A No Objection Certificate (NOC) is a legal document issued by either an organisation, institute or an individual, indicating their consent and confirming that they have no objections to the details specified in the document. NOCs serve a variety of purposes, including employment, trade, litigation, immigration, and more, effectively nullifying any potential objections from involved parties.

In this blog, we focus on elaborating on the No Objection Certificate Format, with different types of formats and their importance.

Instances where a No Objection Certificate (NOC) is required

A No Objection Certificate (NOC) is often needed in various legal and administrative scenarios to indicate that there are no objections to proceeding with a particular action or decision. Here are some common instances where a NOC is required:

- NOC for Property Transfer: When transferring ownership of a property, a NOC is essential to confirm that there are no disputes or objections related to the property. It ensures a smooth transfer process by providing legal assurance that all parties involved agree to the transaction.

- NOC for Court Purposes: In legal matters, a NOC may be needed to demonstrate that a party has no objections to a specific legal action, such as a case settlement or property dispute resolution. This document helps streamline legal proceedings by clarifying the position of all involved parties.

- NOC for Vehicle Transfer from One State to Another: When transferring a vehicle from one state to another, such as moving a car from Maharashtra to Karnataka, a NOC from the original state’s Regional Transport Office (RTO) is required. This certificate confirms that there are no pending legal issues or financial obligations tied to the vehicle, facilitating its re-registration in the new state.

- NOC for a Visa (Employees and Students): For individuals applying for visas, especially students and employees traveling abroad, a NOC from their employer or educational institution is often required. This document certifies that the individual has the organization’s or institution’s approval to travel for specific purposes, such as work or study.

- NOC for GST Registration: When registering for Goods and Services Tax (GST), businesses may need a NOC from relevant authorities or stakeholders, ensuring that there are no objections to their registration and that they comply with all necessary legal requirements.

- NOC from Landlord for Business Establishment: If a business plans to operate from a rented property, a NOC from the landlord is necessary. This document confirms that the landlord has no objections to the business activities being conducted on the premises, thus preventing any future disputes.

- NOC for Leaving a Job (Issued by Employer): Employees leaving a job may require a NOC from their employer, which certifies that the employer has no objections to the employee’s departure and that all contractual obligations have been fulfilled. This is often needed for smooth transitions to new employment opportunities.

- NOC for Banking Requirements: Banks may require a NOC for various financial transactions, such as loan approvals, opening joint accounts, or changing account details. This document ensures that all involved parties agree to the transaction and comply with banking regulations.

- NOC for Leaving a Course of Study: Students wishing to leave a course of study before completion may need a NOC from their educational institution. This certificate indicates that the institution has no objections to the student’s decision to withdraw and that any obligations have been settled.

- NOC for Attending an Event or Conference: Individuals attending events or conferences, particularly those requiring travel or time away from work or studies, might need a NOC. This document serves as approval from employers or educational institutions, indicating that there are no objections to the individual’s participation.

- NOC for Going on a Tour: For organized tours, especially those involving group travel or international destinations, a NOC might be required. This can be issued by employers, educational institutions, or guardians, confirming that there are no objections to the individual’s travel plans.

