Cost accounting, a vital aspect of managerial accounting, plays a pivotal role in deciphering a company’s overall production expenses. This method analyses variable costs at each production stage alongside fixed costs like lease expenses. It is important to note that cost accounting, while not GAAP-compliant, is a powerful tool designed exclusively for internal purposes.

Rooted in the Industrial Revolution, cost accounting emerged as a necessity for businesses navigating the complexities of the evolving global supply and demand landscape. As industries faced the challenge of automation in manufacturing, the need to monitor fixed and variable costs became imperative. The early 20th century witnessed a surge in the prominence of cost accounting, particularly among rail and steel companies seeking to enhance competitiveness.

Internally, cost accounting serves as a methodical approach for a company’s management department to delineate both variable and fixed costs associated with the manufacturing process. This involves the meticulous calculation and reporting of individual costs, facilitating a comprehensive comparison of input costs with production outcomes. Such analyses prove instrumental in assessing financial performance and guiding strategic business decisions.

In this article, we will explore all one needs to know about cost accounting, its evolution, methodologies, and contemporary applications.

What is Cost Accounting?

Cost accounting serves as a critical tool within a company’s internal management framework, employed to meticulously uncover both variable and fixed costs intricately linked to the production process. This method involves the initial measurement and individual recording of these costs, followed by a comprehensive comparison of input costs against the resulting output. The primary objective is to facilitate a nuanced evaluation of financial performance, aiding in the formulation of informed decisions for future business strategies.

Various types of costs come into play, each playing a distinct role for the accountant. These diverse cost categories contribute to a holistic understanding of the finances.

History of Cost Accounting

Cost accounting has its roots in the Industrial Revolution, a period spanning the 18th to 19th centuries, marked by significant economic transformations. As industrial supply and demand dynamics emerged, manufacturers found it imperative to track both fixed and variable expenses to optimise their production processes. Cost accounting became a catalyst for efficiency in industries like railroads and steel, allowing companies to exercise control over costs. By the early 20th century, cost accounting had evolved into a widely discussed and recognised subject in the literature on business management. Its historical trajectory reflects its crucial role in helping industries adapt to changing economic landscapes, control expenses, and enhance overall efficiency.

