Individuals must declare their investments through Form 12BB at the start of each fiscal year. This declaration is necessary for an employer to accurately calculate the taxes to be deducted from an individual’s monthly salary. By declaring investments, individuals can increase their take-home pay.

An individual only needs to estimate the amount they plan to invest at the start of the financial year. They do not need to submit any proof until the end of the financial year. Additionally, they are free to invest more or less than their initial estimate, and the investments do not need to align with the initial declaration.

This blog will discuss Form 12BB–what it is and how to fill it out.

What is Form 12BB?

Form 12BB is a statement salaried employees must submit to employers to claim tax deductions and exemptions on their Salary income. This form includes details of investments, expenses and allowances that qualify for tax benefits. Employers use this form to determine the accurate amount of tax to be deducted from an employee’s salary.

Form 12BB applies to all salaried taxpayers and must be submitted by the end of the financial year. An employee must declare their investments made during the year with this form. Additionally, they must provide documentary evidence of these investments and expenses at the end of the financial year.

Form 12BB contains the following details:

- Employee’s name and address

- Employee’s PAN

- Details of House Rent Allowance (HRA) received by the employee

- Declaration of the rent paid if HRA is claimed

- Details of Leave Travel Allowance (LTA) claimed by the employee

- Declaration of investments made under tax-saving schemes such as the Public Provident Fund (PPF), Equity Linked Saving Scheme (ELSS), and National Pension System (NPS), among others

- Declaration of the interest paid on a home loan, if applicable

- Any other exemptions and deductions applicable

Information Required to be Filled in Form 12BB

The details that must be reported in Form 12BB are as follows:

- Personal Details – Name, address, PAN, Aadhar Number, position, Father’s Name

- Financial Year

- HRA

- LTA

- Interest on a home loan, if any

- Income Tax Deductions under Chapter VI-A

- Other details like date, place, signature, etc.

