Form 26AS, introduced on June 1 2020, is a vital document that encapsulates a comprehensive overview of your financial transactions related to taxation. This annual statement acts as a consolidated record, encompassing details about Tax Deducted at Source (TDS), tax collected by collectors, advance tax payments, self-assessment tax payments, received refunds, regular assessment tax deposits, and high-value transactions concerning mutual funds, shares, and more. This article will cover all the basics to help you understand the concept better.

What is Form 26AS?

Form 26AS serves as a comprehensive dossier, offering intricate details about various aspects of your tax-related transactions. It encompasses information on Tax Deducted at Source (TDS), indicating the amount deducted from your income by payers like employers and banks. Additionally, it includes data on taxes collected by collectors, reflecting taxes collected by entities other than employers. The form further outlines advance tax payments made by taxpayers, self-assessment tax payments initiated voluntarily, and details about refunds received during the financial year.

Moreover, Form 26AS delves into regular assessment tax payments, providing insights into the taxes deposited following a thorough assessment. One of its key features is the disclosure of high-value transactions, particularly in the realm of mutual funds, shares, and other financial instruments. This section offers transparency, ensuring taxpayers are aware of significant financial activities.

The new format of Form 26AS, implemented in June 2020, goes beyond routine transactions. It sheds light on specified financial transactions (SFT) and pending tax proceedings, providing a comprehensive snapshot of an individual’s tax profile. This enhanced version ensures taxpayers have access to a detailed, organised, and holistic overview of their financial interactions, making the process of tax compliance more transparent and efficient.

What Does Form 26AS Tell You?

Form 26AS is a comprehensive document that provides crucial financial information to taxpayers. When reviewing Form 26AS, individuals can interpret the following key details:

- Tax Deducted on Income: Form 26AS displays the amount of tax deducted at source (TDS) from various sources of income, such as salary, interest, or dividends.

- Tax Collected Details: It includes information about tax collected by collectors, indicating payments made where tax has been collected at source (TCS).

- Advance Tax Payments: Details about any tax paid in advance by the taxpayer, which is typically done through self-assessment tax payments.

- Self-Assessment Tax Payments: Information about self-assessment tax payments made by the taxpayer before the filing of the income tax return.

- Regular Assessment Tax: It provides data regarding the tax deposited during regular assessment processes, ensuring compliance with tax regulations.

- Investments in Shares, Mutual Funds, etc.: Form 26AS includes transactions related to investments in shares, mutual funds, and other high-value financial transactions, aiding in calculating capital gains tax.

- Tax Deducted on Property Sale: Details about tax deducted on the sale of immovable property, applicable under certain circumstances.

- Yearly Turnover Information: For businesses, it includes turnover details, which is crucial for assessing business income tax.

- Income Tax Refund Details: Information regarding any income tax refunds received by the taxpayer, indicating excess tax paid in previous years.

The updated AIS, operational since June 1, 2020, incorporates data on specific financial transactions, ongoing and concluded assessment proceedings, tax liabilities, refunds, and the previously available information in the form.

How to Download Form 26AS?

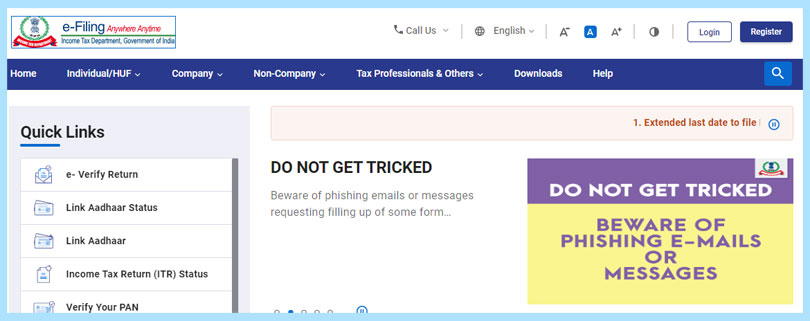

The form can easily be downloaded through the government site. We have taken the liberty of writing the steps to help you walk through the process:

1. Visit the official Income Tax e-filing website.

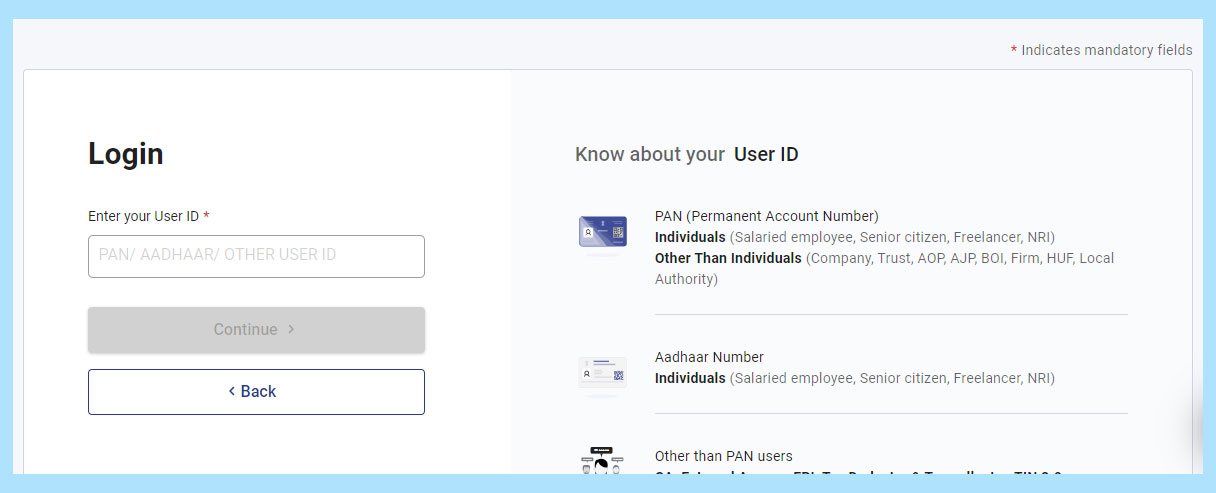

2. Click on ‘Login‘ and enter your User ID (PAN or Aadhar number). Continue to the next step.

3. Select ‘e-file‘ and then click on ‘Income Tax Returns‘.

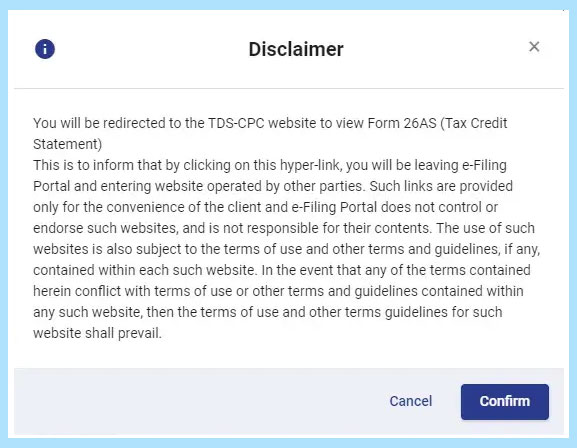

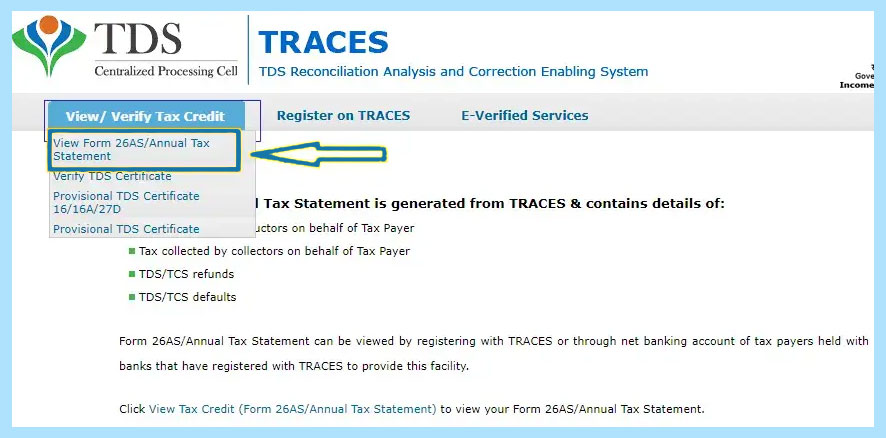

4. Choose ‘View Form 26AS‘ and click ‘Confirm‘ in the pop-up disclaimer.

5. Click on ‘View Tax Credit (Form 26AS)‘.

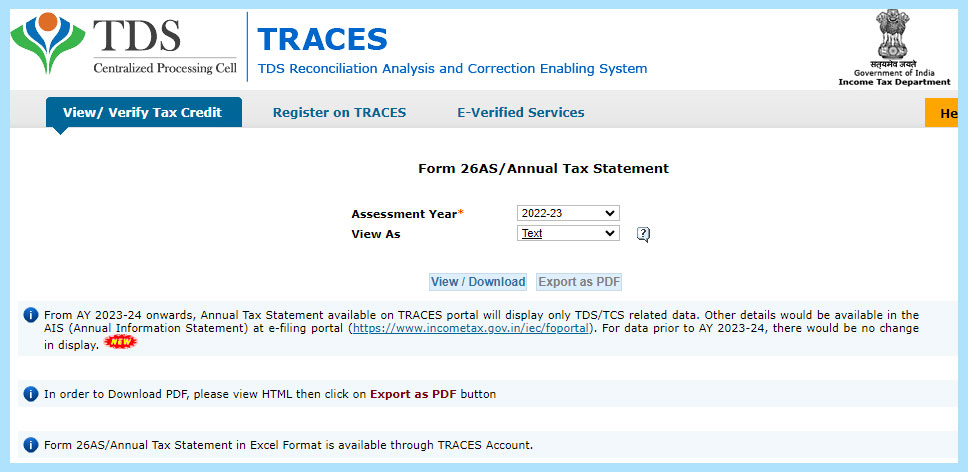

6. Select the ‘Assessment Year‘ and the desired format for Form 26AS.

7. Enter the ‘Verification Code‘ and click ‘View/Download‘.

Alternatively, you can also download Form 26AS through net banking facilities provided by specified banks.

How to View Form 26AS Through a Net Banking Facility?

If you hold a PAN and have a net banking account with authorised banks, you can access Form 26AS for free. Ensure your PAN is linked to the specific bank account. Here’s a list of banks registered with NSDL for Form 26AS viewing:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Citibank

- City Union Bank Limited

- Corporation Bank

- Federal Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Saraswat Co-operative Bank