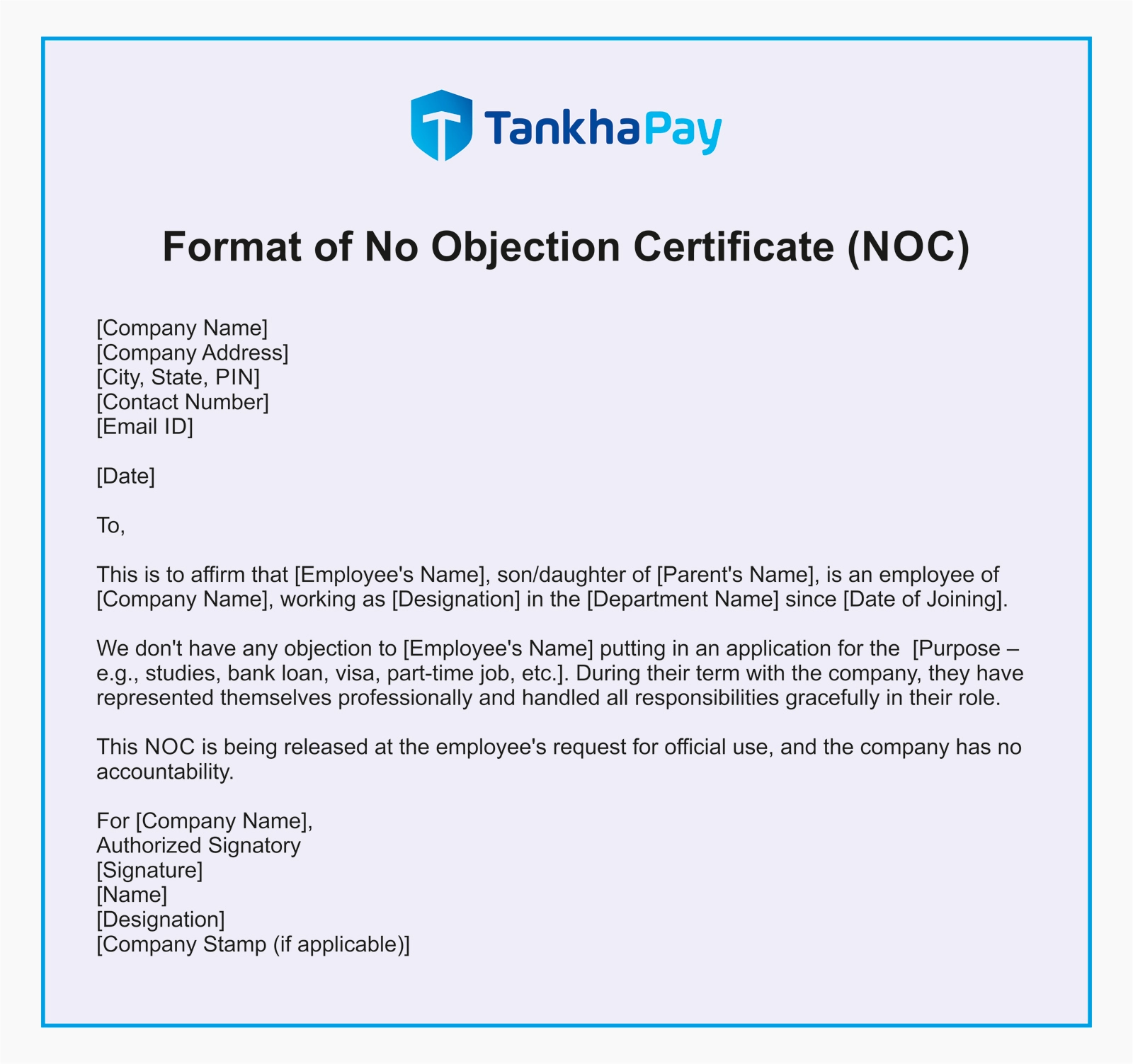

Significant Elements of a No Objection Certificate Format:

Letterhead

Mention the letterhead of the issuing authority, e.g. Company, Organization, Government Department, etc.

Date

Mention the date on which Noc is released.

Subject Line

A subjection line must be clear and indicate the reason for the NOC (e.g., “No Objection Certificate for Visa” or “No Objection Certificate for loan”).

Recipient Details

Name and designation of the recipient of Noc.

Declaration Statement

A statement must be apparent from the issuer’s side that they have no problem.

Example: “This is to certify that (Bank name) ., has received a complete amount for the facility availed by the customer under the Loan Agreement [Loan no.] Dated: ( ) and no further amount is outstanding and payable by the customer to (Bank Name)., under the previously mentioned Loan.

Purpose and Details

Mention the reason & Details for issuing the NOC (such as Loan, travel, vehicle transfer, etc.).

Details of authority that releases NOC

Name, designation, and signature of the accountable person for issuing NOC.

Name and stamp of the issuing organization/Company.

Contact Information

Address, phone number, and email of the issuing authority for verification.

Sample of No Objection Certificate Format

A No Objection Certificate (NOC) is a legal document issued by a government body, organisation or individual stating that they don’t have any objection to a particular request, action or decision taken by another party. It is formal permission and can be used for various purposes such as finance, employment, or legal and administrative purposes.

Applying for a No Objection Certificate (NOC)

The application and issuance of a No Objection Certificate (NOC) vary based on the specific purpose and the entity issuing it. Different institutions or individuals provide NOCs in formats tailored to their respective requirements. Here’s an overview of how NOCs are issued for different purposes:

- NOC for Bank Purposes: Banks issue NOCs in their official format for various financial activities, such as loan closures, to confirm that there are no pending obligations. This document is crucial for both the bank and the account holder to maintain a clear financial record.

- NOC for GST Registration: When a business registers for Goods and Services Tax (GST), the premises owner issues a NOC. This document assures the tax authorities that the property owner consents to the business operations conducted on the premises, ensuring compliance with tax regulations.

- NOC for Vehicle Transfer: Regional Transport Offices (RTOs) issue NOCs for vehicle transfers between states. This certificate confirms that the vehicle has no pending liabilities or legal issues in the original state, enabling a smooth registration process in the new state.

- NOC for Employment: Employers issue NOCs in the form of official company letters for employees leaving the organization. This document certifies that the employee has fulfilled all obligations and there are no objections to their departure, allowing them to transition smoothly to new job opportunities.

- NOC for Educational Purposes: Educational institutions provide NOCs on their official letterhead when students wish to leave a course or attend events. This document serves as an official acknowledgment of the student’s decision, ensuring that the institution has no objections to their actions.

Types of No Objection Certificate Format

Before we have any further information regarding the NOC, look at the many different types of NOC letter formats we will discuss in this article.

No Objection Certificate Format for GST Registration

Here is the No Objection Certificate format for GST:

The Goods and Services Tax Officer,

[State],

[GST Department Address]

Subject: No Objection Certificate regarding GST Registration

Respected Sir/Madam,

I, [Owner’s Name], r/o [Owner’s Address], hereby confirm that I am legally in possession of and the owner of the premises located at [Business Address].

I have no objection to [Business Name], owned by [Applicant’s Name], using the previously mentioned premises as its principal place of business for obtaining GST registration.

The property is being provided for a [rental/ leased/ shared/ owned] Purpose. I have no objection to the applicant using the aforementioned property for business and communication purposes under GST regulations.

Verification

Confirmation ______ (mention place) on ________ (date) that the above statement is correct and accurate to the best of my knowledge.

