Employment has changed in recent years. People change jobs more often now. When an employee changes jobs mid-year, the new employer needs details about their previous income, TDS transactions, and perquisites. Form 12B is necessary to obtain this information. The form discloses the information regarding an individual’s previous income.

This blog will explore Form 12B–what it is, its types, its importance, and how to fill it out.

What is Form 12B?

Form 12B is an income tax form to be submitted per Rule 26A guidelines when an individual moves from one company to another mid-financial year. It contains details regarding the income and tax deductions from the previous employer. It is mandatory for employees who have switched jobs within the financial year to furnish Form 12B to their new employer. This facilitates the accurate calculation of tax liability by the new employer, ensuring the correct amount of TDS from the salary. Any mismatch in the form can result in higher employee tax liability and cause new employers difficulty deducting the accurate TDS. Submission of Form 12B to the new employer should occur within 15 days of joining the new organisation.

Components of Form 12B

The components of Form 12B are as follows:

- Permanent Account Number (PAN) and Tax Account Number (TAN) details of previous employer.

- A detailed breakdown of the previous salary, including:

- Basic Salary

- Dearness Allowance (DA)

- Leave Travel Allowance (LTA)

- House Rent Allowance (HRA)

- Prerequisites

- Leave Encashment

- The amount of Tax Deducted at Source (TDS) from the last salary.

- Deduction for Employee Provident Fund (EPF) contributions.

- Professional tax paid during previous employment, if any.

- Deduction for rent-free accommodation provided by previous employer.

- Any deduction made under certain sections of the Income Tax Act of 1961, such as Sections 80C, 80D, 80E, 80G, and Section 24.

Individuals must furnish this information for the time they were associated with their previous employer. If an individual joins a new company in October, he has to submit this form to the company between April 1 and September 30 of that same year.

Importance of 12B

The significance of Form 12B is as follows:

For Employers

Form 12B provides information about the new employee’s previous salary and deductions. This information helps employers accurately deduct TDS from employees’ income for the financial year. Furthermore, it assists employers in generating Form 16 with the correct information so that there are no issues in the future.

For Employees

Submitting Form 12B of Income Tax to the new employer will relieve employees of the stress of TDS deduction. As the details are provided, there will be no chance of any discrepancies arising.

When Should Form 12B be Submitted?

Form 12B of Income Tax is mandated for all employees who switch jobs within a fiscal year. Upon transitioning to a new employer, it’s incumbent upon employees to furnish this form to their new workplace. However, it’s essential to note that self-employed professionals are exempt from this requirement if they transition to a full-time position during the fiscal year. Form 12B submission exclusively applies to salaried employees undergoing job changes, ensuring accurate tax compliance and seamless integration into the new employment setting.

Details Needed to Fill Form 12B

The details needed to fill out the form are as follows:

- A document signed by the employee containing their name, date, location, and details extracted from Form 12B.

- The employee’s name is required.

- Employer’s PAN or TAN must be provided.