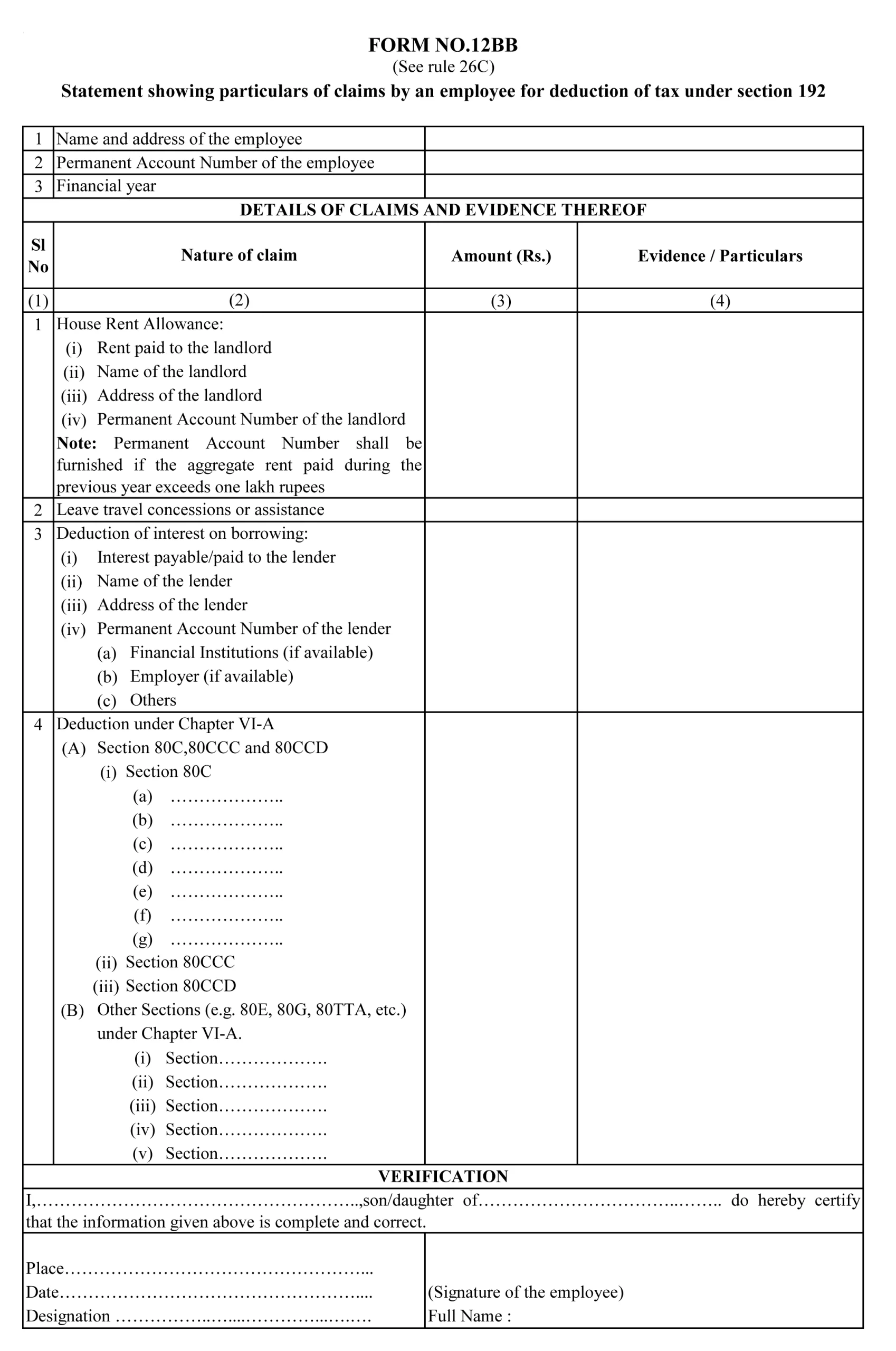

Form 12BB Sample

Purpose of Form 12BB

The purpose of Form 12BB is as follows:

- It allows employers to provide their employees with the benefits of all tax-deductible expenses and investments.

- It grants employees the power to claim tax exemption by submitting proof or declaration of tax deduction in Form 12BB.

- Only employees who provide this proof or declaration can claim this benefit.

- Form 12BB enables employers to determine the appropriate amount of tax to be deducted from their monthly salary and calculate their take-home salary accordingly.

How to Fill Form 12BB

Follow these instructions to fill out the form:

Personal Details

This is the first section of Form 12BB. An individual must mention the following:

- Full Name

- Address

- PAN (Permanent Account Number)/Aadhar Number

- Financial year

House Rent Allowance (HRA)

If an individual receives HRA, they can claim exemption by submitting:

- Amount of Rent paid to the landlord

- Name of the landlord

- Address of the landlord

- PAN of the landlord in case the total rent paid exceeds Rs.1 lakh

- Monthly rent receipts or the rental agreement as proof for claiming an HRA tax exemption

The things to remember when claiming HRA tax exemption are as follows:

- If an individual is not receiving HRA as a part of their salary, they can claim a similar tax deduction under section 80GG if they live in a rented house.

- An individual only needs a rent receipt if the monthly rent exceeds Rs. 3,000.

- If an individual resides in their own house, they cannot claim HRA exemption.

- If an individual is paying rent to their parents, it is recommended that they report it as part of their income while filing their Income Tax Return.

- Submitting fake rent receipts is not advisable and can get an individual into trouble with the tax authorities.

- Print a formal rent agreement on stamp paper to ensure authenticity.

