Companies in today’s dynamic and evolving workforce are adapting to new employment models to maximize operations, increase efficiency, and stay competitive. This is achieved by exploring different employment strategies tailored to their specific needs. Some of the most important human resource management concepts are On-Payroll and Off-Payroll employment.

Knowing the definitions, implications, and differences between these two employment types is important for businesses to navigate the modern workforce challenges. This understanding allows organizations to align their staffing strategies with broader goals, such as cost optimization, compliance with labor laws, and the ability to quickly scale operations up or down. Both models have advantages and disadvantages. On-payroll employment encourages employee engagement and predictable workforce management, but it is typically more expensive and less flexible in areas of fluctuating demand. Off-payroll employment allows a business to access a global pool of talent and reduces the cost, but it could come with higher compliance risk, such as proper worker classification, and challenges building cohesive teams

Let’s get a little deeper into what on-payroll and off-payroll really means.

What is On-Payroll Employment?

On-payroll employment refers to a traditional employment setup in which people are employees of an organization. Such persons are listed on the payroll rolls of the organization, indicating that the employer has control over the employee’s salary so as to deduct and remit taxes and also is answerable to statutory benefits and labor laws. This includes paying into pension funds, healthcare insurance, paid time off, among other fringe benefits that are an addendum to the employment benefits. Most on-payroll employees are mainstays of the corporation and serve as its core workforce, usually playing some of the firm’s more critical roles in driving long-term business goals and preservation.

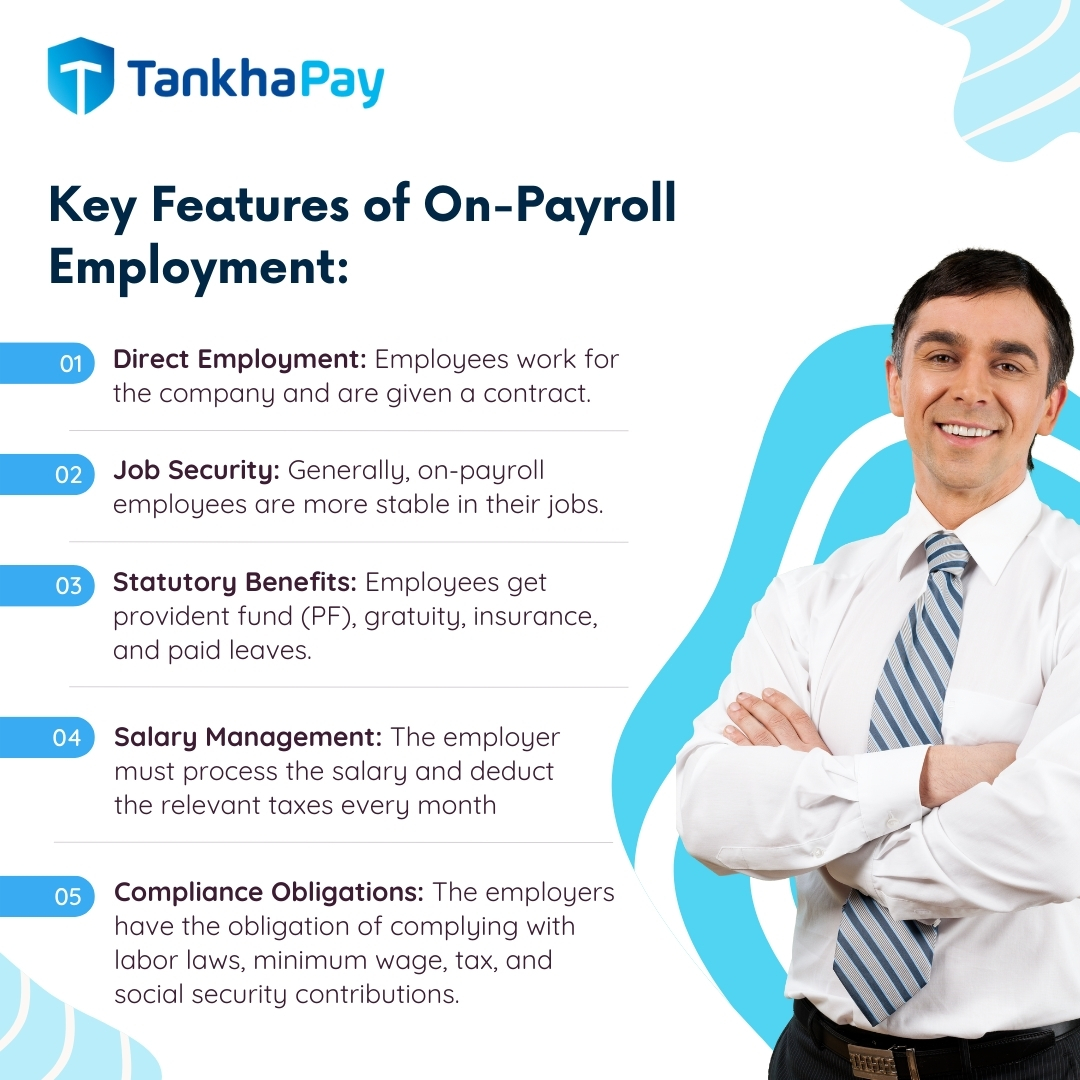

Key Features of On-Payroll Employment:

- Direct Employment: Employees work for the company and are given a contract.