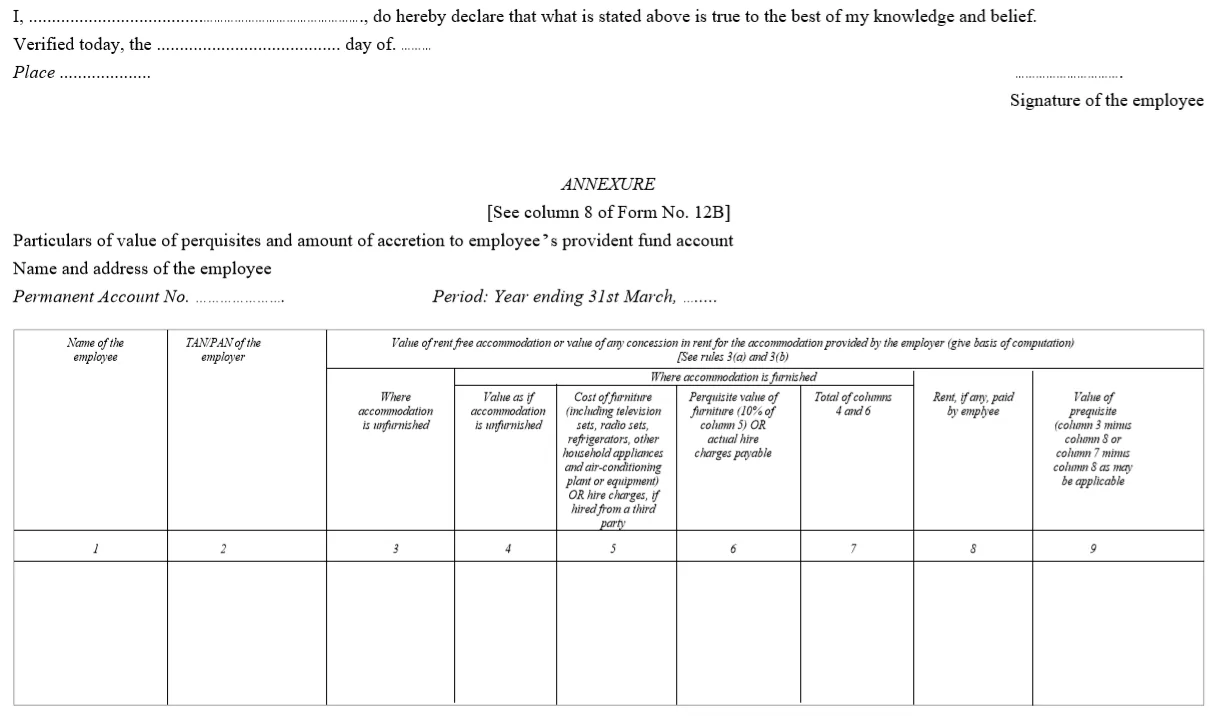

- Separate columns for furnished and unfurnished housing to indicate the value of rent-free accommodation provided by the employer.

- Confirmation if the employee is responsible for paying the rent.

How to Fill the Form 12B

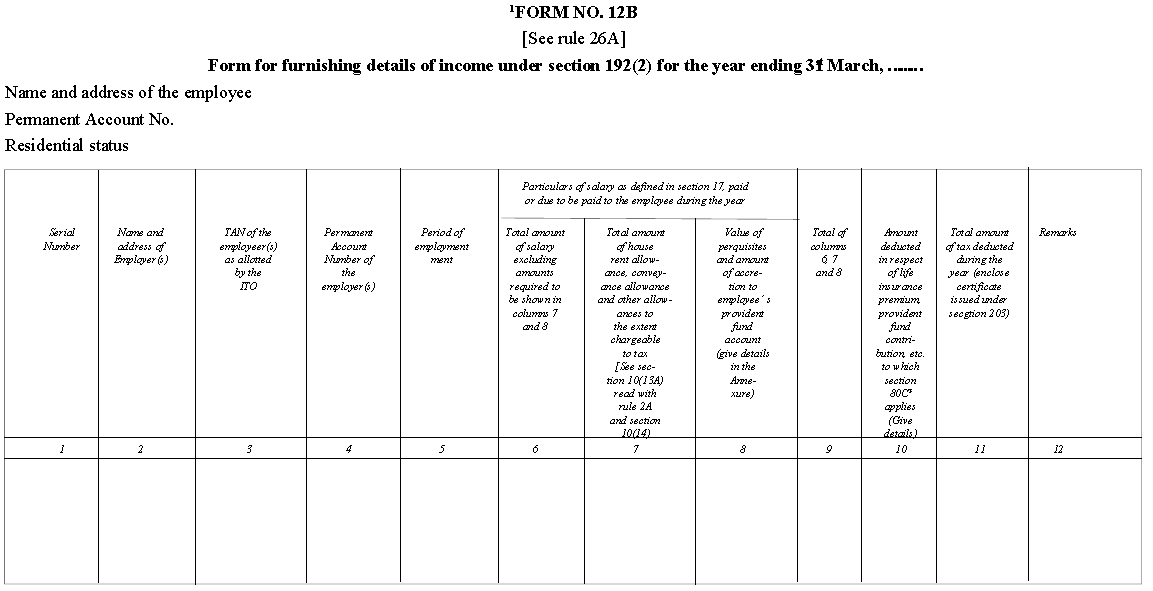

The following fields must be filled in while completing this form:

- Name and location of the previous company.

