Form 15G is a form that declares that an individual’s income is below the tax limit and helps in getting an exemption on TDS on certain types of income.

Submitting this form does not mean that individuals are exempt from paying taxes if their total income surpasses the tax limit. They must still submit their ITR and settle their tax obligations accordingly.

Let us discuss Form 15G in detail – how to fill, download, and submit it and the precautions taken while filing these forms.

What is Form 15G?

EPF Form 15G or Form 15G is a declaration an individual submits to ensure no TDS is deducted from the interest they earn from their EPF, RD or FD. Individuals below 60 and Hindu Undivided Families (HUFs) can fill out this form. However, those 60 years and older should use Form 15H.

Key Features of Form 15G

Some key features of Form 15G are as follows:

- Form 15G allows taxpayers to self-declare their income below the taxable limit, thereby seeking to exempt TDS deductions on specific income sources.

- The rules for this form are given under the provisions of Section 197A of the Income Tax Act.

- Since 2015, the format of Form 15G has been revised to simplify compliance and reduce costs for both the tax deductor and the tax deductee.

- The current format of Form 15G was introduced by CBDT (Central Board of Direct Taxes).

- Any individual below the age of 60 years can submit Form 15G. Any individual above the age of 60 years falls in the category of senior citizens.

- An individual must submit this declaration in the first quarter of the financial year to avail benefits for existing investments. An individual must submit Form 15G before the first interest credit occurs for new investments.

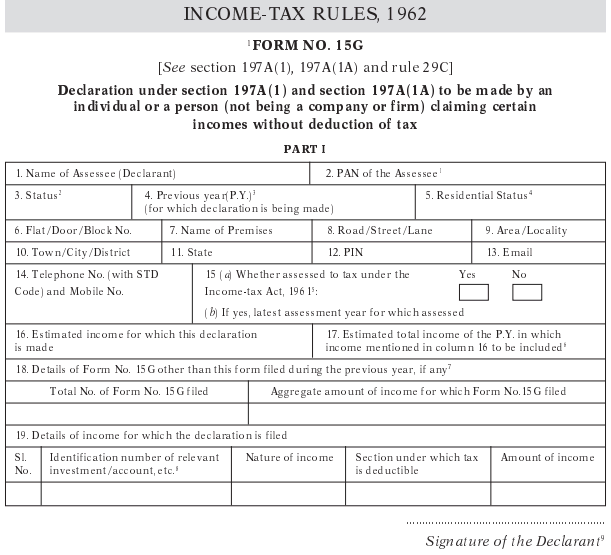

Form 15G Sample

Here is a sample of Form 15G.

Eligibility Criteria for Submitting Form 15G

The eligibility criteria to submit Form 15G is as follows:

- You are an Individual or a person (other than a company or a firm).

- You must be an Indian resident for the applicable financial year.

- You should not be more than 60 years of age.

- Your tax liability on the total taxable income for the Financial Year is zero.

- Your total interest income for the financial year does not exceed the exemption limit.

How to Download Form 15G?

- You can download Form 15G from the websites of major banks or EPFO’s online portal.

- Just log in and search for the PF Form 15G download, and then you can easily download it to your computer or smartphone.

- You can also get it from the Income Tax Department’s official website.

How to Fill Out Form 15G

To fill in Form 15G for PF withdrawal, take the following steps:

- Get a physical copy from the bank or post office or download it from the Income Tax Department’s official website.

- Fill out personal details like name, address, PAN, and contact information.

- The applicable income tax status.

- Ensure you meet the eligibility criteria for Form 15G and provide information about your income and investments.

- Mention the previous year as the financial year you claim non-deduction of TDS.

- Enter the bank details of where you want to credit the PF withdrawal amount.

- Sign and date the form after ensuring that the information provided is accurate.

- Submit Form 15G and any required supporting documents to the PF office, your employer, or the bank holding your PF account.

How to Submit Form 15G for PF Withdrawal Online

Follow the steps given below to fill out Form 15G for PF withdrawal:

- Log in to the EPFO UAN portal.

- Select the ‘Online Services’ tab and click on ‘Claim’.

- Enter your bank account number and then click on ‘Verify’.

- Press on ‘Upload Form 15G’ under the ‘I want to apply for’ section.

Is Form 15G Mandatory?

Section 192A of the Finance Act 2015 states that a PF withdrawal will attract TDS if the amount is more than Rs.50,000 and your employment tenure is less than five years. So, if you want to avoid TDS being deducted from your PF withdrawal amount, then Form 15G is mandatory.

