Form 31, commonly called the EPF Advance Form, serves as the means to request a partial withdrawal or advance from an individual’s Employees’ Provident Fund (EPF) account. It’s important to note that EPF account holders cannot freely withdraw funds whenever they wish; specific criteria must be met for any withdrawal. Form 31 is designed explicitly for withdrawals in designated situations, such as medical treatment, housing-related expenses, loan repayments, and other specified circumstances.

Understanding the details of these criteria is crucial for those seeking to utilise Form 31 for EPF withdrawals.

This article serves as your comprehensive guide to unlocking the benefits of EPF Form 31 with professionalism and ease.

When Can You Make an EPF Withdrawal

EPF withdrawal using Form 31 is subject to specific circumstances, and individuals can only withdraw their entire savings in the EPF under certain conditions, such as retirement or prolonged unemployment certified by a gazetted officer for more than 2 months.

If individuals do not meet these criteria, withdrawing the entire fund from the EPF goes against Provident Fund rules. Partial withdrawals can be made under special circumstances, and the eligibility conditions are detailed in the table below:

| Circumstance | Withdrawal Limit | Minimum Service Required | Other Conditions |

|---|---|---|---|

| Education | Up to 50% of EPF contribution | 7 years | Withdrawal for financing further studies or education of children post 10th standard. |

| Marriage | Up to 50% of EPF contribution | 7 years | Withdrawal allowed for the marriage of self, brother or sister, son or daughter. |

| Land Purchase/Construction | For land purchase: Up to 24 times monthly wages and dearness allowance. For houses: Up to 36 times monthly wages and dearness allowance. | 5 years | Property to be purchased under the individual’s name, spouse’s name, or jointly. |

| Home Renovation | Up to 12 times monthly wages | 5 years | The home to be renovated should be registered under the employee’s or spouse’s name, or jointly owned. |

| Home Loan Repayment | Up to 90% of both employee and employer contributions | 1 year | Property must be registered under the individual’s, spouse’s, or jointly owned name. Required documents for loan repayment. Account corpus must be above Rs. 20,000. |

| Before Retirement | Up to 90% of the accumulated corpus with interest | After 57 years | To cover financial expenses. |

Individuals can apply for premature withdrawal online or offline under these specified circumstances.

Declaration in Form 31

Form 31 serves as a crucial declaration for partial withdrawal from the Employees’ Provident Fund (EPF), confirming that the withdrawal reason aligns with specified criteria. To ensure accuracy, the form necessitates the employee’s signature before submission. The employer and EPF Commissioner are also required to fill in specific details. It is essential to provide the latest and factual information in the form and include the necessary documents during submission.

Key details to be filled in Form 31 include:

- Member’s name, father/husband’s name

- Factory/establishment name and address

- PF account number

- Basic wage and dearness allowance

- Full postal address of the member

- Mode of remittance (e.g., account payee cheque for site/house flat purchase, construction through agency, or housing loan repayment; electronic mode; money order for withdrawals below Rs.2,000)

- Signatures of both the member and the employer

- Advance stamped receipt (Re.1 stamp)

- A section designated for the employer to complete

- A section designated for use in the PF Commissioner’s office

Ensuring the accuracy and completeness of these details, along with the required documentation, is crucial for the smooth processing of the EPF withdrawal request.

Document Required for EPF Form 31

This table provides a clear overview of the required documents for each specific purpose of Form 31 submission.

| Purpose of Form 31 Submission | Documents Required |

|---|---|

| Medical Reasons | Certificate by the employer

Certificate by the doctor |

| Purchasing a House | Declaration

Registration certificate of the property |

| Loan Repayment | Certificate from the agency stating the outstanding principal and interest |

| Marriage | Declaration within Form 31 |

| Grant Advances in Special Cases | Certificate from the employer |

| Physically Handicapped | Certificate from the doctor |

| Withdrawal Before Retirement | Declaration from the member |

How to Download EPF Form 31

To download EPF Form 31 and submit an online advance claim, follow these steps:

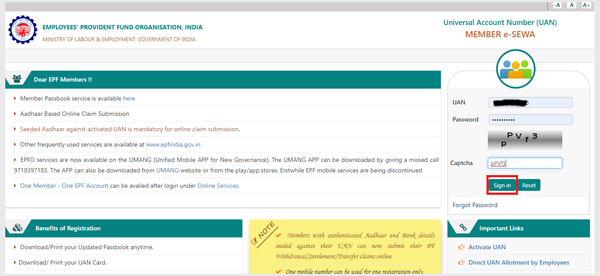

- Step 1: Log in to the EPFO member portal using your UAN (Universal Account Number) and password.

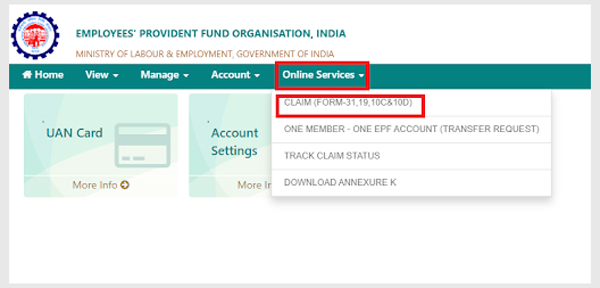

- Step 2: Navigate to the ‘Online Services’ menu and select ‘Claim.’