- Former employer’s Permanent Account Number (PAN) and Tax Deduction Account Number (TAN), which can be found on pay stubs.

- Duration of employment at the previous organisation.

- Income earned in the fiscal year preceding joining the new company.

- Breakdown of earnings, including components such as House Rent Allowance (HRA), Dearness Allowance (DA), leave encashment, and other benefits.

- Contribution to Provident Fund, if applicable.

- Deductible expenses under Section 80C, such as life insurance premiums.

- Total tax deductions of the fiscal year.

- Details regarding rent-free housing provided by the former employer, including information on both furnished and unfurnished accommodations, as well as any specifications for furnishings.

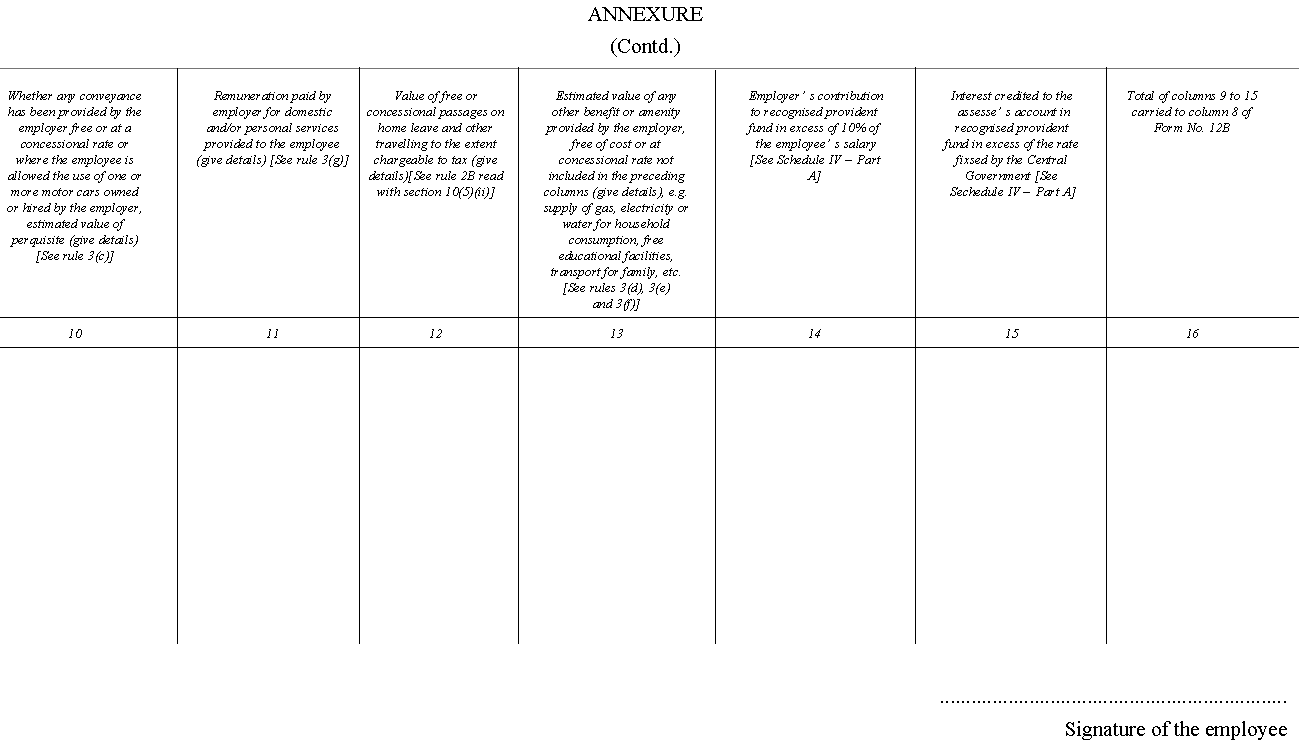

- Additionally, the second annexure should include information regarding conveyance allowance and similar incentives provided by the former employer.