When TDS is Applicable

When an employee wishes to withdraw Rs. 50,000 or more from their EPF with less than five years of service, the TDS is applicable for the following:

- 10% TDS if an employee submits the PAN Card but fails to submit Form 15G

- 34.608% TDS if an employee fails to submit the PAN Card and Form 15G

When TDS is Not Applicable

The TDS is not applicable for the following:

- When an employee transfers their EPF account to another.

- The termination of service of an employee due to ill health, discontinuation of business by the employer, project completion or any other factor beyond an employee’s control.

- If the EPF withdrawal is made after five years of service (Including the service with a former employer).

- If the amount withdrawn is less than Rs. 50,000 from EPF before an employee has completed Five years of service.

- If Rs. 50,000 or more is withdrawn from EPF before an employee has completed Five years of service, they submit Form 15G along with their PAN card.

Purposes of Submitting Form 15G

Form 15G can be submitted for the reduction of TDS in the following cases:

- Interest Income: To avoid the deduction of TDS on interest income, you need to submit Form 15G to banks and financial institutions.

- Premature EPF Withdrawal: If Rs. 50,000 or more is withdrawn before five years from the account’s opening, the amount is liable for TDS. However, compliance requirements can be bypassed by submitting Form 15G, provided all conditions are met.

- Post Office Deposits: Digitalised post offices also charge TDS under certain conditions. You can submit Form 15G to request an exemption from the applicable TDS deduction.

- Corporate Bonds: If your income from corporate bonds surpasses Rs. 5,000 in a financial year, it becomes subject to TDS. However, if you qualify to submit Form 15G, you can request the bond issuer not to deduct TDS.

- Dividends: There is a TDS deduction if the dividend income exceeds Rs. 5,000. You can submit Form 15G to stop the deduction of TDS.

- Proceeds from Life Insurance Policy: If the proceeds, excluding those under section 10(10D), go beyond Rs. 1,00,000 in a fiscal year, the payer must charge 5% TDS. To prevent or minimise this TDS deduction, the taxpayer can submit Form 15G.

- Insurance Commission: An insurance agent who earns a commission exceeding Rs 15,000 is subject to TDS. Such agents can appropriately submit Form 15G to address the TDS implications.

- Rental Income: If your rental income exceeds Rs 8,00,000 for the year, leading to the deduction of TDS, you can submit either Form 15G for non-deduction of TDS.

Difference Between Form 15G and Form 15H

The differences between Form 15G and Form 15H are as follows:

| Form 15G | Form 15H |

|---|---|

| Applicable only to individuals less than 60 years of age. | Applicable only to individuals aged 60 years or more. |

| It can be submitted by HUF as well as individuals. | It can be submitted only by individuals. |

| Only applicable to individuals/HUF with an annual income lower than the exemption limit. | Senior citizens can submit the form irrespective of income level. |

Forgetting to Submit Form 15G

If you fail to submit Form 15G on time and the TDS has already been deducted, you can follow these steps:

- File ITR to claim your TDS refund. After reviewing your claim, the Income Tax Department will process your refund request and reimburse the excess tax deducted for the fiscal year.

- Submit Form 15G promptly to prevent additional deductions for the ongoing fiscal year.

Penalty for Submitting False Declaration using Form 15G

Furnishing a false declaration in Form 15G to evade TDS may result in penalties or imprisonment as per Section 277 of the Income Tax Act. You can get the following punishments:

- A false declaration to avoid taxes exceeding Rs. 1,00,000 could lead to a prison sentence ranging from 6 months to 7 years.

- A prison sentence ranging from 3 months to 3 years for all other cases.

Frequently Asked Questions

Is a PAN card required to file Form 15G?

Yes, a PAN card is mandatory to file Form 15G. Without proper PAN details, a declaration will become invalid.

Can HUFs also submit Form 15G?

HUFs can also submit Form 15G if it meets the conditions.

Do I need to submit this form to the income tax department?

You don’t have to submit this form directly to the income tax department.

Do NRIs need to submit Form 15G?

NRIs are not eligible to fill out this form. Only resident Indians can fill out Form 15G.

What is the perfect time to submit the Form?

Filing your form at the beginning of the financial year is suggested to avoid a situation where the bank has already deducted TDS.

Is Form 15G an alternate to ITR?

No, this form is not an alternative to filing your Income Tax Return. While you may have disclosed your income through these forms, adhering to the separate filing obligations for your income tax return is essential.