Form 15H serves as a self-declaration indicating that an individual’s income is exempt from TDS on specific types of income. This form is submitted by senior citizens (aged 60 years and above).

We will discuss Form 15H in detail – who is eligible, how to fill it out, and download it.

What is Form 15H?

Form 15H is a self-declaration document indicating that an individual is exempt from TDS from interest income earned on fixed deposits, recurring deposits, or other savings instruments. It can be submitted by individuals aged 60 years or more.

Eligibility Criteria for Submitting Form 15H

The eligibility criteria to submit Form 15H are as follows:

- Any individual aged 60 years or above

- The individual should be a resident of India

- The individual should have any Interest Income.

- The individual’s tax liability should be NIL

- The individual must have a valid PAN

Recent Updates on Form 15H

Certain rental income can now be declared in Form 15H as of June 1, 2016. These incomes are as follows:

- EPF Withdrawal Amount

- Income from Dividends

- Rental Income

- Income from the National Savings Scheme

- Income from a Life Insurance Policy

- Interest other than the one earned on securities

Example of Form 15H

Mr. Dube (65 years) has an income of Rs. 2.5 lakh from interest on various deposits. He also has an income of Rs. 2 lakh from other sources, making his overall income for a particular year Rs 4.5 lakh.

He is eligible for Rs. 1.5 lakh in deductions, making his total taxable income Rs. 3 lakh. Per the provisions of the IT slab, he qualifies to use Form 15H since his taxable income falls below the prescribed limit.

When Do You Need Form 15H

Form 15H is necessary when you receive income from deposits, particularly the interest component. Neglecting to submit this form may lead to the deduction of TDS on the interest earned. It is recommended to utilise this form annually, especially when the interest accrued on investments surpasses a specific threshold.

How to Download Form 15H?

You can download Form 15H from the Income Tax Department’s official website. It is also available in a fillable format on the websites of major banks.

Eligibility for Form 15H

Form 15H is specifically tailored for a distinct segment of society. Individuals must meet the following criteria to avail of the TDS exemption on interest earned from specific investments:

- Residency: The individual must be a resident of India to qualify; NRIs are not eligible to submit this form.

- Age: Form 15H is exclusively for senior citizens, meaning the individual should be 60 years or above to use this form.

- Tax Liability: The individual should have zero tax liability after calculating the final tax based on their estimated income.

- Individual Status: Only individuals can use this form; it does not apply to organisations or companies.

- Interest: The total interest earned from various sources in a specific financial year should fall within the limits specified in the income tax slab.

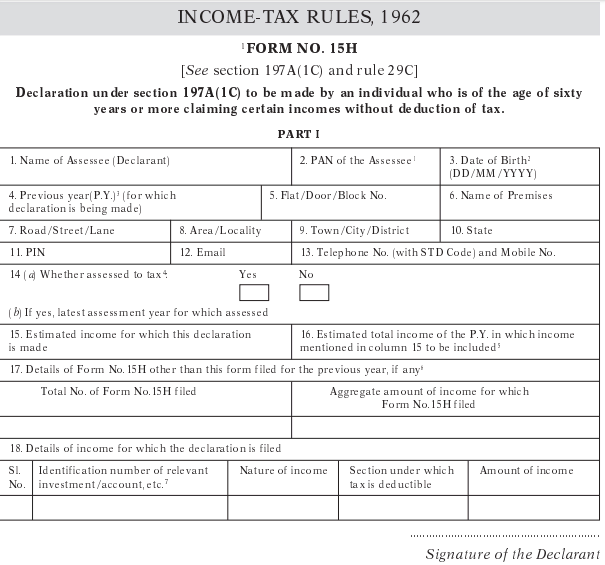

Components of Form 15H

Form 15H consists of the following two components:

Part 1

- Name of the individual claiming relief

- Details of investment

- The amount invested

- Date of investing

- An estimate of the amount that one can receive

- Age and occupation of the individual

- Last assessment year

- Declaration

Part 2

- Name and address of individual

- The period in which the dividend was credited

- Interest rate on investment

How to Fill Out Form 15H

Form 15H is split into two parts, Part 1 and Part 2.

Part 1

This section is intended for senior citizens who aim to claim the TDS on various types of income they have accrued during the fiscal year. The things that need to be filled by the applicant are as follows:

- Name and the PAN details of the applicant

- Date of Birth

- The Financial Year the income was earned

- Address and contact details

- Residential status

- The applicant should indicate ‘YES’ if they have been assessed in any of the six years preceding the specified assessment year.

- The applicant should estimate the total income for which they intend to submit a declaration.

- The applicant should estimate their total income for the current year, with the estimated income mentioned in the preceding point.

