Form 16A is a certificate issued under section 203 of the Income Tax Act, 1961. This certificate is given to the person who has deducted TDS on certain payments which do not include salary payments. These payments can be in interest, commission, rent, etc. The certificate contains all the details regarding the TDS deducted and deposited by the person who made the payment on behalf of the person who received it.

This blog discusses Form 16A–its format, requirements and how to fill it out.

What is Form 16A?

Form 16A is a TDS certificate issued by an employer for income sources other than salary. It provides proof of TDS deduction on fixed deposits, insurance commissions, rent receipts, etc. This certificate is issued quarterly and includes essential details about non-salary income. The rate of TDS depends on the nature of the income, and the details are also available in Form 26AS.

Types of Payments that Attract TDS

Section 206C of the Income Tax Act specifies the non-salary earnings subject to TDS. It is important to note that each type of income is taxed at a different rate. The following types of income generally fall under TDS:

- Dividends

- Rent

- Interest earned on bank accounts

- Winnings from lotteries or crossword puzzles

- Winnings from horse races

- Payments made to contractors

- Insurance commission

- Payments made towards the National Savings Scheme (NSS)

- Payments made to non-resident athletes or sports associations

- Payments made for repurchasing mutual fund units

- Compensation, commission or brokerage

- Income from Indian company’s shares

- Income from foreign currency bonds

- Technical and professional service fees

- Earnings of foreign companies mentioned under Section 196A(2)

- Revenues generated from units mentioned under Section 196B

Note: TDS does not apply to the interest earned on savings accounts if the total amount is less than Rs. 10000. However, if the amount exceeds this limit, the account holder must pay TDS.

When is Form 16A Required?

Form 16A is a document that contains information about the tax deducted at source (TDS) by an individual’s employer. It is essential to know why Form 16A is required. When an individual files their income tax return, tax is calculated on their total income. They may pay the tax twice on the income if they do not claim the TDS mentioned in Form 16A or Form 26AS. This is because TDS has already been deducted and paid to the Income Tax Department (ITD) on their behalf. Therefore, it is essential to keep Form 16A as proof of taxes already paid when filing income tax return.

It is important to note that Form 26AS should always match Form 16/16A. In case of any discrepancy, an individual should immediately contact the deductor. They will not get credit for the correct TDS if the difference is not corrected.

Difference between Form 16 and Form 16A

Form 16 and 16A are TDS (Tax Deducted at Source) certificates that serve as proof of tax deducted on an individual’s income. However, there are specific differences between the two.

Form 16 is a TDS certificate issued to individuals who receive income from their salary. This form provides a detailed summary of the salary paid to the employee during the financial year and the tax deducted from it. Moreover, Form 16 is issued annually.

On the other hand, Form 16A is a TDS certificate issued for tax deducted on income sources apart from salary. This may include income from rent, commission, or interest. Unlike Form 16, Form 16A is issued quarterly.

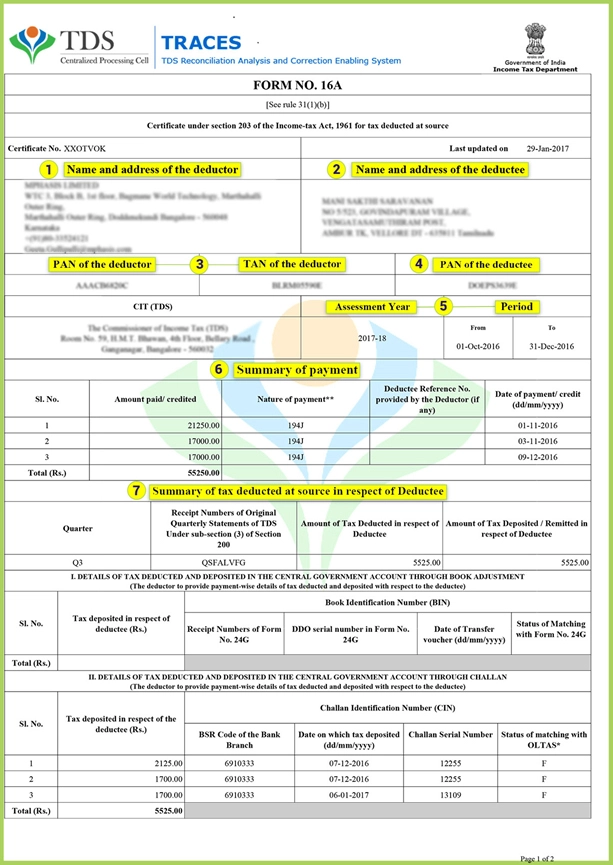

Form 16A Format

The format of Form 16A can differ depending on the software used by the deductor and the format prescribed by the Income Tax Department. The usual details included in Form 16A are as follows:

- Name and address of the deductor and the deductee

- Permanent Account Number (PAN) of both the deductor and the deductee

- The assessment year for which the certificate is issued

- Quarter during which TDS has been deducted

- Nature of payment on which TDS has been deducted

- Date of payment and date of deduction of TDS

- TDS amount deducted and deposited with the government

- Challan number and date of deposit of TDS with the government

- Unique TDS certificate number

- Any other pertinent details as required by regulations

How to Fill in Form 16A

Form 16A can filled by following these steps:

- Fill in the name and address of the Deductor, including their PIN.