Deponent

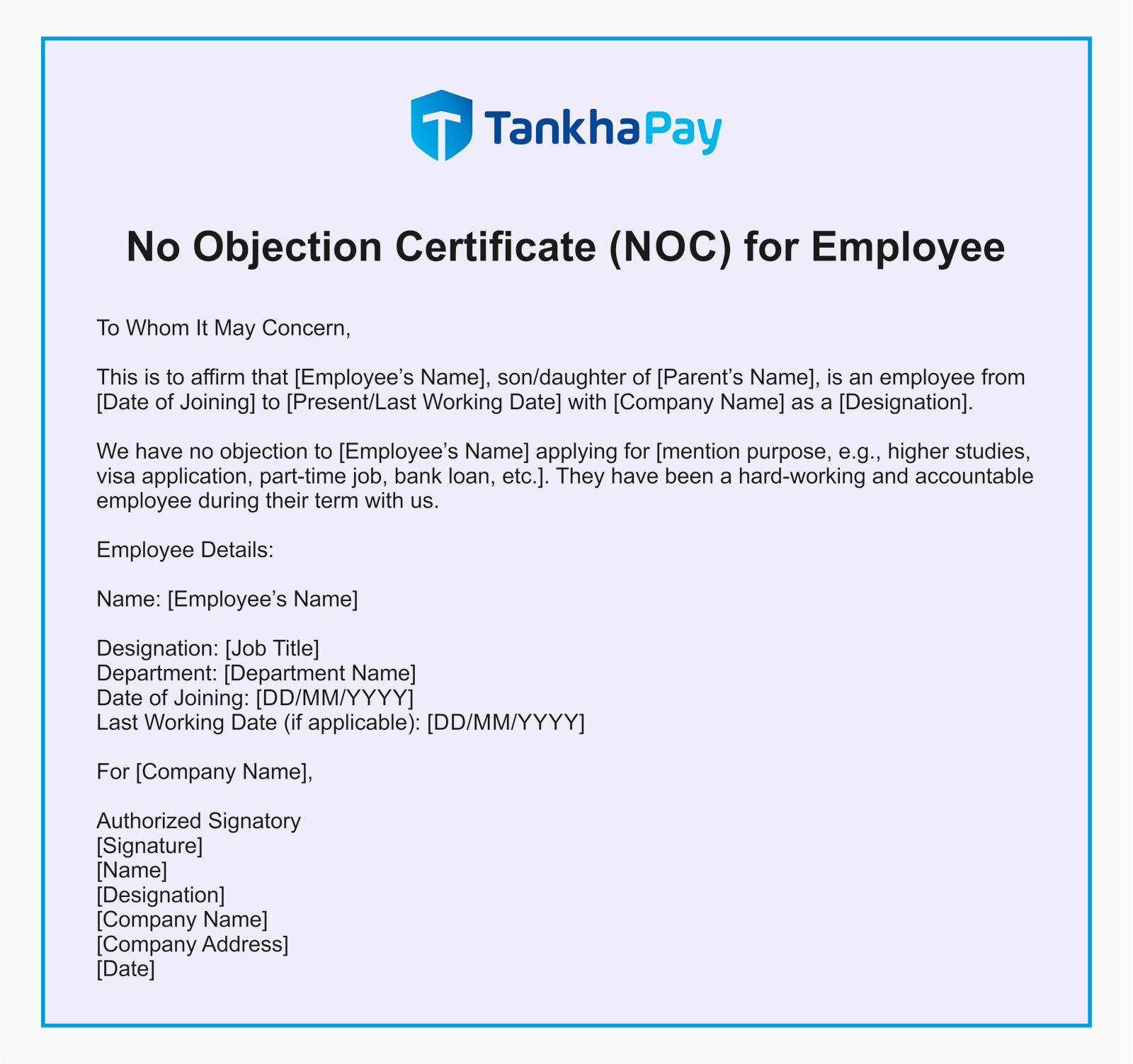

No Objection Certificate Format for Employee

As we know, NOC serves various purposes, so if you are looking for the No Objection Certificate format for employees, look at it.

This is to affirm that [Employee’s Name], son/ daughter of [Parent’s Name], is an employee from [Date of Joining] to [Present/ Last Working Date] with [Company Name] as a [Designation].

We have no objection to [Employee’s Name] applying for [mention purpose, e.g., higher studies, visa application, part-time job, bank loan, etc.]. They have been a hard-working and accountable employee during their term with us.

Employee Details:

Name: [Employee’s Name]

Designation: [Job Title]

Department: [Department Name]

Date of Joining: [DD/MM/YYYY]

Last Working Date (if applicable): [DD/MM/YYYY]

For [Company Name],

Authorized Signatory

[Signature]

[Name]

[Designation]

[Company Name]

[Company Address]

[Date]

No Objection Certificate Format for Training/ Education

NOC is also required when you have joined a training or education programme as an employee or student. Here is a No Objection Certificate format for an employee.

[Date]

To

[Mention Address]

This is to confirm that [Employee’s Name], son/daughter of [Parent’s Name], has been employed with us [Organization Name] as a [Designation] in the [Department] since [Date of Joining].

We have no objection to [Employee’s Name] in the capacity of [Course/ Training Program Name] at [Institution/ University Name]. This training/academic program aligns with their professional development and will unalter their Daily duties.

He/she is hereby allowed participation for the entire duration of the course/ training at ______________________.

For [Company/ Organization Name],

Authorized Signatory

[Signature]

[Name]

[Designation]

[Company Name]

[Company Address]

[Contact Information]

No Objection Certificate Format for Leaving a Job

Another spare of NOC is if you are leaving your job, it is essential to take an NOC certificate from the organization; here is a sample of the No Objection Certificate format for Leaving the job.

[Date]

To,

Address: [optional]

This is to certify that Mr/Ms/Mrs. [Employee’s Name], son/daughter of [Parent’s Name], was employed with [Company Name] as a [Designation] in the [Department Name] from [Date of Joining] to [Last Working Date].

We have no objection and have been relieved of his duties and responsibilities. They have performed their duties responsibly and professionally during their term with us.