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

- UCO Bank

- Union Bank of India

Components of Form 26AS

Below is a comprehensive list of the components in the form:

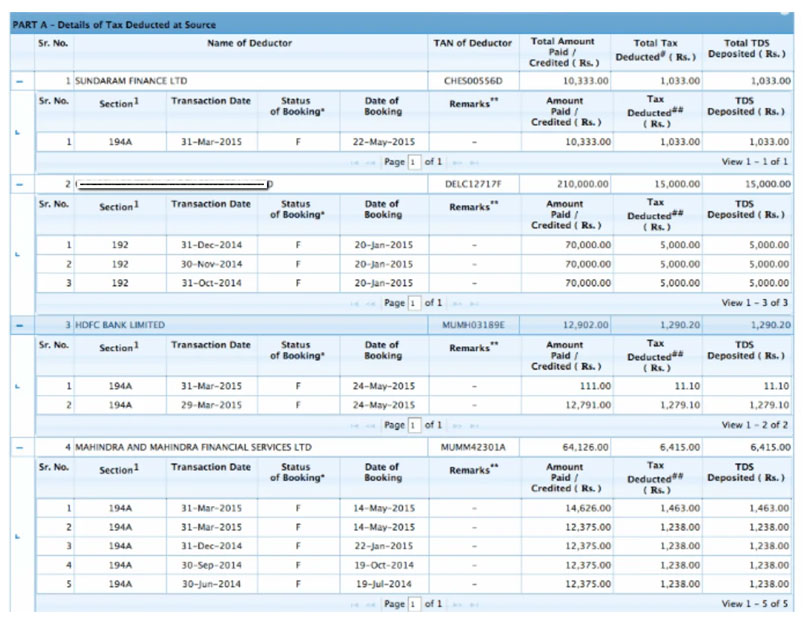

Part A: TDS Details

In this section, Part A of Form 26AS provides a comprehensive breakdown of Tax Deducted at Source (TDS). It encompasses various sources such as salary, interest income, pensions, prize winnings, etc. Each entry includes crucial details like the Tax Deduction and Collection Account Number (TAN) of the deductor, the precise amount of TDS deducted, and the corresponding deposits made to the government. These details are updated quarterly, offering a detailed overview of your TDS deductions throughout the year.

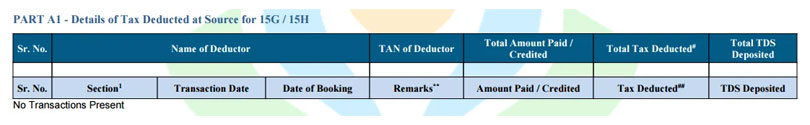

Part A1: TDS for Form 15G/15H

This segment focuses on income sources where no TDS has been deducted due to the submission of Form 15G or Form 15H by the taxpayer. Submission of these forms verifies TDS deduction status. If the taxpayer hasn’t submitted Form 15G or Form 15H, this section will indicate ‘No transactions present,’ providing clarity on income sources where no TDS has been deducted.

