In every organisation, leave is not just a benefit—it’s a right. Yet, managing different types of leave, understanding which ones are encashable, and dealing with related tax implications can overwhelm HR professionals and employers. One such aspect that requires careful attention is leave encashment.

This blog provides a complete guide to leave encashment in India—covering its definition, types of leaves eligible, leave encashment calculation methods, exemption, taxation rules, company policy dependencies, and key benefits. Whether you are an HR executive or an employer, this will help you manage it effectively while staying compliant.

What Is Leave Encashment?

Leave encashment refers to the amount an employee receives in exchange for unused earned leave. Instead of taking time off, the employee converts their remaining leave days into a monetary benefit.

This payment is usually provided:

- During resignation or retirement.

- When the employee’s leave balance exceeds a specific limit.

- Or as a one-time annual payout based on company policy.

However, it is essential to understand that leave encashment is not an automatic entitlement. It is primarily governed by the organisation’s internal HR policy and employment contract.

If you’re wondering about leave encashment meaning, simply put—it’s converting unused leave into money.

Is it mandatory to give leave encashment?

Leave encashment is not mandated by Indian labour law for active employees unless explicitly mentioned in the company’s policies or collective bargaining agreements.

That said, under certain circumstances like retirement, resignation, or termination, organisations must pay out any earned leave balance as part of the final settlement.

Hence, it is entirely policy-dependent—meaning employers are free to:

- Decide which leaves can be encashed.

- Set the frequency (annual/at exit only).

- Impose capping on the number of encashable leaves.

When is Leave Encashment Applicable?

Leave encashment typically becomes applicable under the following scenarios:

- At the time of retirement – Employees can encash their accumulated leave balance.

- During resignation or termination – Unused paid leaves are compensated.

- During employment (optional) – Some employers allow encashment periodically (annually or as per policy).

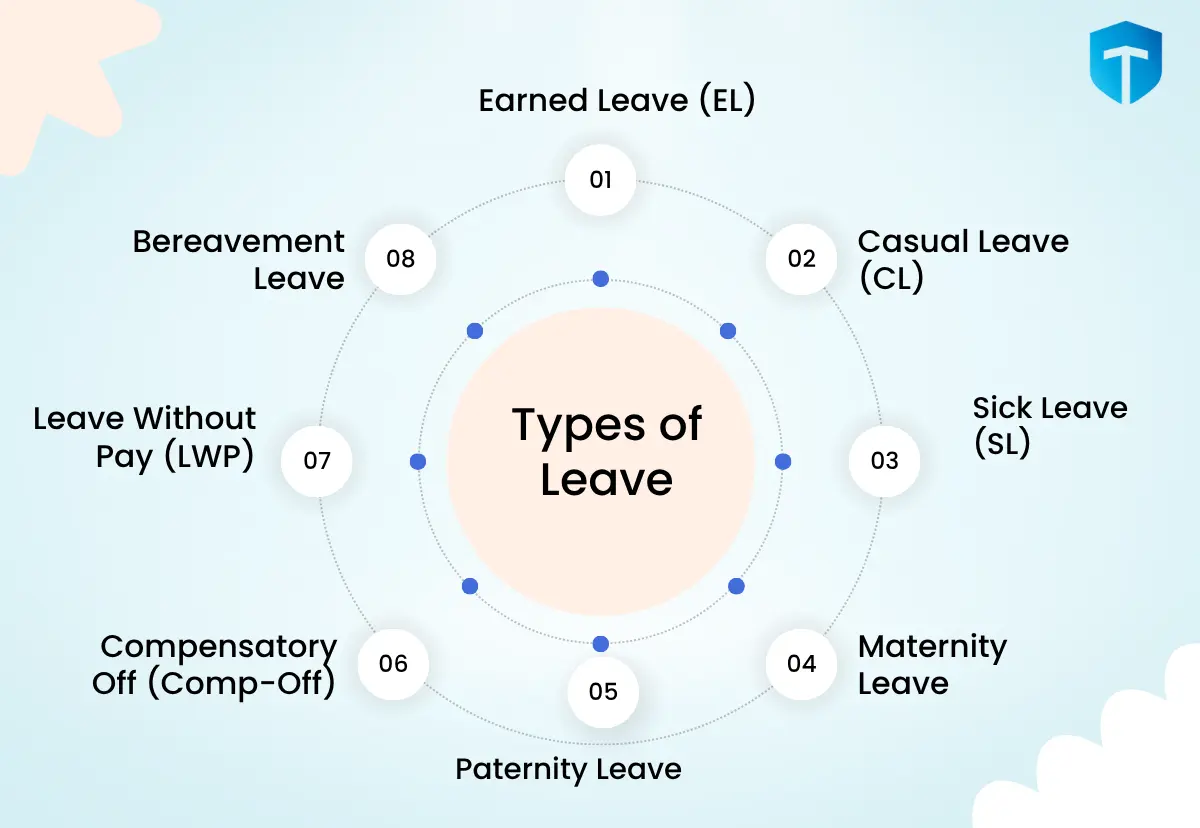

Types of Leave and Their Eligibility for Leave Encashment

Different organisations offer different types of leave. However, not all of them are encashable. Let’s explore each type:

1. Earned Leave (EL) / Privilege Leave (PL)

-

- Definition: Leave earned for days worked.