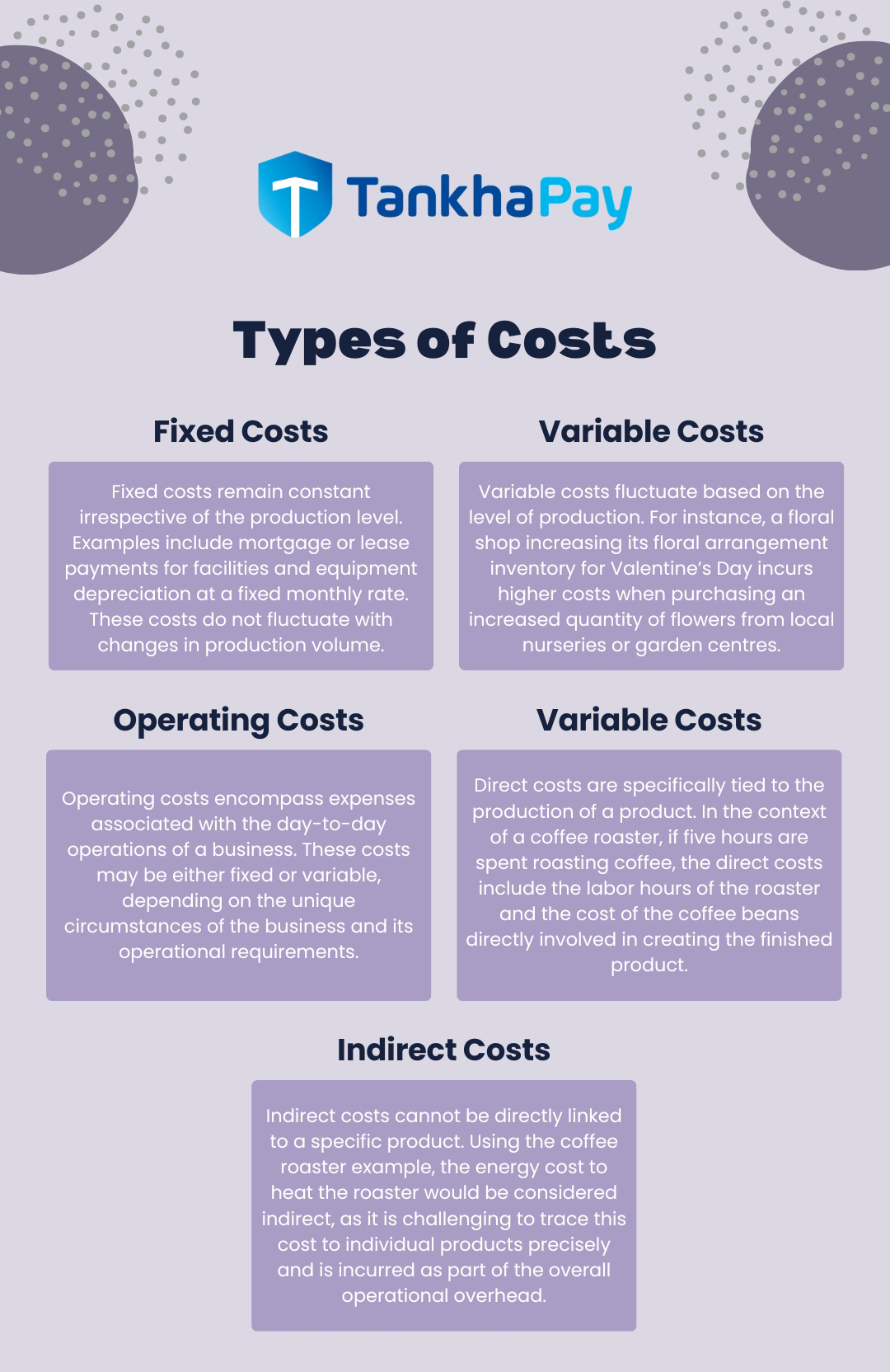

Types of Costs

As we have mentioned, there are multiple types of costs that come under accounting. Let’s review them one by one below:

Fixed Costs

Fixed costs remain constant irrespective of the production level. Examples include mortgage or lease payments for facilities and equipment depreciation at a fixed monthly rate. These costs do not fluctuate with changes in production volume.

Variable Costs

Variable costs fluctuate based on the level of production. For instance, a floral shop increasing its floral arrangement inventory for Valentine’s Day incurs higher costs when purchasing an increased quantity of flowers from local nurseries or garden centres.

Operating Costs

Operating costs encompass expenses associated with the day-to-day operations of a business. These costs may be either fixed or variable, depending on the unique circumstances of the business and its operational requirements.

Direct Costs

Direct costs are specifically tied to the production of a product. In the context of a coffee roaster, if five hours are spent roasting coffee, the direct costs include the labor hours of the roaster and the cost of the coffee beans directly involved in creating the finished product.

Indirect Costs

Indirect costs cannot be directly linked to a specific product. Using the coffee roaster example, the energy cost to heat the roaster would be considered indirect, as it is challenging to trace this cost to individual products precisely and is incurred as part of the overall operational overhead.

Types of Cost Accounting

Similar to the types of cost, there are also types of cost accounting. Let’s review these:

Job Costing

Job Costing finds application in sectors like construction, manufacturing, and custom design. It involves allocating costs of materials, labour, and overhead to each specific job or order. This method enables businesses to assess the profitability of individual jobs, aiding in decisions related to pricing and resource allocation.

Process Costing

Process Costing is employed in industries producing large quantities of identical or similar products, such as chemical processing or food manufacturing. Here, costs of materials, labour, and overhead are allocated to each production process or stage rather than to individual products. This approach helps determine the cost per unit of production, informing decisions on pricing and resource allocation.

Standard Costing

Standard costing involves assigning predetermined “standard” costs, based on the efficient use of labour and materials under standard operating conditions, to the cost of goods sold (COGS) and inventory. Even though the company pays actual costs, assessing the variance between standard and actual costs is crucial. If actual costs exceed standards, it’s an unfavourable variance; lower costs are favourable. This variance analysis is categorised into rate (input costs) and volume (efficiency or quantity of input) variances.

Activity-Based Costing (ABC)

Activity-Based Costing identifies overhead costs by department and allocates them to specific cost objects. Based on activities—events, units of work, or tasks—ABC uses measures known as cost drivers for accurate allocation. Unlike traditional methods using generic measures like machine hours, ABC considers specific activities related to each product or service. It provides precise insights into resource allocation and allows management to understand where time and money are spent.

Lean Accounting

Lean accounting extends lean manufacturing principles to financial management, aiming to minimise waste and optimise productivity. It replaces traditional costing with value-based pricing and lean-focused performance measurements. By focusing on total value stream profitability—profit centres contributing directly to the bottom line—lean accounting improves financial practices and allows for more efficient use of resources.

Marginal Costing

Marginal costing, also known as cost-volume-profit analysis, assesses the impact on product costs by adding one additional unit to production. Beneficial for short-term economic decisions, it helps management understand the impact of varying costs and volume on operating profit. The break-even point, where total revenue equals total expenses, is calculated by dividing total fixed costs by the contribution margin (sales revenue minus variable costs). This approach aids in determining a product’s contribution to overall company profit.

Differences between Cost Accounting and Financial Accounting

Cost accounting primarily serves internal management for decision-making, budgeting, and cost-control programs. It focuses on classifying costs based on management’s information needs rather than standardised accounting principles. This flexibility allows customisation for specific company or department requirements. It aids in improving net margins through strategic cost management.

Meanwhile, financial accounting is designed for external stakeholders, presenting a company’s financial position through standardised financial statements. These statements include details on revenues, expenses, assets, and liabilities. Financial accounting adheres to generally accepted accounting principles (GAAP), providing a standardised view for investors and creditors. It offers a comprehensive analysis of a company’s overall financial performance.