For [Company Name],

Authorized Signatory

[Signature]

[Name]

[Designation]

[Company Name]

[Company Address]

[Contact Information]

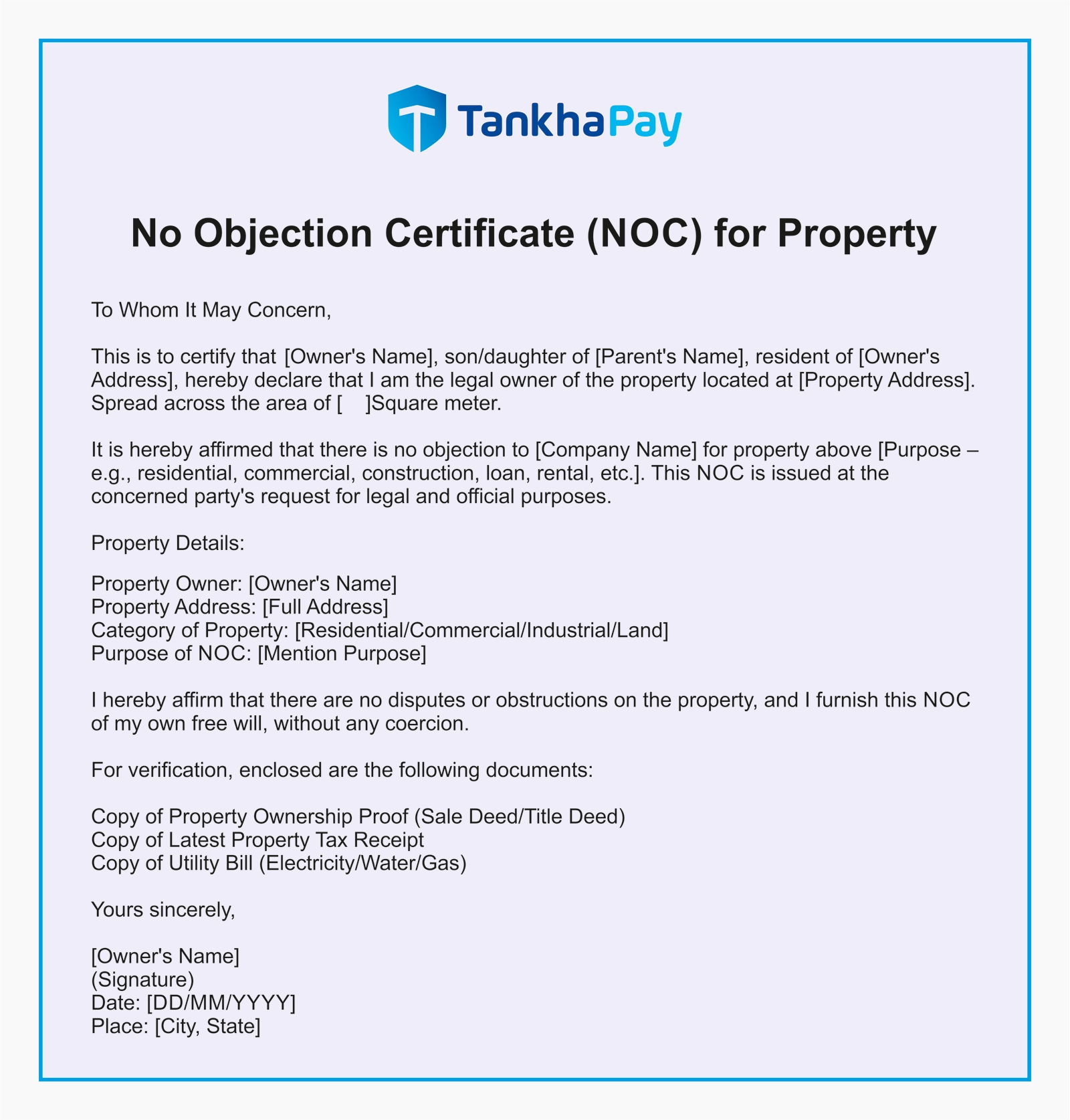

No Objection Certificate Format for Property

The property owners also demand an NOC from the construction organization to seek approval to construct or remodel their Property. Here is a sample of the No Objection Certificate Format for property.

This is to certify that [Owner’s Name], son/daughter of [Parent’s Name], resident of [Owner’s Address], hereby declare that I am the legal owner of the property located at [Property Address]. Spread across the area of [ ]Square meter.

It is hereby affirmed that there is no objection to [Company Name] for property above [Purpose – e.g., residential, commercial, construction, loan, rental, etc.]. This NOC is issued at the concerned party’s request for legal and official purposes.

Property Details:

Property Owner: [Owner’s Name]

Property Address: [Full Address]

Category of Property: [Residential/Commercial/Industrial/Land]

Purpose of NOC: [Mention Purpose]

I hereby affirm that there are no disputes or obstructions on the property, and I furnish this NOC of my own free will, without any constraint.