- Accrual: Typically 1.25 to 2 days per month.

- Encashment: Yes

a. The most commonly encashed leave.

b. Payable at the time of resignation, retirement, or when leave balance exceeds the limit.

2. Casual Leave (CL)

-

- Definition: Leave for short-term personal needs.

- Accrual: 6–12 days annually.

- Encashment: No.

a. CL lapses at the end of the year and cannot be encashed.

3. Sick Leave (SL)

-

- Definition: Leave for illness or injury.

- Accrual: 6–12 days per year.

- Encashment: No.

a. Usually not eligible for encashment unless stated in the policy.

4. Maternity Leave

-

- Definition: Leave granted to female employees under the Maternity Benefit Act.

- Accrual: Statutory 26 weeks.

- Encashment: No.

a. It cannot be encashed under any circumstance.

5. Paternity Leave

-

- Definition: Granted to male employees at childbirth.

- Accrual: 5–15 days, depending on policy.

- Encashment: No.

a. Usually, it is non-encashable and lapses if unused.

6. Compensatory Off (Comp-Off)

-

- Definition: Time off instead of extra workdays or holidays.

- Accrual: Based on actual extra hours worked.

- Encashment: Usually No.

a. It must be used within a set time, or it will lapse.

7. Leave Without Pay (LWP)

- Definition: Unauthorised or excess leave beyond entitlement.

- Encashment: Not Applicable.

8. Bereavement Leave

-

- Definition: Granted in the event of death of a close family member.

- Accrual: 3–7 days, depending on policy.

- Encashment: No.

a. Offered as compassionate leave and not eligible for encashment.

| Leave Type | Purpose | Encashable |

|---|---|---|

| Earned Leave (EL) | Long-term personal/vacation leave | Yes |

| Casual Leave (CL) | Short absences, personal matters | No |

| Sick Leave (CL) | Illness or medical needs | No |

| Maternity Leave (CL) | Childbirth, as per law | No |

| Paternity Leave (CL) | Childbirth, as per company policy | No |

| Compensatory Off (CL) | For working extra hours/days | Usually No |

| Leave Without Pay | Leave beyond entitlement | Usually No |

| Bereavement Leave | Death of a loved one | No |

Key Things to Know About Leave Encashment

Understanding rules is essential for both employers and employees. These rules cover who can claim it, how the amount is worked out, and how taxes apply.

-

- Eligibility: Usually, employees can encash leave when they resign, retire, or during employment, depending on company policy.

- Calculation: The amount is generally based on the basic salary and dearness allowance.

- Tax: Tax rules differ for government and non-government employees, with specific exemptions under Section 10(10AA) of the Income Tax Act.

*Note: The company’s HR or leave policy must clearly define eligibility criteria. Not all employees may qualify, especially if the policy restricts encashment during active service.

How Is Leave Encashment Calculated?

Leave encashment calculation uses the employee’s basic salary and dearness allowance (if applicable). The calculation generally involves the following steps:

1. Identify the eligible leave balance (in days).

2. Calculate daily salary = (Basic Salary + Dearness Allowance) ÷ 30

3. Leave encashment amount = Daily Salary × No. Of Leave Days to be Encased

Example:

-

- Basic Salary + DA = ₹45,000 per month

- Earned leave balance = 20 days

- Daily salary = ₹45,000 ÷ 30 = ₹1,500

- Leave encashment = ₹1,500 × 20 = ₹30,000

Note: House Rent Allowance (HRA), bonuses, and other variable components are usually not included unless defined otherwise in the company’s policy.

Leave Encashment Exemption: Understanding Tax Benefits

Leave encashment taxation depends on when the leave encashment is received and whether the employee is in the private or government sector:

1. During Employment

Fully included in taxable salary income.

2. At Retirement or Resignation

-

- Government employees: Leave encashment is fully exempt.