- Enter the Deductor’s TAN.

- Enter the Deductor’s PAN.

- Enter the information for four acknowledgement numbers.

- Describe the nature of payment, whether contractual, professional or otherwise.

- Enter the corresponding codes for all payments listed.

- Mention the name and PAN number of the deductee whose TDS was deducted.

- Enter the period, which will be the fiscal year.

- Once all these fields are completed, enter the TDS deduction information.

- The TDS amount should be stated in words.

How to Download Form 16A

Form 16A can be downloaded by following these steps:

- Step 1: Visit the Income Tax Department’s official website.

- Step 2: Log in to the TRACES online portal by entering the User ID, Password, TAN or PAN and the captcha code.

- Step 3: Select the ‘Downloads’ tab and click ‘Form 16A’.

- Step 4: Provide the necessary information to download the TDS certificate, including the Financial Year, Quarter, Form type, and PAN.

- Step 5: Click on ‘Go’ to download the form and complete the formalities a

How to Verify Form 16A Online

Taxpayers can use the TDS Reconciliation Analysis and Correction Enablement System (TRACES) provided by the Income Tax Department to verify their income tax 16A. They can access Form 26AS and enter their employer’s TAN and their own PAN, along with the certificate number and financial year, to view their employer’s deductions.

If they notice any discrepancies in the details, they should ask their employer to make the necessary changes.

The reasons for the differences are as follows:

- Failure to fill the TDS return

- Giving incorrect TAN or PAN information

- Not mentioning the details of TDS payment in the TDS return

- Providing the incorrect amount

- Mentioning the wrong Challan Identification Number

Significance of Form 16A

The significance of Form 16A is as follows:

- Tax Filing: The information provided in Form 16A is crucial for accurately reporting total income, including non-salary sources, when filing taxes.

- Income Tax Return (ITR): Form 16A data is required to file the Income Tax Return (ITR). It aids in accurately reporting the total income and ensures compliance with tax regulations.

- TDS Tracking: Form 16A helps individuals keep track of the amount of Tax Deducted at Source (TDS) paid on their non-salary earnings. It provides a summary of the TDS deducted by the deductor.

- Proof of Income: Form 16A is a document that provides proof of income earned from various sources. It is widely recognised as evidence of income by financial institutions, government agencies, and other entities.

- Loan Applications: Form 16A is an essential document for loan applications. Financial institutions require it to verify income and assess loan eligibility by providing a comprehensive overview of the individual’s financial situation.

Similarities Between Form 16A and Form 26AS

Form 16A and Form 26AS share a significant similarity – they contain information about the deducted and deposited tax amount. These forms provide essential details regarding tax credits. However, sometimes, the TDS mentioned in Form 16A may not be sufficient to cover all taxable non-salaried income. This can lead to an increase in the burden of outstanding tax and, subsequently, an increase in payable taxes in tax returns, in addition to what is declared in Form 16A.

Frequently Asked Questions

Is it mandatory to give form 16A?

Forms 16 and 16A are essential because they calculate taxes and are needed for filing tax returns.

What is the advantage of Form 16A?

Form 16A is proof of tax payment. Claim tax mentioned in Form 26AS or Form 16A to avoid paying twice. Keep Form 16A while filing tax returns.

Can ITR be filed using Form 16A without payslips?

Form 16A can be used to file income tax returns unrelated to employee payslips.

How can I get my 16A form online?

You can get Form 16A by following these steps:

- Step 1: Login to TRACES

- Step 2: Select Form 16A

- Step 3: Select Financial Year and PAN

- Step 4: Details of authorised person

- Step 5: KYC validation

- Step 6: Success Message

Are forms 16 and 16A the same?

Forms 16 and 16A are necessary for filing an income tax return. Form 16A is used for TDS on non-salary income, while Form 16 is used for salaried individuals. They assist taxpayers in submitting their tax returns.

Can Form 16A be issued to employees whose TDS has never been deducted?

Form 16A is not required if TDS is not deducted from an employee's income.