- Salary Management: The employer must process the salary and deduct the relevant taxes every month.

- Statutory Benefits: Employees get provident fund (PF), gratuity, insurance, and paid leaves.

- Job Security: Generally, on-payroll employees are more stable in their jobs.

- Compliance Obligations: The employers have the obligation of complying with labor laws, minimum wage, tax, and social security contributions.

Advantages of On-Payroll Employment:

- Higher job security and more structured career development.

- Access to an all-inclusive benefits package.

- Employees are more likely to be committed to work for the employer.

Challenges of On-Payroll Employment:

- Higher costs for the employer due to benefits and compliance obligations.

- Rigidity in adapting to fluctuating workforce needs.

What is Off-Payroll Employment?

Off-payroll employment, often associated with independent contractors, freelancers, or third-party agency workers, refers to individuals who are not directly listed on a company’s payroll. These workers are typically engaged for specific projects or tasks.

The off-payroll employee will be a representation of a more flexible and more transactional workforce model. The term off-payroll workers relates to freelancers, contractors, consultants, or gig workers that perform individually. These are not registered under the payroll of the respective organization but rather work on specific contractual basis for tasks or deliveries undertaken. Off-payroll workers cannot be classified as employees in any case, so employers don’t need to offer statutory benefits and make tax deductions.

Key Characteristics of Off-Payroll Employment:

- Contractual Arrangement: Workers are engaged under contract and are not bound to the organization for long.

- Self-Managed Taxes: Off-payroll workers must manage their taxes and social security contributions.

- Flexibility: This enables the business to rapidly expand or contract the workforce .

- No Employee Benefits: The employers do not need to provide statutory benefits.

Benefits of Off-Payroll Employment:

- Higher flexibility in the workforce

- Reduced cost as the cost of benefits and compliance is less.

- Access to specialized skills on a project basis.

Challenges of Off-Payroll Employment:

- Lack of worker availability and quality control

- Lack of loyalty leading to potential confidentiality risks.

- Compliance with local labor law becomes complicated.

Key Differences Between On-Payroll and Off-Payroll Employment

| Feature | On-Payroll Employment | Off-Payroll Employment |

|---|---|---|

| Employment Type | Permanent or full-time | Contractual or freelance |

| Salary Management | Handled by the employer | Self-managed by the worker |

| Benefits | Statutory benefits provided | No benefits provided |

| Compliance | Employer ensures compliance | Worker ensures compliance |

| Flexibility | Less flexible | Highly flexible |

| Cost to Employer | Higher | Lower |

When to Use On-Payroll and Off-Payroll Employees

On-Payroll Employees:

Use on-payroll employees when:

- You have a need for long-term commitment.

- Jobs involve sensitive or strategic functions.

- Employee involvement and employee loyalty are crucial.

Off-Payroll Workers:

Use off-payroll workers when:

- You have only short term, project-based needs.

- You need specialized skills that the business does not have in house.

- You want to minimize your fixed labor costs.

Best Practices on Management of On-Payroll and Off-Payroll Workforce

Define clearly what is expected from all of them in terms of scope of work and expectations.

- Technology usage: HR automation tools can be effectively utilised to monitor and streamline compliance processes, as well as manage both on-payroll and off-payroll payments.

- Cultural Collaboration: Develop an inclusive culture where on-payroll and off-payroll workforce can collaborate effectively.

- Review Costs: Continuously monitor the cost-benefit analysis of your workforce mix.

Conclusion

Understanding the subtleties of on-payroll and off-payroll employment is vital to businesses that seek to construct a dynamic and efficient workforce. By balancing these kinds of employment strategically, companies will be able to optimize their costs, enhance flexibility, and drive growth while ensuring compliance.

Modern HR tools and practices ensure that both on-payroll and off-payroll arrangements are managed smoothly in order to create a productive and collaborative work environment. TankhaPay can help you manage both off and on payroll employees. Reach out for a demo now!

FAQs about On-Payroll and Off-Payroll

What taxes apply to on-payroll employees?

Deduction of taxes like income tax (TDS), employee provident fund (EPF), professional tax, as applicable.

Who will handle the taxes for off-payroll workers?

Off-payroll workers will be responsible for their taxes and filing according to the local laws and regulations.

Can off-payroll workers become on-payroll employees?

Yes, they can become on-payroll employees if both parties agree and it matches the company's needs.

What are the compliance obligations for on-payroll workers?

The employer must meet the requirements of tax deduction at source (TDS), EPF contributions, gratuity, and minimum wage for on-payroll workers.

Are the off-payroll arrangements less burdensome?

Off-payroll arrangements relieve the employer of some compliance requirements, but the worker needs to be classified carefully so that misclassification does not invite legal consequences.

How will the employer know the number of hours worked by off-payroll workers?

Off-payroll workers' hours and deliverables could be monitored through time-tracking software or using project management tools by an employer.

What are the challenges of administering both employment types?

Challenges include compliance, managing separable workflows, accurate processes for payments, and also maintaining engagement among a diverse set of workers.

How does HR technology help with payrolls?

HR and payroll software streamline processes such as computation of salary, tax deductions, compliance tracking, and attendance management of on-payroll and off-payroll workers.

Can off-payroll workers access employee benefits?

Normally, off-payroll workers are not entitled to employee benefits unless it is mentioned in the contract. However, there are some companies that offer perks like access to training or bonuses.