Form 12B Sample

The following is a Form 12B Format sample of the first page.

Form 12B typically contains two annexures apart from the first page.

When to Submit Form 12B & to Whom?

Form 12B is a mandatory submission for all salaried individuals when transitioning to a new employer in a financial year. However, it’s crucial to note that if a self-employed individual shifts into a salaried position, they are exempt from this requirement. Form 12B applies solely to situations where a salaried employee moves to a new salaried employment within the fiscal year. Once submitted, the new employer utilises the information provided to calculate the employee’s salary and deduct the applicable Tax Deducted at Source (TDS). It’s important to understand that the previous employer is not obligated to furnish these details to the new employer. Hence, the employee may need to gather the information from their payslips and Form 26AS for accurate submission.

What Happens After the Submission of the Form 12B?

After an employee submits Form 12B, the following actions are taken:

- Verification: The new employer undertakes a verification process to cross-reference the details provided in Form 12B with those from the previous employer. This step ensures the accuracy and consistency of the information submitted by the employee.

- Tax Deduction: Utilising the information furnished in Form 12B, the new employer calculates the employee’s tax liability for the relevant financial year. Subsequently, the employer deducts tax at source (TDS) from the employee’s salary based on the determined tax liability.

- Form 16 Issuance: The employer issues Form 16 to the employee following the tax deduction. Form 16 is an official document detailing the employee’s earnings and the corresponding tax deductions made by the employer throughout the financial year. This document is essential for the employee’s tax filing and serves as proof of income and tax deductions.

Difference Between Form 12B and 12BA

Form 12B and Form 12BA are income tax forms related to salary income, yet they serve distinct purposes and contain different contents. Form 12B is submitted by an employee to their new employer upon switching jobs within a financial year. It includes details of the income earned and tax deducted by the previous employer. This form assists the new employer in accurately calculating the tax amount to be deducted from the employee’s salary for the remainder of the year. Form 12B facilitates seamless tax compliance during job transitions.

In contrast, Form 12BA is issued by an employer to an employee when the total salary paid or payable to the employee exceeds Rs. 1,50,000 in a year. This form provides a comprehensive breakdown of the amenities, perquisites, and other fringe benefits provided by the employer to the employee. Perquisites cover employee benefits from their job or position, such as rent-free accommodation, stock options, and contributions to the superannuation fund. If applicable, form 12BA enables employees to report these benefits as part of their taxable income and claim deductions.

Applicability of Form 12BA

Form 12BA is a document issued to employees by employers alongside Form 16. It lists all the benefits received by the employee during the financial year, including bonuses, commissions, and other fringe benefits. The form presents the calculated value of these benefits and outlines the corresponding tax implications. Employers must issue Form 12BA to employees even if they have not received any benefits, ensuring compliance with tax regulations.

Frequently Asked Questions

What is Form 12BA?

Form 12BA lists employee perquisites, profits, and benefits. It's submitted with Form 16.

What is the use of Form 12B?

This tax form helps salaried individuals who switch jobs report TDS deductions accurately from their previous employer and assists new employers in generating Form 16 with correct calculations.

What happens if I don't submit form 12B?

If Form 12B is not submitted, you may receive two Form 16s that you will have to consolidate yourself.

Who needs to fill out form 12B?

New hires who join an organisation in the middle of the year must submit Form 12B, an income tax form. The form provides information about their income from their prior employer.

Who is responsible for completing Form 12B?

The employee must fill out this form and attach Form 16 received from their previous employer before submitting it to the new employer.

Can the new employer refuse to deduct TDS from the previous salary after submitting Form 12B?

It is the employer's responsibility to deduct the applicable TDS from the employee's consolidated income. This deduction should consider any TDS deducted by the previous organisation.

What is the difference between Form 12B and 12BA?

Form 12B and Form 12BA have different purposes. Form 12B shows income earned from salary and TDS deductions, while Form 12BA lists perks received by employees. Employees submit Form 12B when switching jobs, and employers issue Form 12BA to employees along with Form 16.