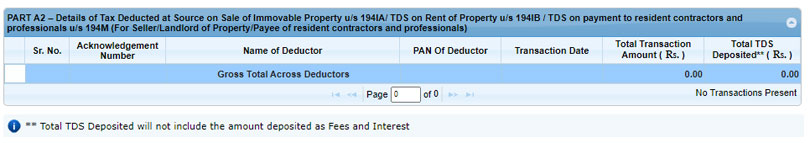

Part A2: Specific TDS Entries

Part A2 provides specific details related to TDS on significant transactions. It includes TDS deductions for property sales (under section 194IA), rent (under section 194IB), and payments made to resident contractors and professionals (under section 194M). This section reveals entries if you have sold or rented property, received payments for contractual or professional services during the year, and TDS was deducted accordingly. It offers a clear overview of TDS deductions from these specific transactions.

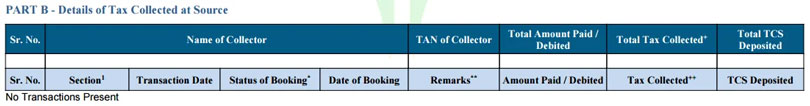

Part B: Tax Collected at Source (TCS)

Part B of Form 26AS highlights Tax Collected at Source (TCS) by sellers of goods. It enumerates sellers who have collected tax from you, providing essential details regarding these transactions. This section is particularly relevant for individuals engaged in transactions where TCS is applicable, offering insights into the sellers’ TCS collection activities.

Part C: Tax Paid (Other than TDS/TCS)

Part C offers insights into taxes paid by the taxpayer, excluding TDS or TCS. It includes self-deposited taxes, such as advance tax and self-assessment tax. Additionally, this section provides detailed information about the challan used for tax deposits, including the Bank and Branch Code (BSR code), deposit date, and Challan Identification Number (CIN). It serves as a comprehensive record of the taxpayer’s self-deposited taxes.

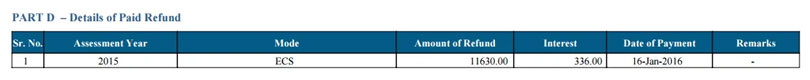

Part D: Paid Refund

This section provides detailed information regarding any tax refunds issued to the taxpayer. It includes the assessment year to which the refund pertains, the mode of payment, the refunded amount, any interest paid along with the refund, and the date of payment. Part D ensures transparency regarding tax refunds processed by the authorities.

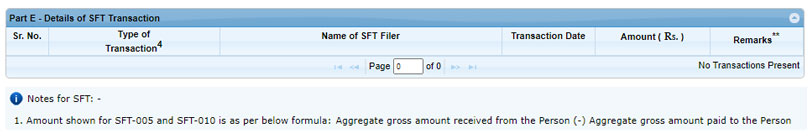

Part E: SFT Transactions

Part E focuses on Statements of Financial Transactions (SFT) reported by banks and financial institutions. It encompasses high-value transactions, such as purchases of mutual funds, properties, and corporate bonds. This section aids in monitoring significant financial activities reported to tax authorities, providing a holistic view of the taxpayer’s financial transactions.

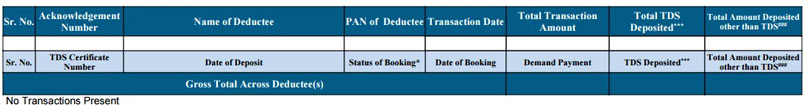

Part F: TDS on Property Sale/Rent and Professional Fees

Part F details TDS deductions made by the taxpayer on property sales, rent payments, or professional fees paid to contractors. It outlines the specific transactions where the taxpayer has deducted TDS and subsequently deposited it. This section ensures compliance with TDS regulations for these specific payment categories.

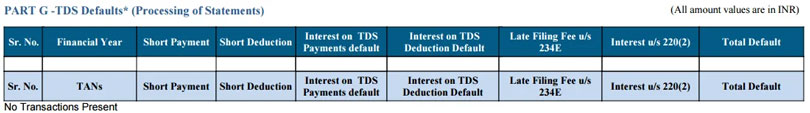

Part G: TDS Defaults (Processing of Statements)

Part G provides information on TDS defaults after the processing of TDS returns. It indicates any discrepancies or defaults detected during the processing of TDS statements. Notably, these defaults do not include demands raised by the assessing officer but offer insights into TDS-related discrepancies.

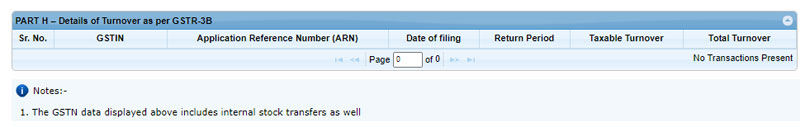

Part H: Turnover per GSTR-3B

Part H presents the taxpayer’s turnover as reported in the Goods and Services Tax (GST) return, specifically in the GSTR-3B form. It provides a detailed overview of the taxpayer’s turnover, aiding in the reconciliation of financial data reported for GST purposes.