Key Differences

| Aspect | Cost Accounting | Financial Accounting |

|---|---|---|

| Audience | Primarily for internal management. | Aimed at external investors and creditors. |

| Purpose | Decision-making, budgeting, cost control. | Presenting overall financial health to external stakeholders. |

| Standards | Not bound by specific standards like GAAP. | Adheres to GAAP standards. |

| Flexibility | Customisable based on management needs. | Standardised for consistency across companies. |

| Tax Liabilities | Limited use for tax analysis. | More comprehensive for tax considerations. |

To sum up, while cost accounting provides valuable insights for internal decision-making and strategic planning, financial accounting offers a standardised, external-facing view to meet the needs of investors and creditors. Each serves a distinct purpose within the broader spectrum of a company’s financial management.

How does Cost Accounting Work?

Cost accounting operates through several key steps, facilitating a systematic approach to financial management:

Classify Costs

- Identification and classification of costs based on their nature and function.

- Examples include categorisation into variable or fixed, direct or indirect, or product or period costs.

Assign Costs

- Allocation of classified costs to specific products or services.

- This step involves linking costs to products based on the resources consumed during their production.

Analyze Cost Data

- Collection and organisation of cost data for thorough analysis.

- Identification of areas for cost reduction and opportunities for improvement.

Make Informed Decisions

- Utilization of cost data to make well-informed business decisions.

- This may include setting product prices based on production costs or identifying opportunities to reduce costs and enhance overall profitability.

Importance of Cost Accounting

Cost accounting furnishes managers with accurate information about costs linked to various products, services, and operations. This empowers informed decision-making, particularly in identifying areas for improvement and implementing cost-effective measures. But, this is not all. Let’s break down more reasons why cost accounting is important.

- Cost Reduction and Efficiency: Managers, armed with cost accounting insights, can strategically reduce costs and enhance operational efficiency. This is crucial for maintaining competitiveness in the market while ensuring profitability.

- Pricing Strategies: Setting prices for products and services is a delicate balance. Cost accounting aids in determining appropriate pricing strategies that align with profitability objectives while staying competitive in the market.

- Budgeting and Forecasting: Essential for budgeting and forecasting, cost accounting provides accurate historical cost data and trends. This enables businesses to plan effectively for the future, allocating resources efficiently.

- Performance Evaluation: Cost accounting plays a pivotal role in evaluating the performance of different departments and employees. It provides valuable data on cost and efficiency metrics, allowing businesses to recognize and reward high-performing areas.

Cost Accounting Advantages

- Enables precise determination of production costs for products and services.

- Provides data for decisions on outsourcing, make-or-buy choices, pricing strategies, etc.

- Facilitates the evaluation of departmental performance, identifying areas for improvement.

- Assists in complying with financial reporting and tax laws.

Cost Accounting Disadvantages

- Primarily deals with historical data, limiting its effectiveness in predicting future trends or making strategic decisions.

- Typically focuses on costs associated with producing goods and services, potentially overlooking broader financial aspects.

While cost accounting provides crucial insights for effective financial management, it is essential to recognize its limitations, especially in terms of its historical focus and scope.

FAQs about Cost Accounting

What are the 4 Types of Cost Accounting?

The four types of cost accounting include:

- Standard Costing

- Activity-Based Costing

- Lean Accounting

- Marginal Costing

Each type serves specific purposes in assessing and managing a company's costs.

What is Meant by Cost in Cost Accounting?

In cost accounting, cost refers to the value of money expended to produce something or deliver a service. It represents the resources utilised and is no longer available for use. Cost can involve acquisition expenses and is a crucial aspect of business evaluations.

How Does Cost Accounting Differ From Traditional Accounting Methods?

Unlike general or financial accounting, cost accounting is internally focused and firm-specific. It is designed for implementing cost controls, offering flexibility and specificity in cost subdivision and inventory valuation. Cost accounting methods vary between firms, providing adaptability according to changing business needs.

Why is Cost Accounting Used?

Cost accounting is employed to identify a company's spending patterns, earnings, and areas of financial leakage. It aims to report, analyse, and enhance internal cost controls and efficiency. While not used in financial statements or for tax purposes, cost accounting is crucial for internal management and decision-making.

Which Types of Costs Go Into Cost Accounting?

Cost accounting encompasses various cost categories, including direct costs, indirect costs, variable costs, fixed costs, and operating costs. The specific types may vary across industries and firms.

What are Some Advantages of Cost Accounting?

Cost accounting offers high customisation and adaptability as it is tailored to a specific firm's needs. Managers value it for its flexibility in guiding pricing, resource allocation, capital raising, and risk management. It is solely concerned with internal purposes, allowing companies to analyse information based on their specific criteria.

What are Some Drawbacks of Cost Accounting?

Cost-accounting systems can have a high start-up cost for development and implementation. Training staff on complex systems may pose challenges, and initial mistakes may occur. Higher-skilled professionals may charge more for evaluating a cost-accounting system compared to standardised ones like GAAP.