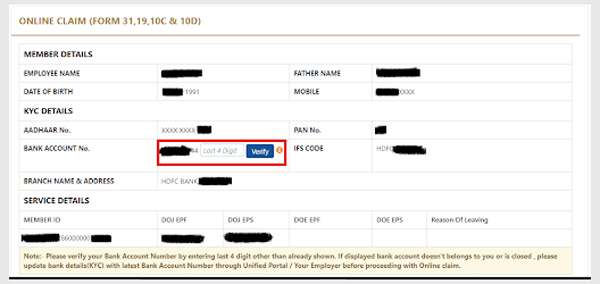

- Step 3: On the claim page, verify the personal information displayed, including your name, date of birth, father’s name, PAN number, Aadhaar number, date of joining the firm, and cellphone number. If all the information is correct, proceed by selecting ‘Proceed for Online Claim.’

- Step 4: Choose the type of claim you want to apply for. In the drop-down menu, select ‘PF ADVANCE (FORM 31).’

- Step 5: Specify the purpose of the advance from the available options, such as illness, natural disasters, power outage, non-receipt of earnings, or purchase of disability equipment. Enter the amount and your current address in the provided form.

- Step 6: Sign the declaration. Once you check the box, the ‘Get Aadhaar OTP’ button will appear. Click on it to receive an OTP (One-Time Password) on your registered Aadhaar-linked mobile number. Authenticate the OTP.

- Step 7: After OTP authentication, enter the OTP and click on ‘Validate OTP and Submit Claim Form’ to complete the online EPF advance application process.

How to File an Online Advance Claim

The provided steps guide you through the process of downloading EPF Form 31 and submitting an online advance claim. Here’s a summarised version:

- Visit the EPFO member portal and log in using your UAN and password.

- Navigate to the ‘Online Services’ menu and choose ‘Claim.’

- On the claim page, verify your personal details displayed, including name, date of birth, PAN number, Aadhaar number, date of joining the firm, and cellphone number.

- If all information is correct, proceed by selecting ‘Proceed for Online Claim.’

- Choose the type of claim by selecting ‘PF ADVANCE (FORM 31)’ from the drop-down menu.

- Specify the purpose of the advance (e.g., illness, natural disasters, power outage, non-receipt of earnings, or purchase of disability equipment). Enter the amount and your current address.

- Sign the declaration by checking the box. Click ‘Get Aadhaar OTP’ to receive a One-Time Password on your registered Aadhaar-linked mobile number.

- Enter the OTP received and click ‘Validate OTP and Submit Claim Form’ to complete the online EPF advance application.

How to File for Online EPF Withdrawal Using Form 31

With the advent of the EPF Form 31 online submission process facilitated by the Employees’ Provident Fund Organization (EPFO), withdrawing funds from EPF has become notably more straightforward. However, individuals need to ensure compliance with certain criteria before initiating the online application:

Active UAN (Universal Account Number) with a functional linked mobile number.

UAN linked to KYC documents, including Aadhaar, PAN card, and other necessary details.

Steps to Submit EPF Form 31 Online

- Access the official government UAN portal and log in.

- Check if KYC details are updated and verified.

- Visit the “Online Services” tab and choose the claim Form 31.

- Complete the required details on the claim screen, such as KYC and service details.

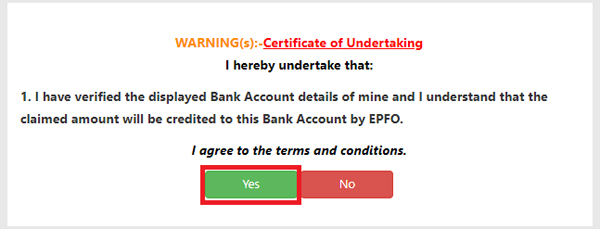

- Accept the certificate of undertaking to proceed.

- Click “Proceed for online claim” and select the PF withdrawal option.

- Choose the “PF Advance form” and provide the necessary details like the withdrawal’s purpose and amount.

- Apply by clicking on the “submit” button.

Post-Application Steps

- Await employer approval.

- Receive fund credit to the designated bank account.

Checking Claim Status

- Inquire about the status of the claim using the EPF Form 31 claim status on the official EPFO website.

This streamlined online process simplifies the withdrawal of EPF funds, offering greater convenience to individuals.

How to Check Claim Status

Here are the steps to check the status of your Form 31 claim:

- Go to the EPFO member portal by clicking on the link: [EPFO Member Portal].

- Log in to the portal using your UAN (Universal Account Number) and password. Click on ‘Sign In’ to proceed.

- In the ‘Online Services’ section, choose the option ‘Track Claim Status.’

- From the drop-down menu, select the location of your respective PF office. The screen will display the code of your PF office and the region code.

- Enter the establishment code, which can be found on your pay slip.

- Enter your 7-digit account number and click on ‘Submit.’

- The portal will display the status of your Form 31 claim.

FAQs on EPF Form 31

What is the processing time for EPF Form 31?

The online withdrawal process for PF (Provident Fund) may take approximately 5-30 days for the PF amount to be credited to your registered bank account. The duration may vary based on factors and processing system efficiency.

How much can be claimed through Form 31?

The withdrawal amount through Form 31 is determined by factors like the reason for withdrawal and the length of service. Rules and limits are set by the Employees' Provident Fund Organization (EPFO) and vary based on individual circumstances.

How can I cancel my EPF Form 31?

Generally, once submitted, Form 31 for PF withdrawal cannot be cancelled. In exceptional circumstances, you may contact the EPFO Regional Office for assistance or guidance.

What does "Under process" mean?

"Under process" indicates that your claim is being reviewed and processed. Regularly monitoring the status until it's marked as "settled" helps stay informed about the progress.

How many times can Form 31 be claimed?

Non-refundable withdrawals from your PF account can be made two to three times with a minimum six-month gap between each withdrawal. Each withdrawal must be for a different reason.