For verification, enclosed are the following documents:

Copy of Property Ownership Proof (Sale Deed/ Title Deed)

Copy of Latest Property Tax Receipt

Copy of Utility Bill (Electricity/Water/Gas)

Yours sincerely,

[Owner’s Name]

(Signature)

Date: [DD/MM/YYYY]

Place: [City, State]

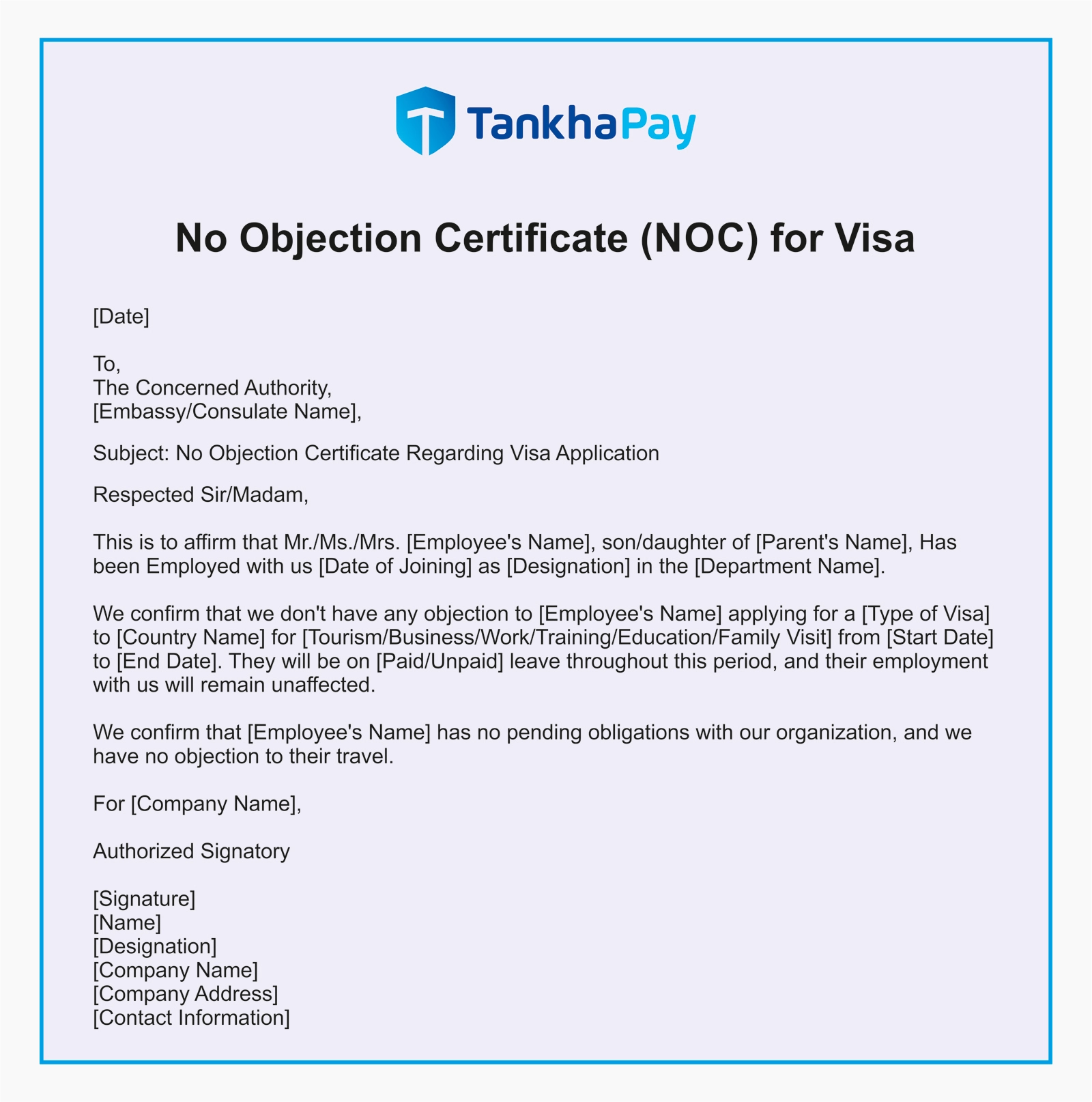

No Objection Certificate Format for Visa

Here is the sample No Objection Certificate Format for Visa.

To,

The Concerned Authority,

[Embassy/Consulate Name],

Subject: No Objection Certificate Regarding Visa Application

Respected Sir/Madam,

This is to affirm that Mr./Ms./Mrs. [Employee’s Name], son/daughter of [Parent’s Name], Has been Employed with us [Date of Joining] as [Designation] in the [Department Name].

We confirm that we don’t have any objection to [Employee’s Name] applying for a [Type of Visa] to [Country Name] for [Tourism/ Business/ Work/ Training/ Education/ Family Visit] from [Start Date] to [End Date]. They will be on [Paid/Unpaid] leave throughout this period, and their employment with us will remain unaffected.

We confirm that [Employee’s Name] has no pending obligations with our organization, and we have no objection to their travel.

For [Company Name],

Authorized Signatory

[Signature]

[Name]

[Designation]

[Company Name]

[Company Address]

[Contact Information]

