is the definition of payroll?

Payroll is the total of all financial compensation that a business needs to pay its employees, including wages, salaries, bonuses, overtime pay, and other benefits, for a specific time or date. It encompasses every form of financial remuneration an employee receives for their work and is a crucial aspect of any organisation's financial management.

Disclaimer: All the information published is in good faith and for general information purposes only and is designed only to provide general information on the payroll process.