- The applicant should specify the number of forms they have filled out and the total income for which the declaration is submitted.

- The applicant should provide information regarding their share count, deposit account number, NSS specifics, LIC policy number, and employee code.

- The applicant must carefully review and correct any errors, if present, before signing the form.

Part 2

This part of the form must be filled and submitted by the deductor. The things that need to be filled by the applicant are as follows:

- Name and Address

- Interest rate on investment

- The period during which the dividend was credited

Form 15H for EPF Withdrawal

Withdrawal from the provident fund before completing five years of service became subject to TDS starting June 1, 2015.

- TDS on EPF is levied when the withdrawal amount surpasses Rs 50,000, effective from June 2016. Before this, the threshold stood at Rs 30,000.

- TDS will be deducted at 10% if a PAN card is provided. However, if a PAN card is not submitted, the TDS will be 34.608%.

- If you withdraw offline, you can submit Form 15H to avoid the TDS application.

Form 15H Sample

Uses of Form 15H

This form is helpful for the following reasons:

- TDS on the Interest from Fixed Deposits: Senior citizens can save taxes on the interest earned on fixed deposits and recurring deposits kept with banks.

- TDS on EPF Withdrawal: TDS is levied on EPF withdrawals when done before completing five years of consistent service with a specific employer. However, if an individual intends to withdraw Rs. 50,000 or more before completing the 5-year tenure, they can submit Form 15H to prevent TDS deduction on their EPF balance. The individual must meet the eligibility criteria for submitting Form 15H.

- TDS on income from Corporate Bonds: TDS is imposed on any income from corporate bonds that exceeds Rs. 5,000 annually. However, an individual can provide Form 15H to the issuer, requesting no TDS deductions, provided they meet the necessary criteria to submit the form.

- TDS on income from Post Office Deposits: Some digitised post offices might deduct TDS from an individual’s income from deposits made at that particular Post Office. However, the individual can still submit Form 15H to the Post Office, seeking no TDS deduction, provided they meet the eligibility criteria.

- TDS on Rent: Rental payments that surpass Rs. 1,80,000 annually are subject to TDS. However, an individual can provide Form 15H to their tenant and ask them not to deduct TDS. It’s important to note that the individual’s tax liability for the preceding year should be nil to qualify for this exemption.

Forgetting to Submit Form 15H on Time

Failure to timely submit the necessary form can result in the bank deducting TDS from interest income on deposits that exceed Rs. 50,000 for the relevant year. The individual must file an income tax return to recover the excess TDS amount. Typically, TDS is deducted quarterly. Therefore, it’s advisable to promptly submit the necessary form to prevent TDS deduction for the respective financial year.

Factors Affecting Form 15H

The factors affecting the submission of this form are as follows:

- Only an individual aged 60 years or more can submit Form 15H. HUFs and other individuals must submit Form 15G to prevent the deduction of TDS.

- Only resident individuals can submit this form. It does not apply to foreigners or NRIs.

- An individual has to deposit Form 15H at every branch of the bank liable to pay interest to the individual on his deposits.

- Individuals need to remember that income from fixed and recurring deposits is subject to taxation. Therefore, one should only submit this form when confident that their total earnings fall below the taxable limit.

- If an individual has a taxable income but mistakenly submits Form 15H to the bank, they must promptly notify the bank about this error. Upon timely notification, the bank can make necessary adjustments and deduct the appropriate TDS on the generated interest income.

- An individual does not need to submit this form to the Income Tax Department directly. The deductor is responsible for submitting the same to the Income Tax department with all the relevant details.

Things to Remember

You must remember the following points while filling out Form 15H:

- Check your eligibility to use this form

- Ensure all details are entered correctly, as incorrect information could lead to issues

- Mention the correct assessment year

- Mention the most accurate estimate of expected income

- Only fill out Part 1 of the form

- This form is not a replacement for ITR, and you must file it separately

- Remember to take an acknowledgment after submitting this form

- Ensure you provide the correct PAN details

Frequently Asked Questions

What is the difference between form 15G and 15H?

Form 15G and Form 15H are submitted as self-declarations by individuals whose income is below the taxable bracket so that no TDS is deducted from the income credited to their account. Individuals below 60 submit Form 15G, while individuals aged 60 years and above submit Form 15H.

What will happen if I do not submit Form 15H?

If you fail to submit Form 15H, TDS will be deducted from your earnings. Subsequently, you'll receive a TDS certificate that can be utilised when filing your income tax return, enabling you to settle any remaining tax liabilities, if there are any.

Where should I submit Form 15H?

An individual can submit this form to your bank or a post office.