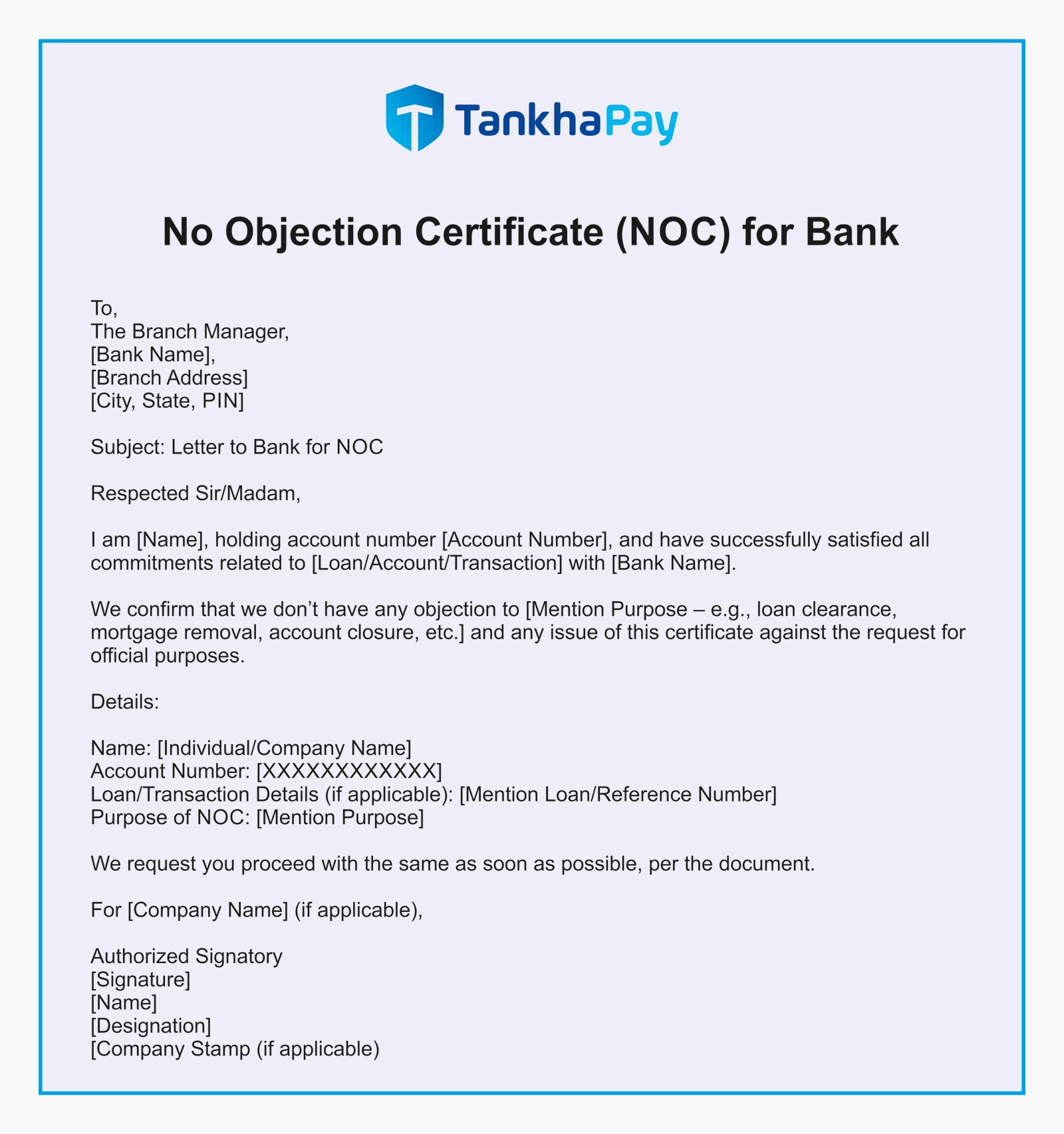

No Objection Certificate (NOC) for Bank

The Branch Manager,

[Bank Name],

[Branch Address]

[City, State, PIN]

Subject: Letter to Bank for NOC

Respected Sir/Madam,

This is to affirm that [Name of the Individual/Company], holding account number [Account Number], has efficiently satisfied all obligations against [Loan/Account/Transaction] with [Bank Name].

We can do further banking transactions without any objections or hindrance [Mention Purpose – e.g., loan clearance, mortgage removal, account closure, etc.] and any issue of this certificate against the request for official purposes.

Details:

Name: [Individual/Company Name]

Account Number: [XXXXXXXXXXXX]

Loan/Transaction Details (if applicable): [Mention Loan/Reference Number]

Purpose of NOC: [Mention Purpose]

We request that you process any necessary formalities as per bank regulations.

For [Company Name] (if applicable),

Authorized Signatory

[Signature]

[Name]

[Designation]

[Company Stamp (if applicable)

No Objection Certificate (NOC) for Vehicle Transfer

[Your Address]

[City, State, ZIP Code]

To Whom It May Concern,

I, [Your Name], declare that I have no objection to transferring ownership in their name. [Buyer’s Name], son/daughter of [buyer’s Father name], residing at [Buyer’s Address]. I have received the complete payment for the vehicle, and there are no pending liabilities, loans, or legal claims for the car.

Type Of Vehicle: [Car/Bike/Truck/Etc.]

Model & Make: [Brand of the vehicle & Model Name of the vehicle]

Registration Number of vehicle: [Vehicle Registration Number]

Chassis Number Vehicle: [Chassis Number]

Engine Number: [Engine Number]

Colour of the vehicle: [Vehicle Color]

I understand all legal and financial responsibilities related to the mentioned vehicle from this date onwards 2025. This No Objection Certificate (NOC) is issued for ownership transfer and registration at the concerned regional transport office (RTO).

Sincerely,

[Your Signature]

[Your Name]

Click here for more information on NOC for vehicle transfer.

When is a No Objection Certificate (NOC) Issued?

In India, a No Objection Certificate (NOC) is a legal document that may be issued by various parties such as employers, employees, landlords, tenants, or individuals. It is a formal declaration that the issuer has no objections to a particular action, agreement, or transaction. NOCs are commonly used in various situations, including:

- Conducting Trade: An NOC can be issued when engaging in trade activities, assuring that there are no objections to the trade from relevant parties.

- Making Offers: When making an offer, whether in business or personal transactions, a NOC can confirm that the offer does not violate any agreements or legal stipulations.

- Business Operations: Businesses often require NOCs to demonstrate that they have the necessary legal approvals or permissions.

The NOC is a versatile legal document that can be used in court, either in favor of or against a party, depending on the situation. It typically includes basic details of the involved parties and is addressed to the concerned party.