- Non-government employees: Exempt up to ₹3,00,000 or the least of the following:

a. Actual amount received

b. 10 months’ average salary

c. Cash equivalent of leave (maximum 30 days/year for each completed year)

d. ₹3,00,000 (lifetime limit)

This is the leave encashment exemption calculation, which is crucial during final settlements.

Legal Framework for Leave Encashment

There is no single central law that mandates leave encashment for private-sector employees. However, some key legislations provide basic guidelines:

-

- Factories Act, 1948: Covers earned leave and its encashment on exit.

- Shops and Establishments Acts (State-specific): Defines leave entitlements and encashment rules.

Ultimately, company policy prevails, provided it doesn’t offer less than what is prescribed under applicable state laws.

Benefits of Leave Encashment

|

Stakeholder |

Benefit |

Impact |

|---|---|---|

|

Employees |

Monetary Reward |

Provides cash instead of untaken leaves. |

|

Greater Flexibility |

Employees can balance time off and income. |

|

|

Retirement Support |

Lump-sum benefit at retirement acts as a financial bonus. |

|

|

Employer |

Reduced Liability |

Prevents excessive leave accumulation on company books. |

|

Improved Planning |

Encourages employees to plan time off more efficiently. |

|

|

Employee Motivation |

It improves the overall compensation package and lifts employee morale. |

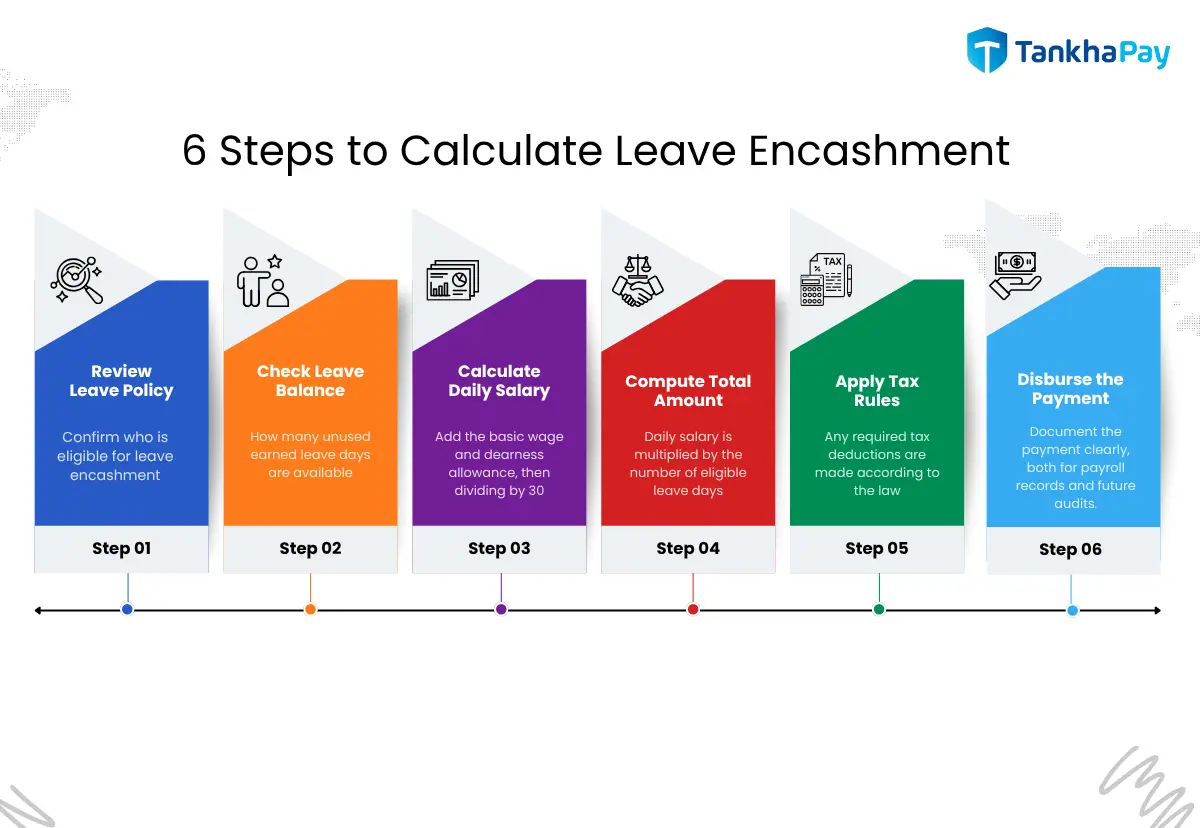

6 Steps to Calculate Leave Encashment

Leave encashment might sound complicated, but when broken down into a few clear steps, it’s much easier to manage. Whether you’re an employer trying to stay compliant or an employee wanting to understand your payout, following the right process ensures everything is fair, accurate, and within policy. Here’s a quick and simple guide to how it’s typically done.

