Form 16B is a document that certifies the amount deducted at source during the sale of a property. This deducted amount is deposited by the buyer to the income tax department. The buyer deducts the tax from the payment made to the seller. The buyer is responsible for deducting the tax and paying the amount to the Government. The deductor must furnish a TDS certificate called Form 16B. This article provides detailed information regarding Form 16B and its various aspects.

Read further to learn about Form 16B–what it is, its components and how to download it.

What is Form 16B?

Form 16B is a certificate the buyer provides to the seller when purchasing an immovable property. It verifies the amount of tax deducted at the source and deposited with the Income Tax department. TDS does not apply to agricultural and immovable properties sold for less than Rs. 50 lakh. If the value of the property is greater than Rs. 50 lakhs, the buyer must deduct a 1% TDS under Section 194 of the Income Tax Act and issue Form 16B to the seller. This form verifies TDS on the sale proceeds of a property and is downloadable on the portal.

Components of Form 16B

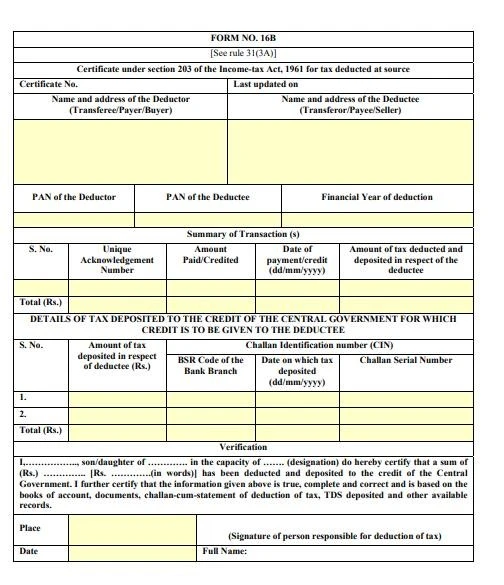

The components of Form 16B are as follows:

- The Seller’s PAN (Permanent Account Number)

- The Assessment Year

- The payment acknowledgement number

- Income Tax Act Deduction

- Breakup of salary

- Reliefs under Section 89

Form 16B Eligibility

As per the Income Tax Act, 1961 provisions, anyone who purchases an immovable property (excluding agricultural land) from a resident transferor for Rs. 50 lakhs or more must deduct TDS at 1%. A TDS certificate in Form 16B must be issued to the seller, certifying the amount of TDS deducted and deposited with the Income Tax department. This certificate provides the seller with proof of the TDS deducted and can be used while filing their income tax returns.

Form 26QB and Form 16B

When an individual pays TDS, they receive a challan or return under section 26QB. This is an electronic document for tax deducted under section 194-IA. It is essential to fill out Form 26QB accurately, as mistakes cannot be corrected once the form is submitted. If any changes need to be made, the individual must contact the income tax department directly.

Form 26QB is necessary to obtain Form 16B, and there are specific rules for filling it out. The form should be filed within 30 days following the month of deduction, and if TDS is paid in instalments, a separate Form 26QB should be submitted for each instalment.

Moreover, Form 26QB should be made for both the buyer and the seller. For example, if there is one buyer and three sellers, separate Form 26QB will be made for each seller and buyer, like seller one and buyer, seller two and buyer, and seller three and buyer separately. The same rule applies if the number of buyers increases.

Due date for Form 16B

The Form 16B must be provided to the payee within 15 days from the due date for Form 26QB. The payee can then generate and download Form 16B from TRACES by following simple steps.

How to Deposit TDS Payment?

The Income Tax Department makes depositing TDS easy by allowing taxpayers to submit the amount online. Various users can use Internet banking facilities to deposit their TDS amount. When the transaction is completed successfully, a counterfoil with CIN, bank details, and payment details will be displayed. This counterfoil serves as proof of payment made by the payer.

On the other hand, submitting TDS offline is challenging. After obtaining Form 26QB, a challan can be printed, and TDS can be paid using a cheque or draft at any authorised bank.