Example 1: Renting a Building for Business

Consider a scenario where a company plans to rent a building for its business operations. In this case, the company must obtain a NOC from the building owner. This NOC states that the owner has no objection to the company conducting its business in the rented building. With this document in hand, the company can use the building as its official business address. This NOC is crucial for the registration process and must be submitted to the Registrar of Companies when registering the company.

Example 2: Vehicle Transfer Between States

Another common scenario where NOCs are essential is during the transfer of a registered vehicle from one state to another. For instance, if someone wishes to transfer a vehicle registered in Maharashtra to be used in Karnataka, the vehicle seller must obtain a NOC from the Maharashtra Regional Transportation Officer (RTO). This NOC confirms that the vehicle has no outstanding traffic offenses in Maharashtra and specifies whether there is any hypothecation (a lien or financial obligation) against the vehicle in that state. The buyer in Karnataka must present this document when re-registering the vehicle in the new state, ensuring a smooth and legal transfer process.

NOC for Business Establishments

When establishing a business such as a sole proprietorship, partnership firm, Limited Liability Partnership (LLP), or company on rented land or buildings, obtaining a NOC from the property owner is essential. This document confirms that the owner has no objections to the business operating on their premises, thereby preventing potential legal disputes and ensuring a smooth start for the business. Here’s how to obtain a NOC for a business establishment:

Process to Obtain NOC for Business Establishment

- Requesting the NOC: Business owners, partners, or promoters must formally request a NOC from the landlord or owner of the rented premises. This request should clearly state the intention to start and operate a business on the property.

- Issuance of NOC: The owner or landlord provides a NOC, which includes the following essential details:

- Name of the Owner/Landlord: The full name of the property owner who is granting the NOC.

- Address of the Rented Premises: The complete address of the property where the business will be established.

- Name of the Business Entity: The name of the sole proprietorship, partnership firm, LLP, or company intending to operate on the premises.

- Date and Signature: The date of issuance and the signature of the owner or landlord, affirming their consent.

- Format of the NOC: While there is no specific format required for a NOC for business establishments, it must be a clear, written document. The language should be unambiguous, indicating the owner’s lack of objections to the business activities.

- Submission of the NOC: The NOC provided to the business owners, partners, or promoters may need to be submitted during the business registration process. This step is crucial to verify that the business has the legal right to operate from the specified location.

Documents Required for NOC

Applying for a No Objection Certificate (NOC) typically involves submitting specific documents to verify identity and address. The required documents can vary depending on the type of NOC and the issuing authority. Here’s a general list of documents you may need when applying for a NOC:

Identity Proof

You will need to provide valid identity proof to establish your identity. Acceptable documents include:

- Aadhaar Card

- Voter ID Card

- Driver’s License

- Passport

- PAN Card

Address Proof

Address proof is essential to verify your current residence. The documents you can submit include:

- Aadhaar Card

- Voter ID Card

- Utility Bills (electricity, water, or gas bills, not older than two months)

- Rental Agreement (if applicable)

- Bank Statement (with address details)

Other Related Documents

Depending on the specific NOC you are applying for, additional documents may be required. These might include:

- Property Papers (for property transfer NOCs)

- Registration Certificate (RC) of the Vehicle (for vehicle transfer NOCs)

- Employment Contract or Offer Letter (for job-related NOCs)

- Business Licenses or Agreements (for business establishment NOCs)

- Educational Certificates (for education-related NOCs)

What is the Validity of a NOC?

The validity of a No Objection Certificate depends on the purpose for which it is issued. NOCs are not one-size-fits-all documents, and their duration can vary significantly based on the specific context. Here’s a breakdown of how long a NOC might be valid:

- Short-term Validity:

Some NOCs have a validity period of six months to one year, suitable for temporary activities such as short-term projects or vehicle transfers that need to be completed within a specific timeframe. - Medium-term Validity:

Certain NOCs, such as those for business operations or legal processes, might be valid for up to five years. This duration provides enough time for activities that require a longer commitment or multiple phases of implementation. - Long-term or Indefinite Validity:

In cases where the NOC is linked to a permanent or ongoing situation, such as a property ownership transfer or an educational qualification, the NOC may remain valid until the specific purpose is fulfilled. This type of NOC does not have a set expiration date and remains effective until its stated purpose is achieved.

NOC for Loan Closure

In the context of loans, a No Objection Certificate (NOC) is a document provided by the lender to confirm that the borrower has successfully settled all outstanding dues. Securing the NOC is a crucial step upon loan repayment completion. This certificate, issued by the lender, includes essential details such as:

- Your name

- Loan particulars

- Property address

- Date of loan closure

Additionally, the NOC serves as a formal acknowledgment that the lender relinquishes any claims or rights over the collateral, if applicable, which may have been pledged to secure the loan.

Typically, banks, non-banking finance companies (NBFCs), and other financial institutions dispatch the NOC to the borrower’s registered address. It is imperative to ensure that your updated address is on record with the lender, particularly if any changes occurred during the loan tenure. The NOC not only signifies the successful conclusion of the loan but also establishes the borrower’s clear ownership of the mortgaged property or collateral.

Benefits of a No Objection Certificate (NOC) Letter

Acquiring a No Objection Certificate (NOC) marks a significant milestone in the loan repayment process, offering several advantages that contribute to your financial well-being. Key benefits of this certificate include:

- The NOC serves as an authentic and formal document, providing clarity and eliminating any potential discrepancies that may arise in the future regarding loan repayment.

- Submitting the NOC to credit bureaus, such as CIBIL, positively impacts your credit score. A clear credit history enhances your creditworthiness and financial standing.