1. Review Leave Policy:

The company’s leave policy is checked to confirm who is eligible for leave encashment and what rules apply.

2. Check Leave Balance:

The employee’s record is reviewed to see how many unused earned leave days are available.

3. Calculate Daily Salary:

The daily salary is calculated by adding the basic wage and dearness allowance, then dividing by 30.

4. Compute Total Amount:

This daily salary is multiplied by the number of eligible leave days to get the total encashment amount.

5. Apply Tax Rules:

Tax exemptions are considered, and any required tax deductions are made according to the law.

6. Disburse the Payment:

Once everything is approved, the final step is to credit the leave encashment amount directly to the employee’s bank account. It’s good practice to document the payment clearly, both for Payroll Software records and future audits.

When each stage is handled with care, businesses can ensure the process stays fair, transparent, and error-free—for everyone involved.

Here’s a simple example to understand how the calculation works:

- Suppose the employee’s monthly salary (Basic + DA) is ₹60,000

- They have 20 days of eligible leave available for encashment.

- The daily salary would be ₹60,000 ÷ 30 = ₹2,000

So, the total encashment = ₹2,000 × 20 = ₹40,000

This ₹40,000 would then be paid out as per the company’s payout cycle or policy.

This amount is then added to the employee’s salary or processed as a separate payout, depending on company policy.

Organisations can automate this workflow using the cloud-based software TankhaPay, which ensures real-time calculations and compliance.

Define Leave Policies That Fit Your Organisation with TankhaPay

Managing employee leave shouldn’t be complicated—or rigid. With TankhaPay, you can create leave policies that actually reflect how your organisation works. Whether you run a startup, a factory, or a growing enterprise, the platform lets you tailor time-off rules to fit your exact needs.

You can set up multiple leave types (like sick leave, casual leave, or earned leave), define eligibility rules, automate carry-forwards, and calculate leave balances automatically. It’s all designed to reduce manual work and improve accuracy in payroll processing.

No matter if your policies change based on location, department, or contract type—TankhaPay adapts to your structure with ease, helping HR stay in control and employees stay informed.

Conclusion

Leave encashment is a practical benefit that gives employees added financial security and helps employers manage costs more effectively. Knowing how it’s calculated and taxed is important for both sides. With TankhaPay, this process is easy to manage—clear, accurate, and fully automated, so you can avoid confusion and stay compliant.

Want to simplify apprentice hiring and compliance? Read more about the NATS Scheme India 2025 and how TankhaPay can help

FAQ

How many days of leave can be encashed?

The number of leave days that can be encashed depends on the organisation’s leave policy or applicable labour laws. Employees can encash earned or privileged leave exceeding a set limit, often 30 days or more.

What is the new rule for leave encashment?

As per the new rule effective from April 1, 2023, the tax-free limit for leave encashment at the time of retirement or resignation has been revised upwards from ₹3 lakh to ₹25 lakh for employees in the private sector.

What is the maximum leave encashment limit?

For non-government employees in India, the maximum amount of leave encashment exempt from income tax has been increased to ₹25 lakh. This revised limit came into effect from 1st April 2023 and applies to leave encashment received at the time of retirement or resignation. Any amount above ₹25 lakh will be taxable as per the applicable income tax slab.

What salary is considered for leave encashment?

Basic salary and DA are considered for leave encashment. Other components like HRA or bonuses are generally not included unless specified in the company’s policy.

What is the difference between leave encashment and earned leave?

Earned leave is the paid time off employees accumulate for rest or personal use. Leave encashment is the monetary compensation employees receive for unused earned leave when they leave the organisation or during specific payout periods. Essentially, earned leave is the benefit accrued, while leave encashment is the cash value of that benefit.

Is HRA included in leave encashment?

HRA is generally not included in leave encashment calculations unless the company’s policy states otherwise. Typically, only Basic Salary and Dearness Allowance are considered.

Which leaves cannot be encashed?

Casual, sick, maternity, and bereavement leave are generally not eligible for encashment unless the company’s policy specifically allows it. Only earned (privilege) leave is typically encashable.

Which employees are eligible for leave encashment?

Employees who have accumulated earned leave and meet their company’s eligibility criteria—such as completion of a minimum service period or exit from the organisation—are eligible for leave encashment. Eligibility ultimately depends on the employer’s leave encashment policy.

How many times can leave encashment be availed?

The frequency of leave encashment varies depending on your organisation’s rules. While some companies allow employees to encash unused leave annually, others restrict encashment to only when an employee retires or resigns. It’s best to check your employer’s specific policy for exact details.