Leave Travel Allowance (LTA)

Employees must provide travel proof, such as boarding passes, flight tickets, or invoices from a travel agent to their employer to claim LTA benefits. This tax exemption only applies to travel costs up to the amount specified in the CTC. The fare is exempt per the following conditions:

| Travel Mode | Exempt Amount |

|---|---|

| Air | Airfare for economy class on the National Carrier (Indian Airlines or Air India) will be based on the shortest route or the amount spent, whichever is less. |

| Rail | Air-conditioned first-class rail fare will be calculated based on the shortest route or the amount paid, whichever is lower. |

| Bus | First class or deluxe class ticket price by the shortest route or the lowest cost, whichever is less. |

| Unrecognised public transport | Air-conditioned first-class rail ticket price by shortest route or the lowest price, whichever is less |

The things to remember when claiming LTA tax exemption are as follows:

- LTA can only be claimed if explicitly included in the CTC.

- Individuals can claim LTA for themselves, their spouse, children, dependent parents, and dependent siblings.

- LTA can be claimed twice within a block of four years. The current block for LTA claims is from 2022 to 2025.

- Individuals can carry forward one LTA if they have claimed only one in the previous block of four years. But, they must use it in the first calendar year of the next block.

- LTA benefits cover only domestic travel, excluding accommodation expenses.

Deduction of Interest on Borrowing

Deduction for interest on home loans is allowed under section 24 of income tax laws. Individuals can claim the deduction on loans taken for their home’s construction, reconstruction, repair, purchase, or renovation.

The details that need to be filled in are as follows:

- Interest paid to the lender during the fiscal year

- Name and address of the lender from whom the loan is taken

- PAN or Aadhar number of the lender

- Specify whether the lender is a financial institution or employer

- Submit a statement/certificate of total EMI paid, possession/construction completion certificate or a self-declaration of occupancy as evidence

Amount of Savings on Home Loan:

- Tax benefits on payment of interest: If an individual is paying interest on a home loan, the deduction they can claim will depend on the type of house property.

- Tax benefit in case of self-occupied property (SOP): An individual can claim a maximum interest deduction of Rs. 2,00,000 if they have taken a loan to purchase or construct their house. Such a benefit shall be reduced to Rs. 30,000 if they have taken a loan for repair or reconstruction. Construction or purchase must be completed within five years from the end of the financial year in which the loan is taken.

- Tax benefits in case of renting out (let out) the property (LOP): The entire interest amount that an individual pays towards the loan is available as a deduction in case of a rented property. This amount shall be deducted from the rental income for the year.

- Tax benefits on repayment of Principal Amount: Whether an individual owns a self-occupied or rented property, they can claim the repayment of the principal amount under Section 80C of the Income Tax Act. The maximum amount that can be claimed for the principal amount is Rs. 1.5 lakh under this section.

Additional Deduction under Section 80EE:

First-time buyers can claim up to Rs. 50,000 other deductions under this section. Section 80EE is only valid for loans sanctioned until March 31. The following conditions must be met to claim the home loan tax benefit:

- The loan amount must not exceed Rs.35 lakhs, and the property value should not exceed Rs.50 lakhs.

- The individual must be a first-time homebuyer on the date of loan sanction.

Additional Deduction under Section 80EEA:

An additional deduction of up to Rs. 1,50,000 is allowed for first-time home buyers under Section 80EEA. The following conditions should be met to claim the tax benefits under a home loan:

- The individual must be a first-time home buyer on the loan sanction date.

- The individual claiming a deduction under Section 80EEA cannot claim the deductions under Section 80EE.

- The stamp duty value of the property must not exceed Rs. 45 lakhs.

- The loan must be sanctioned between April 1 and March 31.

The things to remember when claiming Interest on Home Loan tax exemption are as follows:

- If an individual has taken a home loan jointly, they can claim the interest deduction proportionately based on their share in the loan.

- Interest payments made to individuals other than banks (e.g., friends, relatives, money lenders) can be claimed as a deduction under Section 24.

- An individual must obtain a certificate of interest from the person to whom the interest was paid as proof.

- Principal loan repayment from non-banking sources is not eligible for deduction under Section 80C.