Each section of Form 26AS serves a specific purpose, providing taxpayers with detailed insights into their TDS, TCS, tax payments, refunds, significant financial transactions, and compliance status, ensuring transparency and accuracy in their financial records.

What is in the New Form 26AS?

The new Form 26AS has these components:

PART A

Part A of the updated Form 26AS provides essential personal details, including the individual’s name, PAN Card information, Aadhar details, mobile number, email address, and communication address.

PART B

Part B includes detailed information about various transactions, encompassing:

- Tax Deducted or Collected at Source: Details of tax deducted or collected at source from various income sources.

- Specified Financial Transactions: Information related to specific financial transactions undertaken by the individual.

- Tax Payments: Records of tax payments made by the taxpayer.

- Demand and Refund: Information regarding tax demands raised and refunds processed.

- Pending Proceedings: Updates on ongoing tax-related proceedings.

- Completed Proceedings: Details of concluded tax proceedings.

- Other Relevant Information: Any additional data as per sub-rule (2) of 114-I, providing comprehensive insights into the taxpayer’s financial activities.

This division into Part A and Part B in the new Form 26AS enhances transparency and offers a comprehensive overview of the individual’s financial landscape, facilitating efficient tax management and compliance.

Why Do You Need Form 26AS?

Form 26AS holds significant importance for taxpayers due to the following reasons:

- Verification of TDS and TCS Details: Allows verification of accurate TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) information submitted by deductors and collectors.

- Confirmation of Timely Deposits: Enables taxpayers to confirm if the deducted and collected taxes have been deposited in the government account within the stipulated time frame.

- Tax Credits Verification: Helps in verifying tax credits, ensuring they align with the taxpayer’s records and aiding in accurate calculation of income tax liabilities.

- Pre-Filing Tax Review: Provides a comprehensive overview of tax-related transactions, enabling taxpayers to review and validate their tax data before filing income tax returns

How to Verify Your TDS Certificate with Form 26AS?

When cross-checking your TDS certificate with Form 26AS, it’s crucial to focus on the following key aspects:

- Accurate Personal Information: Verify your name, PAN, Deductor’s TAN, refund amount, and TDS details on Form 26AS. Any discrepancies can hinder the filing of your income tax returns.

- Confirmation of TDS Receipt by Government: Ensure the TDS amount shown in your certificate has been received by the Central Government of India. Compare TDS data on Form 26AS with your payslips to validate the accuracy.

- Matching Form 16/16A Data: Cross-verify the TDS details in Form 16/16A with Form 26AS. If discrepancies exist and TDS is missing in Form 26AS, it indicates the deductor has deducted TDS but has not yet submitted it to the IT department. Resolve such issues promptly by contacting your deductor.

FAQs

How to Rectify Errors in Form 26AS?

Inform the deductor to file a corrected TDS return to fix errors in Form 26AS.

What Information is in Form 26AS?

Details of tax deducted, collected, self-assessment tax, advance tax, assessment tax, and refunds.

Which Forms Do I Need to Submit for TDS?

If TDS is not deducted (Form 15G/Form 15H), it's mentioned in Part A1 of Form 26AS.

Why is Form 26AS Important?

Proof of tax deductions and confirmations from banks and employers.

How to Correct Bank Errors in Form 26AS?

Contact your bank to rectify any wrongly reflected advance tax payments in Part C of Form 26AS.

Can I Update the PAN Holder's Details in Form 26AS?

Yes, update incorrect PAN holder details using the 'Request for new PAN card or/and changes or correction in PAN data' option on the official website.

When Does Form 26AS Get Updated?

Form 26AS updates after the income tax department processes the filed TDS return, usually within seven days.

What is the Password for Form 26AS in PDF?

The password for Form 26AS in PDF format is the taxpayer’s date of birth/incorporation in DDMMYYYY format.

How to View Form 26AS via Net Banking?

Use net banking of any authorised bank where your PAN is linked to access Form 26AS.

Why Do I Need Form 26AS?

It serves as proof of taxes deducted, collected, and deposited on your behalf, ensuring compliance and accuracy in tax payments.

When Does TDS Reflect in Form 26AS?

TDS appears in Form 26AS after filing a TDS return, processed by the CPC, usually within seven days.

Disclaimer: The intent of this article is to inform the general audience. It is not to be taken as a legal document. For the most accurate and latest information, kindly refer to the government sites.