Difference between Form 16 and Form 16B

Form 16 and Form 16B are essential documents issued under Indian tax laws. Still, they serve different purposes and are related to various aspects of tax deduction at source (TDS).

Form 16 is a TDS certificate issued to employees by an employer. It provides details of salary, TDS, and tax deposited and helps employees compute their taxable income.

Form 16B is a TDS certificate issued by a buyer of immovable property to the seller. It serves as proof of the deduction of TDS and provides details of the property and transaction date. Sellers can use it as evidence of tax payment while filing their tax returns.

Difference between Form 16A and Form 16B

Form 16A and Form 16B are different tax deduction certificates under Income Tax laws.

Form 16A is issued by deductors (other than employers) to deductees for different types of payments, such as interest income, commission, brokerage, rent, etc. Income recipients can use it as proof of TDS to claim credit while filing their income tax returns.

Form 16B is specifically related to the sale of immovable property (excluding agricultural land) and is issued by the buyer to the seller when the sale consideration is Rs. 50 lakhs or more. Sellers can use it as evidence of tax payment while filing their income tax returns and for claiming credit of TDS.

What if the Payer does not have a TAN?

As mentioned earlier, all deductors are required to obtain a TAN to deduct TDS and submit it to the Government. It is crucial to mention TAN in all communication with the Income-tax (TDS) department. The payment of TDS must be made through Challan No. ITNS 281. However, when transferring an immovable property, individuals are often parties to the transaction and cannot use Challan No. ITNS 281 without a TAN. Obtaining a TAN for a one-off transaction is not practical.

Therefore, an exception has been made for deductors under Section 194-IA, and they can file TDS returns without a TAN. A separate Return cum Challan Form 26QB has been created to allow deductors without a TAN to file TDS returns for Section 194-IA.

How to Generate and Download Form 16B

The steps to generate and download Form 16B are as follows:

- Open the Traces online portal and register.

- If already registered, log in with PAN (Permanent Account Number) and password.

- Click the ‘Download’ tab and select ‘Form 16B for the buyer’.

- Enter details like assessment year, the seller’s PAN and the acknowledgement number of Form 26QB.

- Form 16B will then become available under the requested downloads section under the downloads category.

- Form 16 is then ready for saving/ printing.

Form 16B Sample

Frequently Asked Questions

How many days for Form 16B?

Deductor should issue Form 16B to the payee within 15 days of the due date for furnishing Form 26QB. Form 16B can be downloaded from TRACES - TDS Reconciliation and Analysis and Correction Enabling System.

Who will generate form 16B?

Form 16B is a TDS certificate issued by a buyer, called a deductor, to a seller.

How is Form 16B generated?

To generate Form 16B, register with TRACES and provide specific details. These details include your PAN details, information about tax deductions or challan, and details of Form 26QB. After submitting the required information, you must enter a verification code. Once you have entered the code, an activation link will be sent to your email.

How can I get Form 16B online?

You can get Form 16B by:

- Log in to the portal using a valid username and password.

- Click 'Downloads' and select Form 16B.

- Fill in details like the Seller's PAN, assessment year, and acknowledgment number from 26QB.

- Afterwards, you download the form.

What are Forms 16 A and B?

Form B breaks down an employee's salary, additional income, deductions, and tax payable. Form 16 Part A covers non-salary income issued quarterly, while Part B depends on the number of transactions.

What is the Form 16C?

Form 16C is a certificate the tenant must issue to the landlord in case of TDS on rent payment under section 194-IB of the Income-tax Act, 1961. It reflects the amount of tax deducted and deposited.

Is Form 16B mandatory for a home loan?

Form 16 is a vital document for understanding your income and taxes. It's crucial for home loans as it provides details on taxes deducted by your employer. Lenders require it as evidence of a consistent income stream.

How do I verify my Form 16B?

Log on to the TRACES website and provide the employer's TAN, employee's PAN, TDS certificate number, assessment year, TDS amount, and source of income to view TDS details.