- The NOC acts as a safeguard against legal complications that could arise in case of confusion or disputes regarding loan settlement. It provides legal protection and clarity on the completion of the repayment process.

- Obtaining the NOC offers peace of mind, relieving you from concerns related to the loan. It assures that all obligations have been fulfilled, and the lender acknowledges the successful closure of the loan.

- By securing this essential legal document, you proactively mitigate potential future hassles related to loan settlement. The NOC protects against unforeseen challenges, providing a smooth transition into a debt-free status.

Loans Requiring a No Objection Certificate (NOC)

A No Objection Certificate (NOC) holds significance in various types of loans, serving as a crucial document in different financial transactions. Here are some types of loans that typically require an NOC:

- Home Loan: Obtaining an NOC is essential when you have successfully repaid your home loan. It signifies the closure of the loan and confirms your full ownership of the property.

- Car Loan: Similar to a home loan, a car loan also necessitates an NOC upon complete repayment. It proves that you have fulfilled all financial obligations related to the car purchase.

- Business Loan: Entrepreneurs who have settled their business loans are usually required to obtain an NOC. This certificate assures that the business assets or collateral are free from any encumbrances.

- Personal Loan: Individuals who have paid off their personal loans obtain an NOC, confirming the settlement of the borrowed amount and concluding the loan agreement.

- Loan Against Property (LAP): Borrowers who have utilised their property as collateral for a loan, commonly known as Loan Against Property (LAP), need to secure an NOC upon complete repayment. It releases any claims the lender may have on the property.

- Loan Against Shares (LAS): For loans secured against shares, obtaining a NOC is a standard procedure after settling the borrowed amount. It ensures the release of any claims on the shares that were pledged as collateral.

These examples highlight the versatility of the No Objection Certificate across various loan types, providing legal clarity and confirming the successful closure of financial transactions. Whether it’s a home, vehicle, business, personal assets, or investments, an NOC serves as a crucial document in the completion of the loan repayment process.

How to Obtain a No Objection Certificate (NOC) from Your Lender

While many lenders automatically send the NOC to your registered address after loan repayment, it’s crucial to take proactive steps to ensure timely receipt. To obtain your NOC, follow these steps:

- Draft a formal letter addressed to your lender, explicitly requesting the No Objection Certificate and the return of any original documents submitted during the loan application process.

- Mention specific details such as your name, loan account number, and the particulars of the loan for which you are seeking the NOC.

- Some lenders may require specific documentation, especially in the case of education loans. Ensure you have any necessary documents related to the loan agreement.

- After sending the request, follow up with your lender to confirm the status of your application for the NOC. This step ensures that your request is being processed on time.

- If the loan is related to a registered property (e.g., a home loan), it’s essential to submit a copy of the NOC to the registrar of properties. This step is crucial for removing the lien of hypothecation, indicating the release of the lender’s claim on the property.

- Failing to submit the NOC to the registrar may result in the lender maintaining a claim on the property. To avoid this, promptly submit the NOC to ensure full property ownership.

Taking these steps ensures a smooth process for obtaining your No Objection Certificate, confirming the successful closure of your loan and releasing any claims the lender may have on your assets.

Steps to Take if You Misplace Your No Objection Certificate (NOC)

Misplacing important documents like the No Objection Certificate (NOC) can be concerning, but you can take the following steps to address the situation:

- Visit the nearest police station and file an FIR stating the loss or misplacement of your NOC. Obtain a copy of the FIR as it may be required for further documentation.

- Reach out to your lender as soon as possible, providing them with a copy of the FIR and explaining the circumstances. Inform them about the loss of the original NOC.

- Furnish any additional loan-related documents requested by the lender to verify your identity and loan details.

- Formally request the issuance of a duplicate No Objection Certificate. Lenders typically have procedures in place for such situations.

- Obtaining a duplicate NOC may take some time, as the lender will need to verify the information and process the request. Exercise patience during this period.

- Once you receive the duplicate NOC, carefully review the document to ensure that all details are accurate. Verify that the term “no objection” is explicitly mentioned.

- If the NOC is associated with any property registrations or other legal processes, ensure that the duplicate copy is submitted to the relevant authorities to maintain accurate records.

Losing an NOC can be an inconvenience, but taking swift action by filing an FIR and communicating with your lender can help expedite the process of obtaining a duplicate certificate. It’s essential to verify the duplicate NOC’s accuracy to avoid future complications.

FAQs About No Objection Certificate (NOC)

What is the fee for filing an NOC application?

The fee for filing an NOC application is Rs.100.

Why is NOC needed for employment?

For employment, NOCs are necessary to:

- Comply with non-compete or non-disclosure agreements.

- Prevent legal disputes related to intellectual property or client information when transitioning between employers.

How do I get a NOC Certificate for a job?

To obtain an NOC for a job, the employee needs to write a letter to the HR of the current organisation, specifying the reason for leaving and providing other necessary details.

Is an NOC required for a job change?

Depending on the employment contract and country labour laws, NOC is required for a job change. It is usually necessary in government jobs and visa transfers, e.g. (Gulf countries) otherwise, NOC is not mandatory in the private sector. Depends on employment agreements.

Do I need an NOC to start my own business while employed ??

It depends on your company’s policies. Some companies need NOC to make sure there are no conflicts of interest. In case the business is in the same industry or field. Some countries need NOC from your employer for a business licence. check the legal and contractual regulations before starting a business while doing a job

Thanks

How do I get an NOC from the bank after a loan is paid off?

Yes, getting an NOC from a bank is very easy after a loan has been fully paid. First, clear all dues and submit an application with all loan details; the bank will release an NOC confirming the loan closer. Keep a copy of the record