Deductions under Chapter VI-A

The last part of Form 12 BB deals with the highest expenses that can be claimed as deductions under Section 80 of the Income Tax Act.

| Section | Investment Class |

|---|---|

| 80C | The total exemption limit under this section is Rs. 1.5 Lakhs, covering various tax-saving options such as PF, PPF, LIC premium, NSC, ELSS, and children’s tuition fees. |

| 80CCC | Exemption for LIC pension plans and other insurers |

| 80CCD | Contribution to the NPS Tier-I account |

| 80D | Exemption for health insurance premiums covering self, family, and parents. Limit increases for seniors. |

| 80DD | Deduction for expenses sustained on the treatment of physically challenged dependents |

| 80E | An individual can claim interest paid on education loans for eight years without limit. |

| 80EE | Claim deduction against a housing loan if the individual is a first-time homeowner |

| 80G | Donations to approved organisations granted exemption facilities by the IT Department |

| 80GG | The deduction for rent payments for accommodation without receiving any HRA from the employer |

| 80GGA | Donations made to organisations involved in scientific research and rural development |

| 80GGC | Non-cash contributions made to political parties |

| 80TTA | An individual can claim up to Rs. 10,000 deduction for savings bank interest but not term deposit interest. |

| 80U | Disabled individuals can claim a maximum rebate of Rs. 1.25 Lakhs under this section. |

Verification

The final section of Form 12BB is the ‘verification’ section for the information provided in the form. To complete this section, an individual only needs to enter their name, along with the name of either their father or mother, the city where they are filling out the form, and the filing date. After completing the details, sign the form to confirm the accuracy of the information submitted.

Is it mandatory to fill out Form 12 BB for every salaried individual?

Starting from June 1, 2016, it has become compulsory for salaried individuals to submit Form 12BB to employers to claim tax deductions and exemptions. The purpose of this form is to assist the employer in calculating the accurate tax amount that should be deducted from the employee’s salary. Employees who submit Form 12BB can ensure they receive the maximum tax benefits for all deductions and other tax exemptions they are qualified to receive. This can decrease their overall tax liability and increase their take-home pay.

Is Form 16 and Form 12 BB the same?

Form 16 gives a detailed breakdown of your salary, tax deductions, and deposit information with the government. On the other hand, Form 12BB informs your employer about all the investments and expenses you have made. It is important to note that these two forms are not identical and serve different purposes.

Frequently Asked Questions

What happens if form 12BB is not submitted?

You may lose tax deductions and exemptions if you miss the deadline to submit Form 12BB to your employer.

What is the difference between 12B and 12BB?

Form 12BB ensures accurate TDS deduction from workers' wages. Form 12B pays salaries to employees who switch jobs in a fiscal year, with details for the new employer.

How do I download form 12BB?

You can download Form 12BB from the Income Tax Department website.

What deductions can I claim under Form 12BB?

You can claim the following deductions under Form 12BB:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Interest payable on a Home Loan

- Deductions under Chapter VI-A

When do I have to submit Form 12BB?

Submit Form 12BB when your employer asks for it. It is due at the end of the financial year and helps estimate your TDS calculation.

When must I turn in Form 12BB?

Employers request a declaration at the beginning of the financial year to predict TDS computations for the entire year. Form 12BB must be filled by the end of the fiscal year.

What should I do if I did not declare my investments and my employer deducted excess TDS?

If you haven't declared your investments on time, you can claim excess TDS deducted by your employer while filling out the ITR.

What happens if you forget to provide Form 12BB to the employer?

Submit Form 12BB on time to avoid a TDS deduction from your salary. You can claim a refund for the excess TDS deducted.

How do you Fill out Form 12BB when you change jobs?

Do not claim maximum deductions from both employers if you change jobs in a financial year. It may lead to incorrect TDS deductions, penalties, and tax payments. So, avoid claiming deductions from both employers after changing jobs.